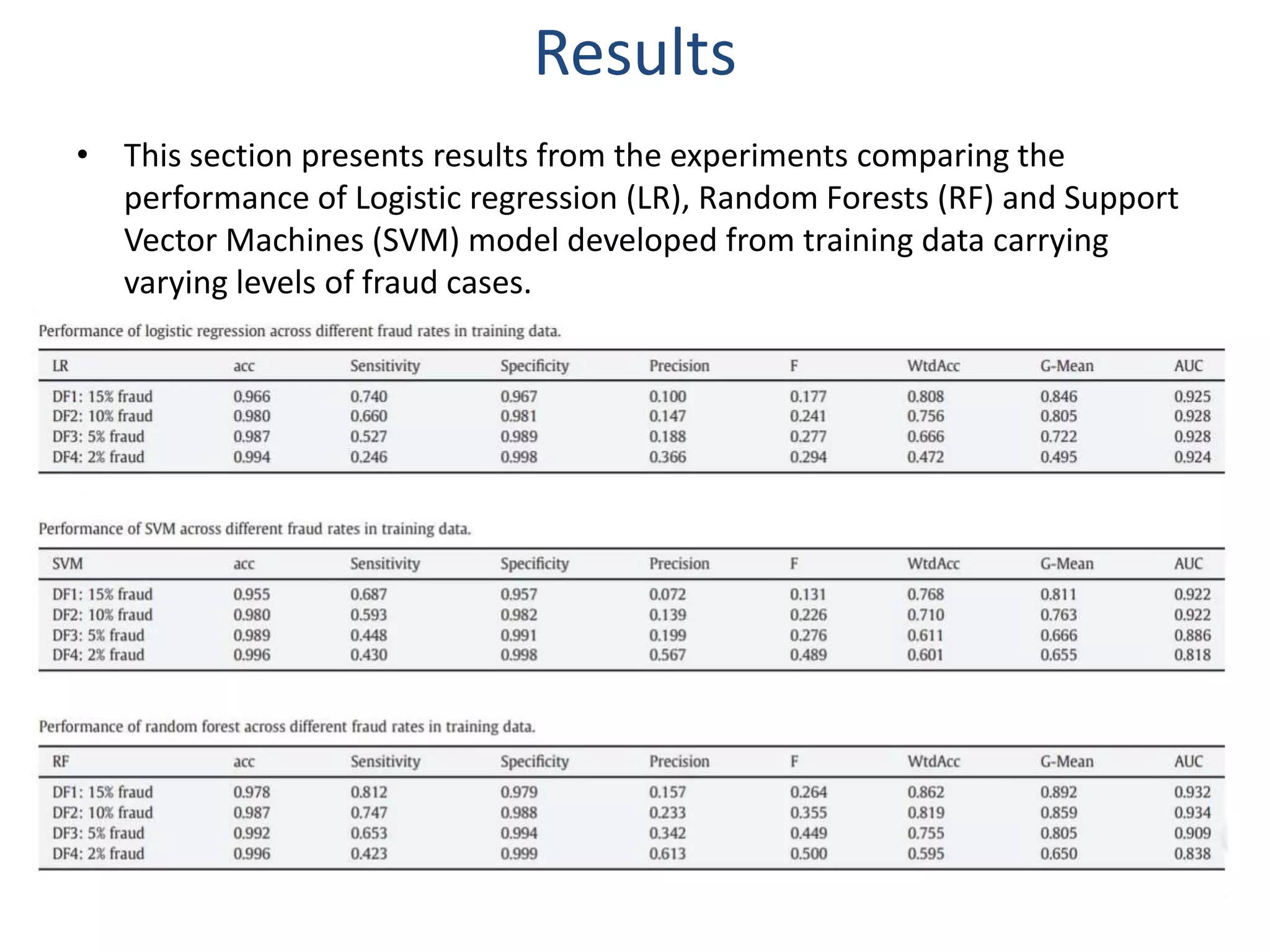

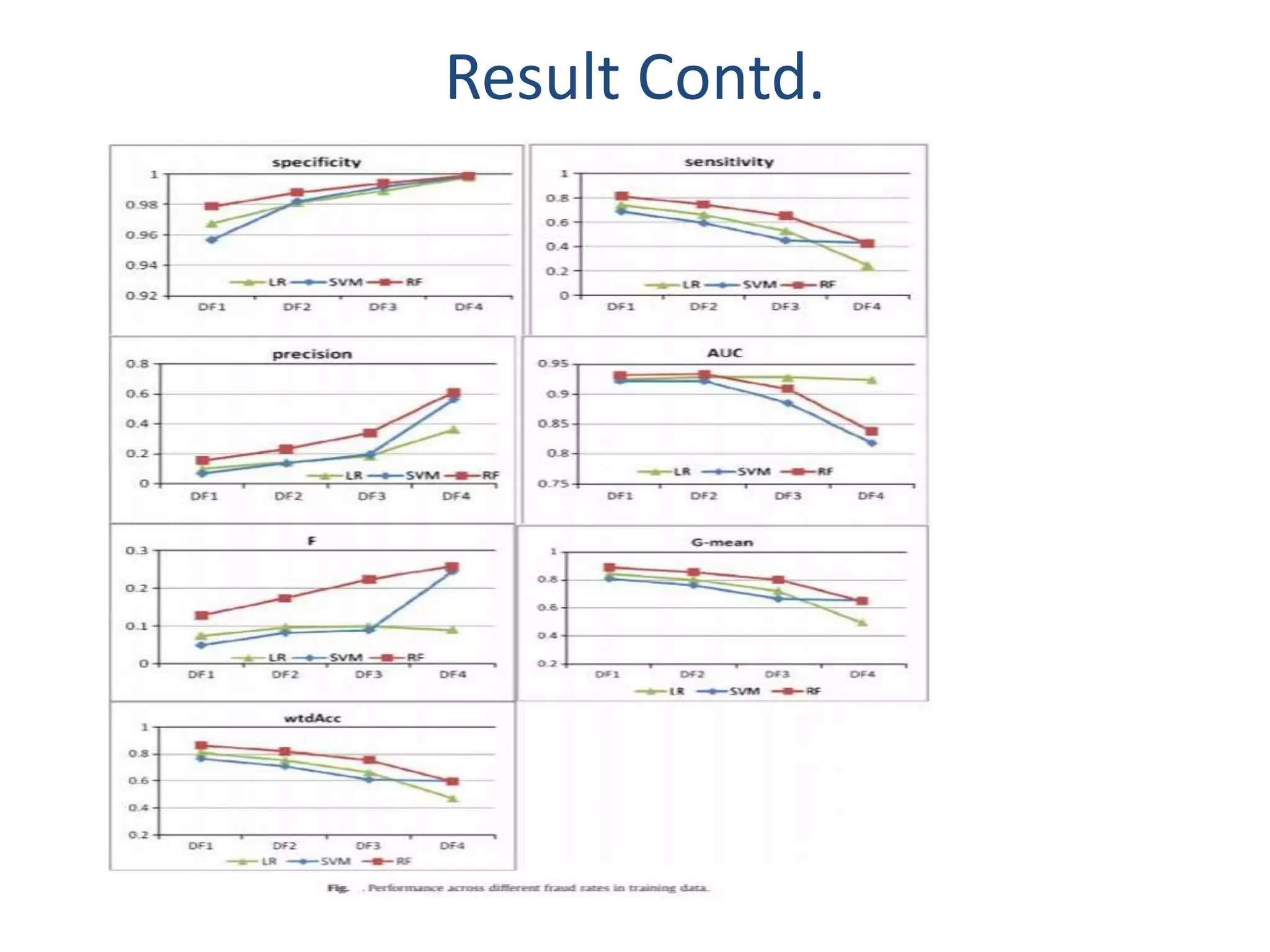

This paper evaluates three data mining techniques - logistic regression, support vector machines, and random forests - for detecting credit card fraud using real transaction data from an international credit card operation. The study finds that random forests and support vector machines outperform logistic regression, with random forests achieving the best results. A key finding is that these advanced techniques can better detect fraud even when the test data contains much lower fraud rates than the training data, demonstrating their effectiveness.