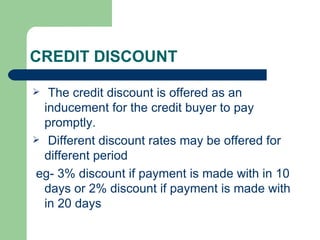

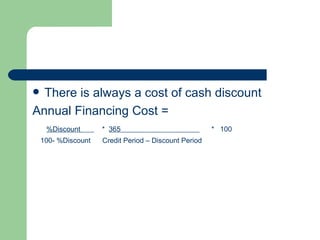

The document discusses receivable management and outlines several objectives and factors related to managing accounts receivable. The key objectives of receivable management are to obtain optimal sales volume, control credit costs, maintain an optimal investment in accounts receivable, and maximize firm value. The nature of maintaining receivables involves risk, economic value, futurity, and credit sales/collection periods. Costs of maintaining receivables include credit department costs, credit evaluation costs, opportunity costs, discounted payment costs, selling/production costs, and bad debts costs. Factors affecting receivable size are credit sales volume, credit policy, trade terms, and seasonality of business.