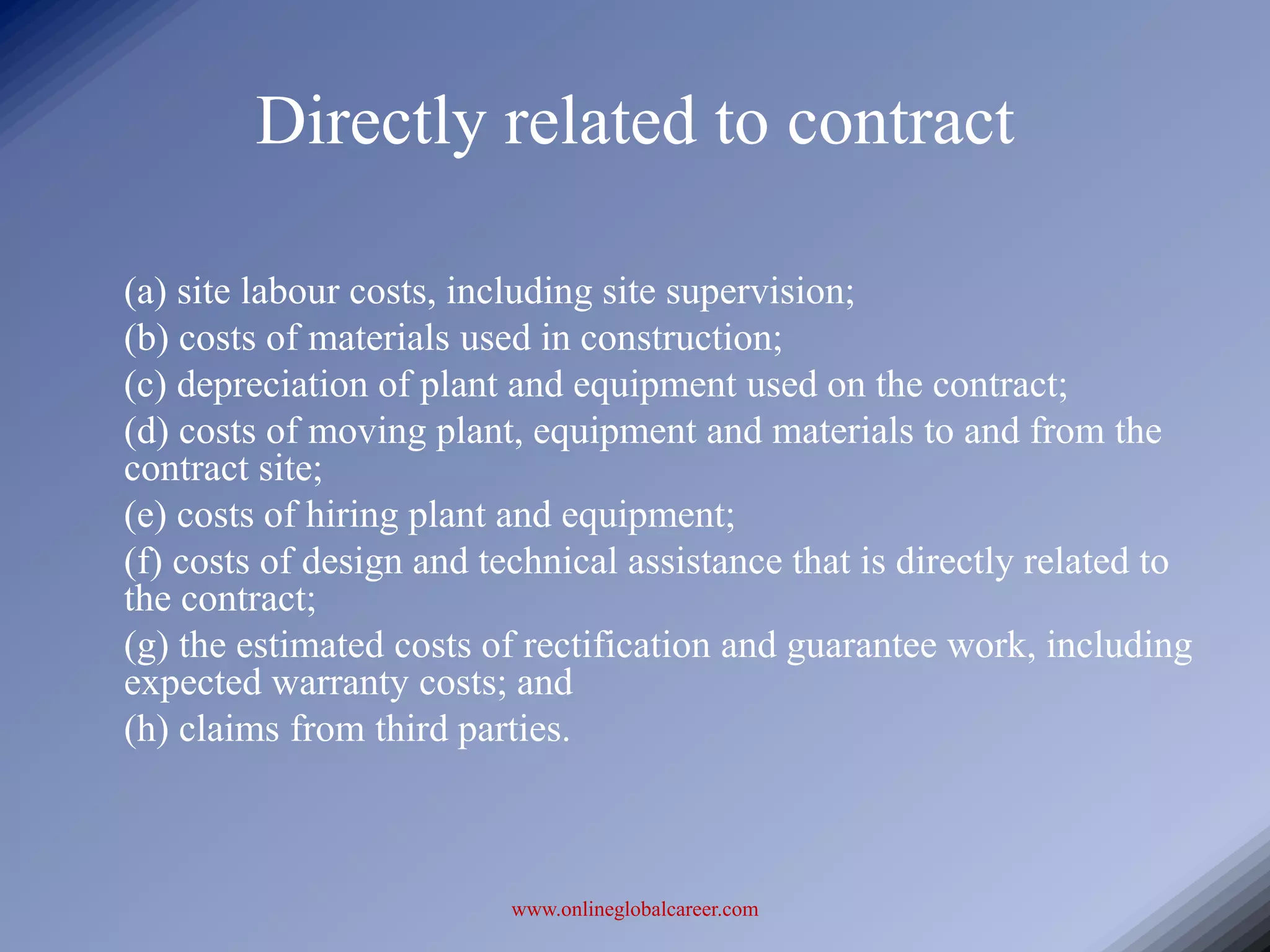

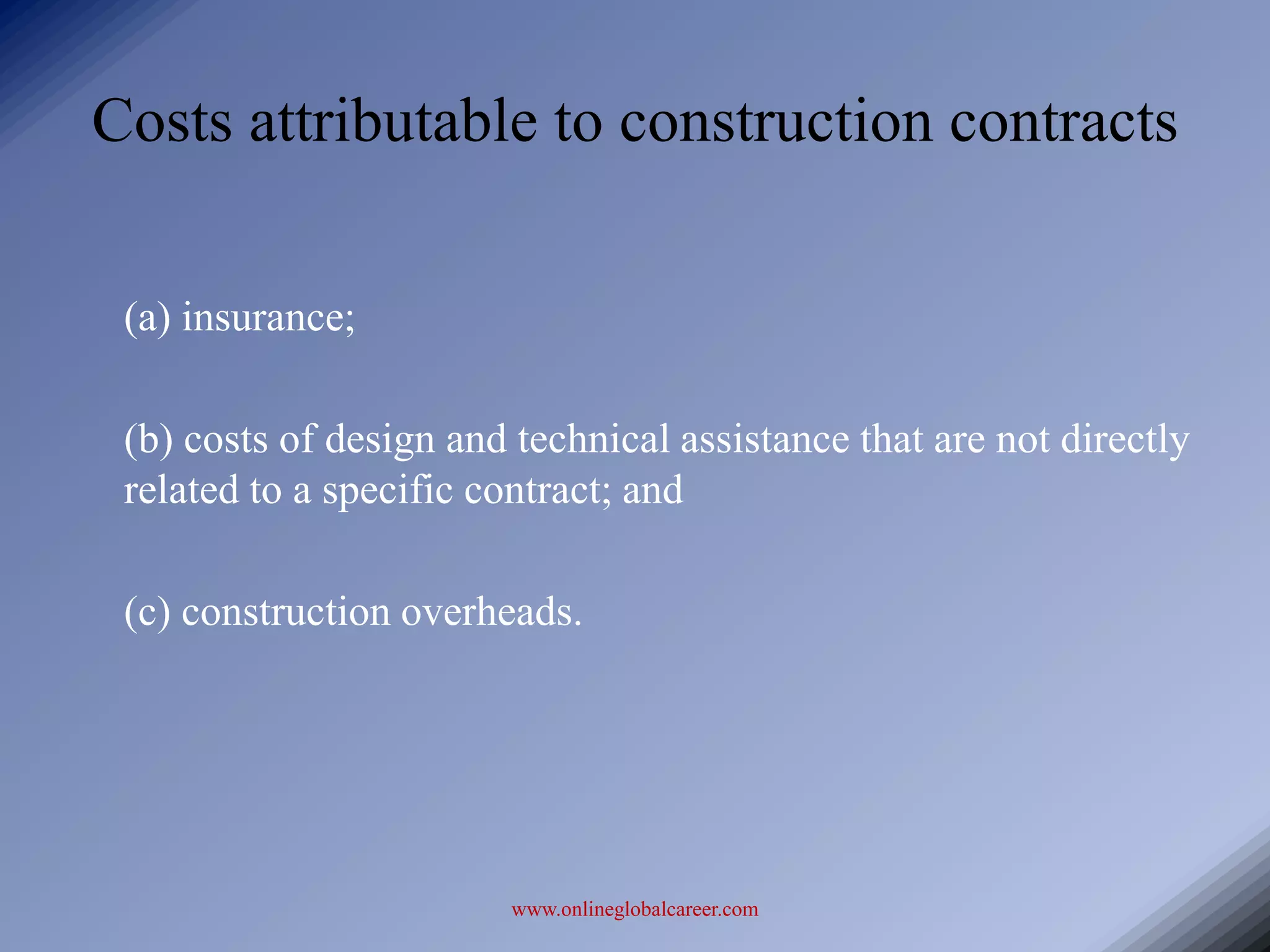

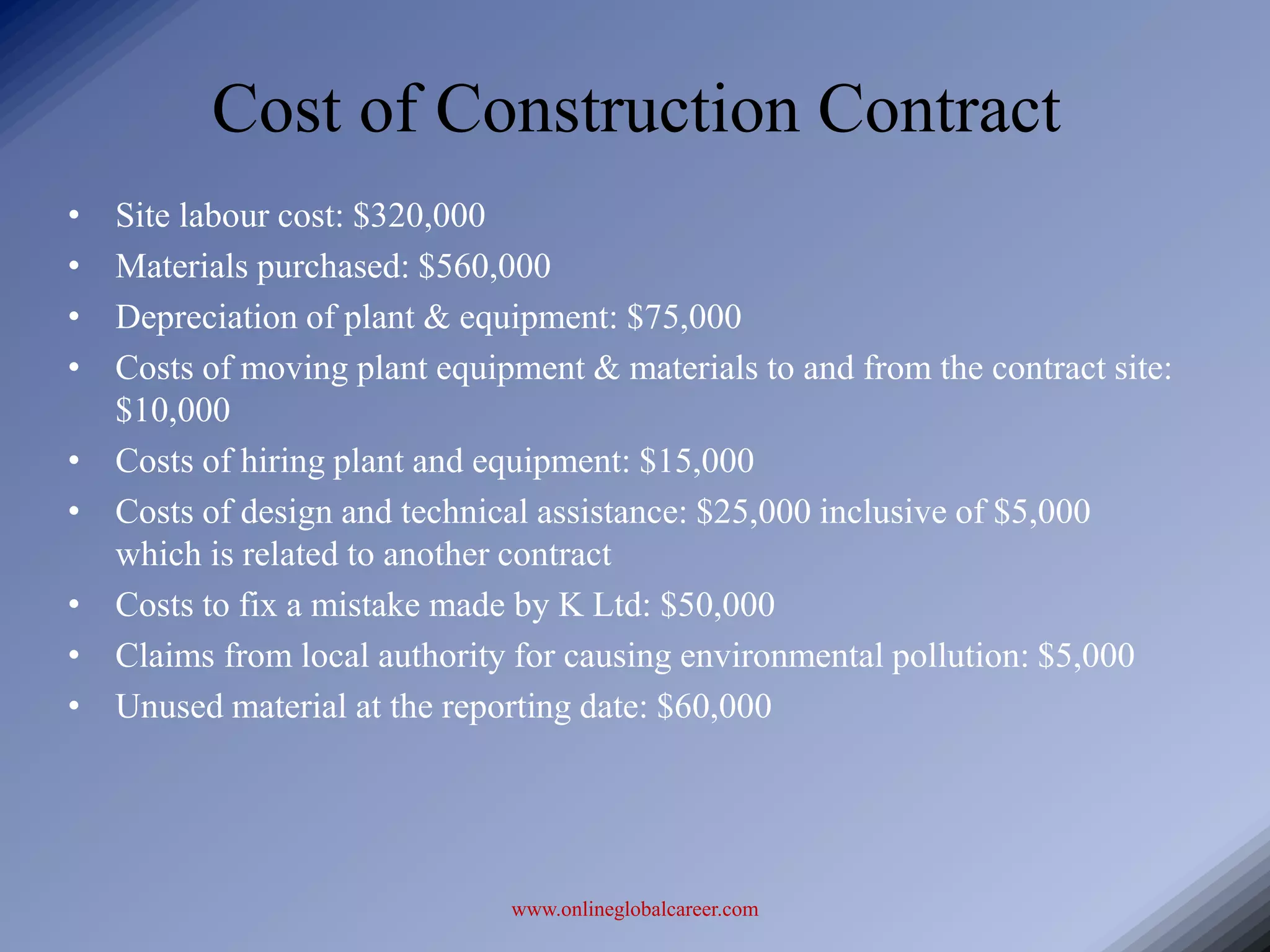

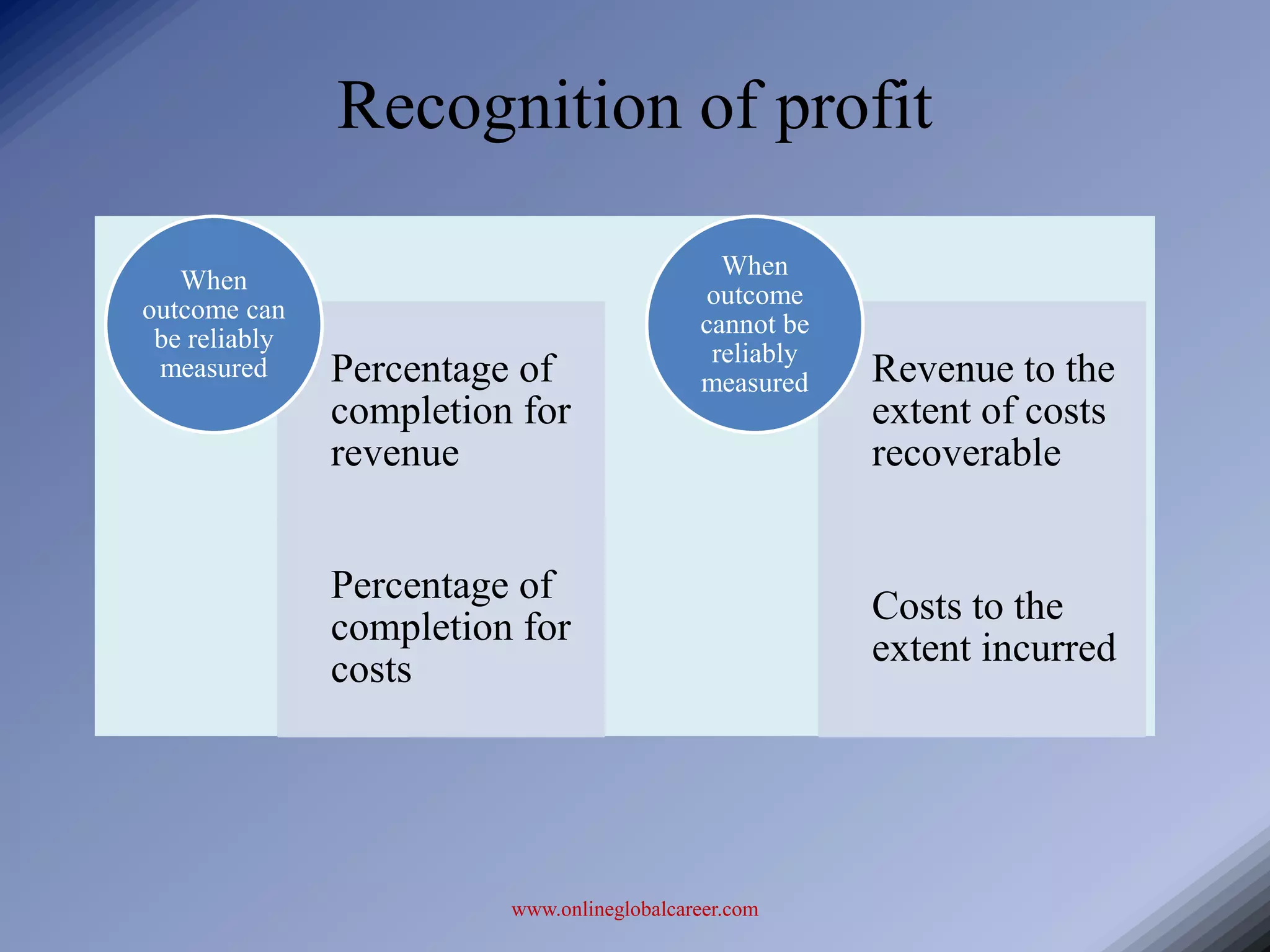

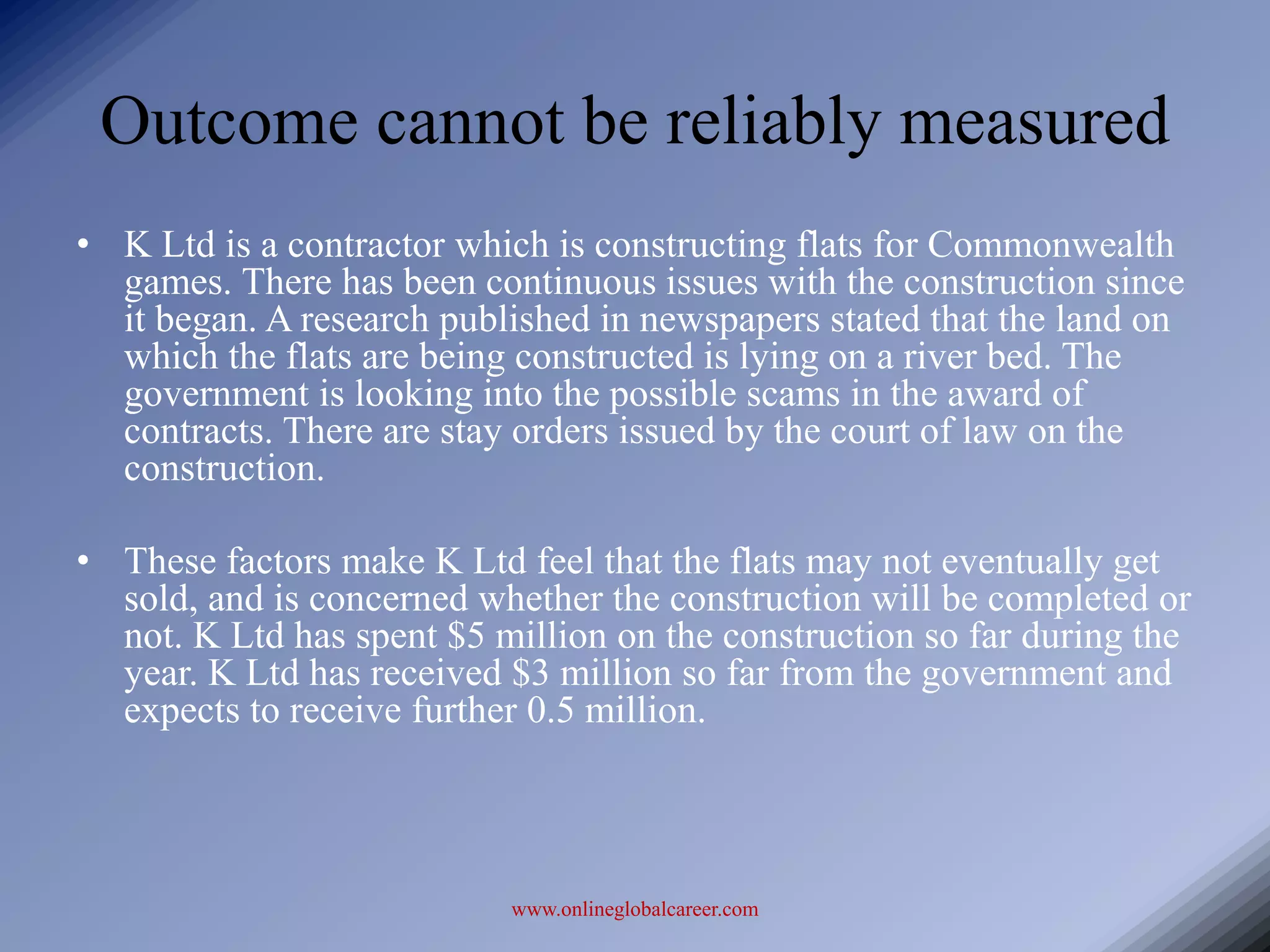

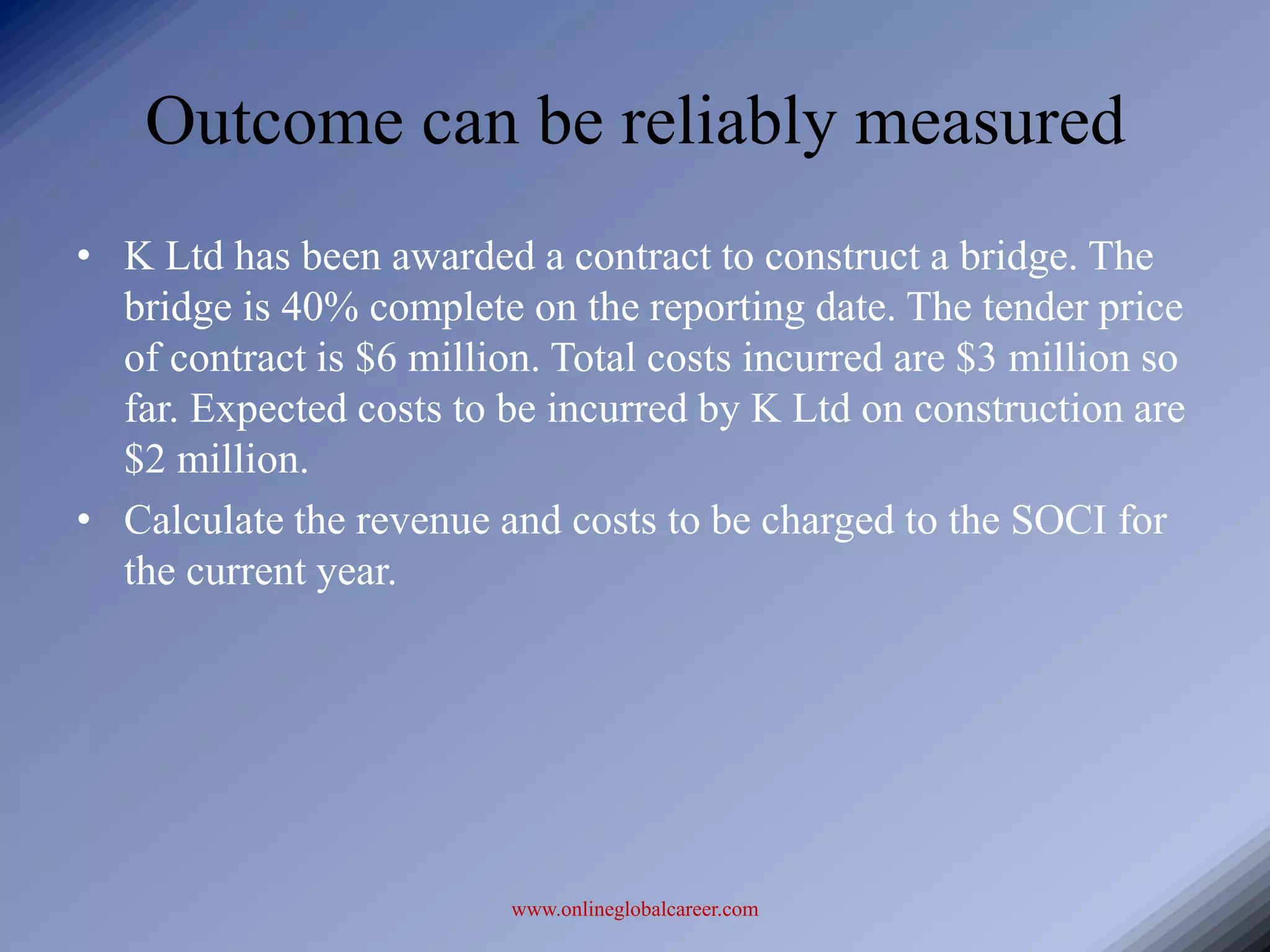

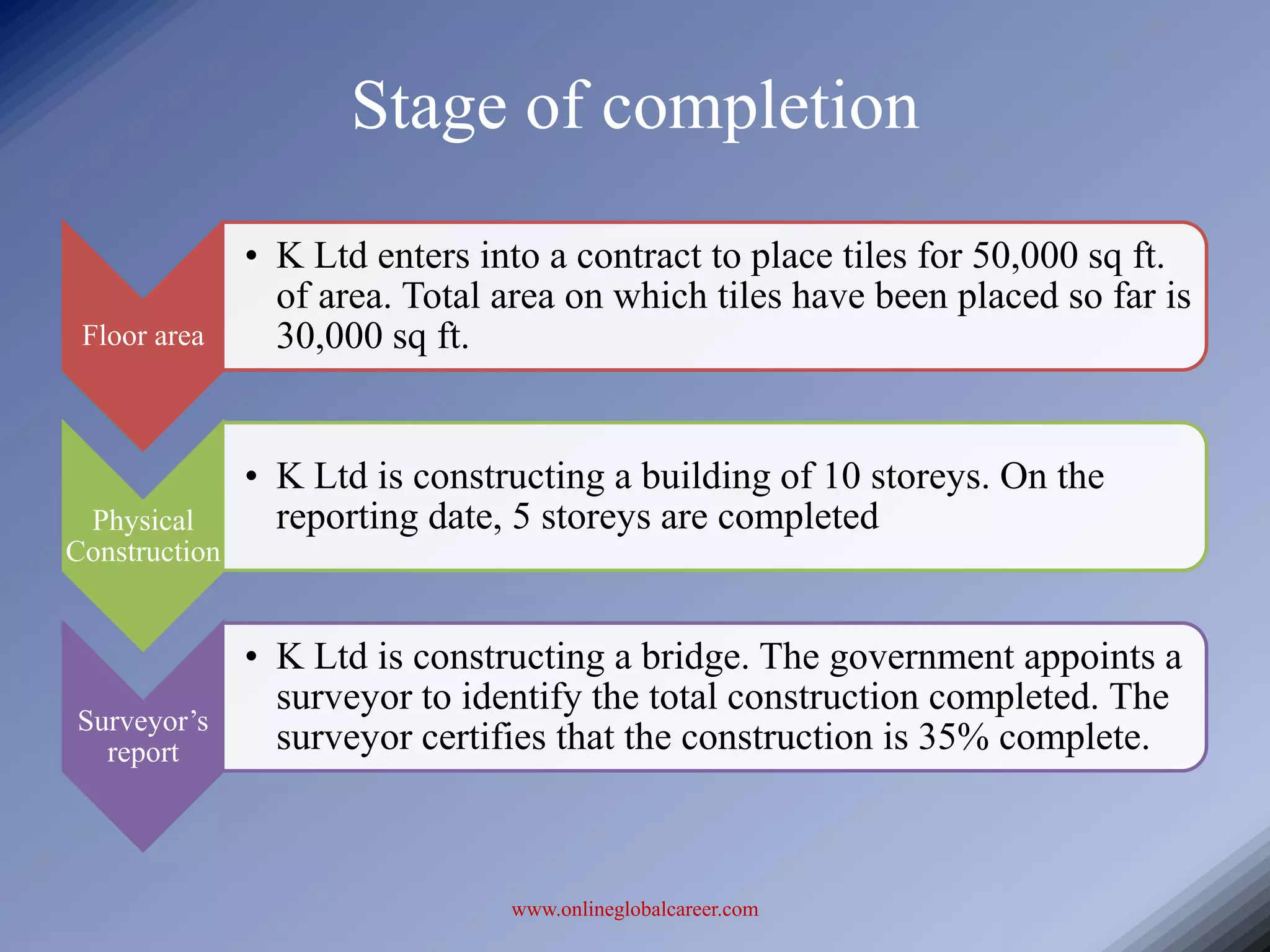

This document discusses accounting for construction contracts under IAS 11. It defines a construction contract, explains how to recognize contract revenue and costs over time using the percentage of completion method when the outcome can be reliably measured. It also discusses how to account for fixed price and cost plus contracts, as well as loss making contracts, contract variations, claims, incentives and how to determine the stage of completion.