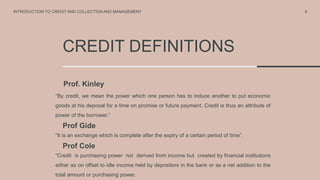

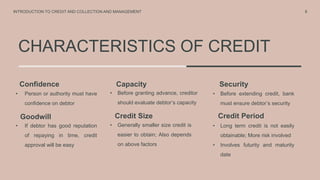

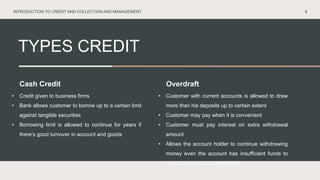

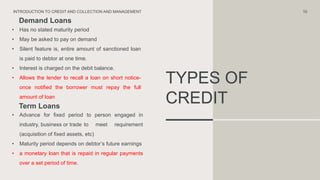

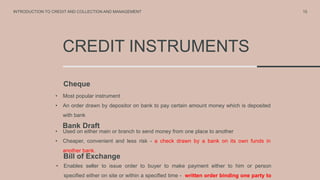

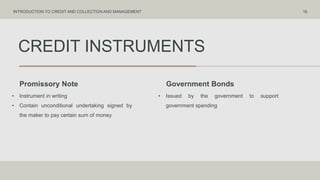

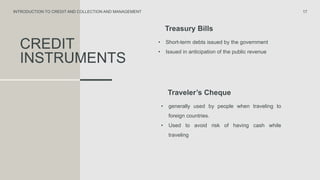

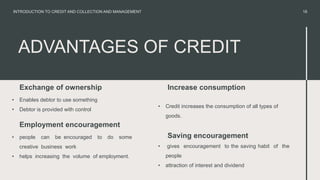

This document discusses credit and credit management. It begins by defining credit as a trust that allows one party to provide resources to another who will repay later. It then outlines the importance of credit in facilitating business financing and economic growth. The document also defines various types of credit like cash credit, overdrafts, demand loans and term loans. It describes credit instruments like checks, drafts, promissory notes and bonds. The advantages of credit are noted as increasing consumption, savings and capital formation. Potential disadvantages include encouraging wasteful spending and economic instability.