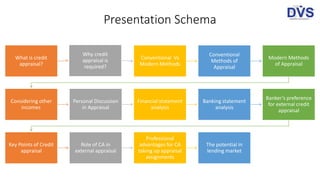

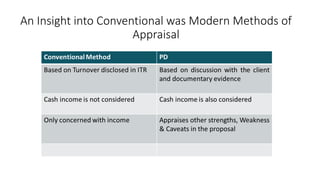

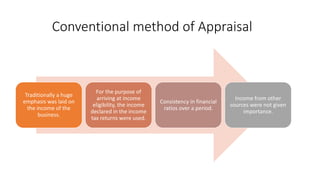

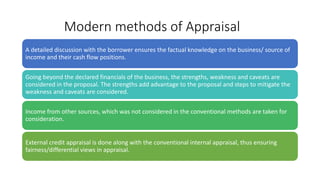

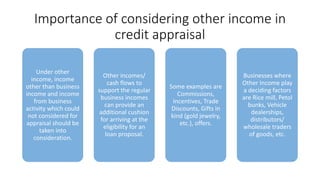

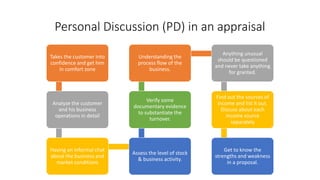

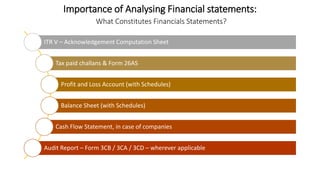

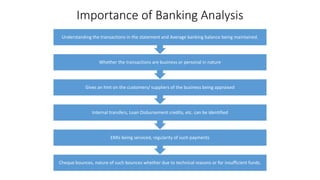

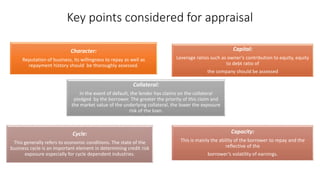

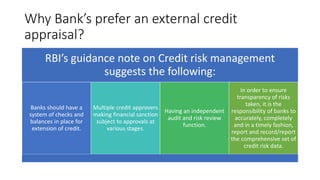

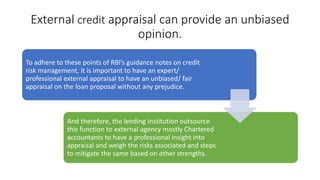

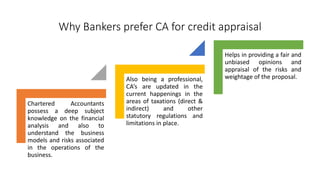

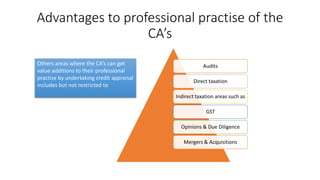

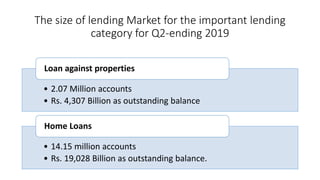

The document provides an overview of credit appraisal, detailing its definition, significance, and the evolution from conventional to modern appraisal methods. It highlights the importance of evaluating various income sources and personal discussions in assessing a borrower's repayment capacity while emphasizing the role of chartered accountants in external credit appraisal for unbiased evaluations. Additionally, it examines financial statement analysis, banking habits, and key principles such as character, capital, capacity, cycle, and collateral that influence credit risk assessment.