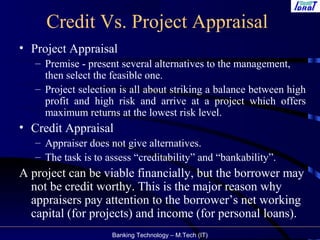

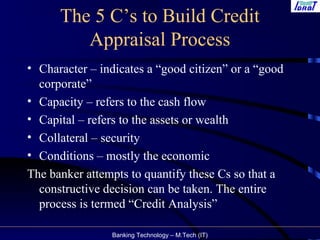

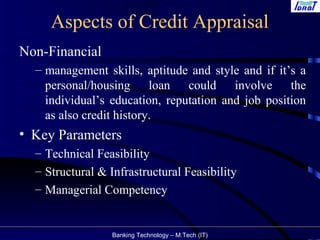

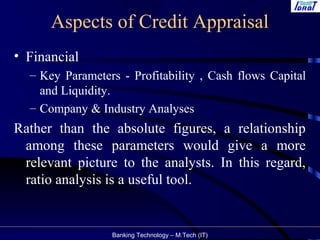

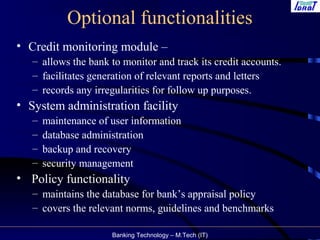

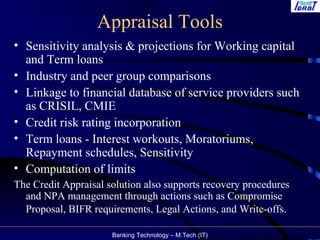

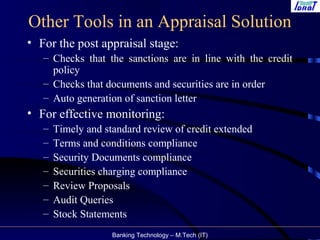

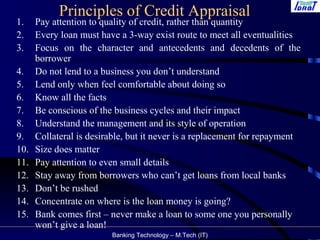

This document discusses credit appraisal systems used by banks. It begins with background on how high levels of non-performing assets (NPAs) can hamper bank operations. It then discusses the differences between credit appraisal and project appraisal, with credit appraisal focusing on a borrower's creditworthiness rather than alternative projects. The document outlines the four pillars of credit assessment as repayment, remuneration, relationship, and reputation. It also discusses the financial and non-financial aspects evaluated in credit appraisal systems as well as features and functionalities of credit appraisal software solutions.