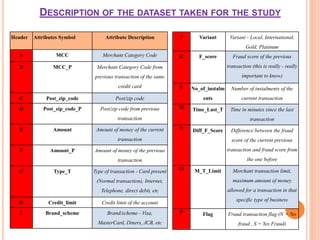

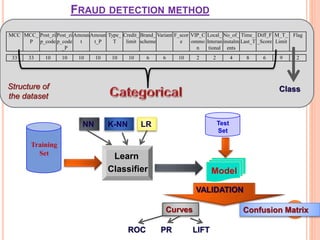

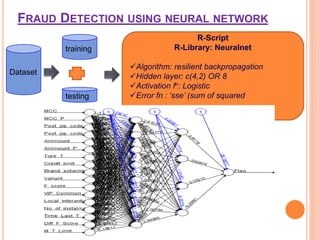

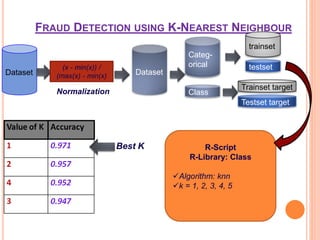

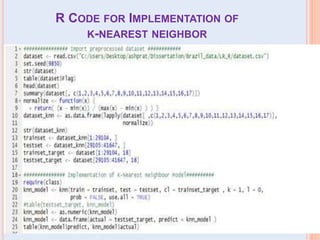

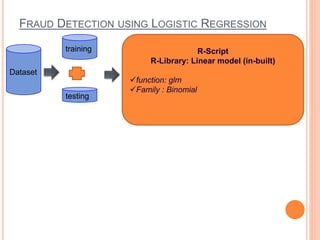

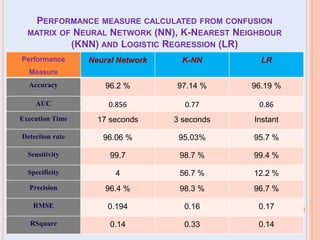

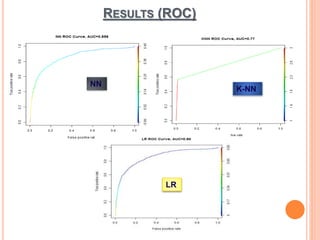

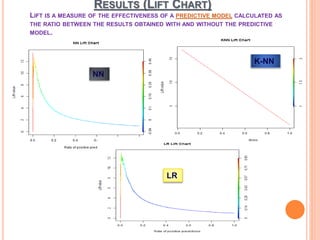

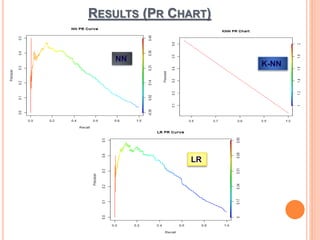

The document presents a comparative study of three predictive data mining techniques—neural network (NN), logistic regression (LR), and k-nearest neighbor (KNN)—for transaction fraud detection using a dataset from a Brazilian bank. The findings indicate that NN achieves the highest fraud detection rate, while KNN demonstrates superior execution time. The study emphasizes the potential advantages of a multi-algorithmic approach in managing complex and noisy datasets for fraud detection.

![LITERATURE SURVEY

As we can see in paper [5] S.Bhattacharyya has done

comparative study of various approaches on one

synthetic dataset and analysed results of logistic

regression, random forest and SVM. And the results

shows LR is best in his research.

I took this[5] paper as a base paper and done

comparative study on LR, NN and KNN on real dataset

which would be helpful for further research.](https://image.slidesharecdn.com/pratibhacomparativestudy-181204182946/85/Comparative-study-of-various-approaches-for-transaction-Fraud-Detection-using-Machine-Learning-Algorithms-5-320.jpg)

![REFERENCES

[1] S. Benson Edwin Raj, A. Annie Portia “Analysis on Credit Card Fraud Detection Methods”.

IEEE-International Conference on Computer, Communication and Electrical Technology; (2011).

(152-156).

[2] Haruna, C., abdul-kareem., S. abubakar. A: A Framework for selecting the optimal technique

suitable for application in data mining task., Future information technology,163-169, (2014).

[3] Manoel Fernando Alonso Gadi, Xidi Wang, and Alair Pereira do Lago. Credit card fraud detection

with artificial immune system, 7th international conference, icaris 2008, phuket, thailand, august

10-13, 2008, proceedings. In ICARIS, volume 5132 of Lecture Notes in Computer Science, pages

119 – 131. Springer, 2008

[4] E.W.T. Ngai, Yong Hu, Y.H. Wong, Yijun Chen, Xin Sun “The application of data mining techniques

in financial fraud detection: A classification framework and an academic review of literature”.

Elsevier-Decision Support Systems.50; (559–569), (2011).

[5] S.Bhattacharyya, S. Jha, K. Tharakunnel, J.C. Westland, “Data mining for credit card fraud: A

comparative study”, in Elsevier- Decision Support Systems, 2011.

[6] Usama, M. Fayyad, et al., Advances in Knowledge Discovery and Data Mining. Cambridge,

Mass.: MIT Press (1996).

[7] Han, Jun; Morag, Claudio, “The influence of the sigmoid function parameters on the speed of

Backpropagation learning", In Mira, José, Sandoval, Francisco, From Natural to Artificial Neural

Computation. pp. 195–201, 1995.

[8] Neda .S Halvaiee, M. Kazem Akbari “A novel model for credit card fraud detection using Artificial

Immune Systems”, Elsevier-Applied soft computing, Vol- 24, pp 40-49, 2014.

[9] F. Campos, S. Cavalcante, An extended approach for Dempster–Shafer theory, in:

Proceedings of the IEEE International Conference on Information Reuse and Integration, 2003,

pp. 338–344.](https://image.slidesharecdn.com/pratibhacomparativestudy-181204182946/85/Comparative-study-of-various-approaches-for-transaction-Fraud-Detection-using-Machine-Learning-Algorithms-31-320.jpg)