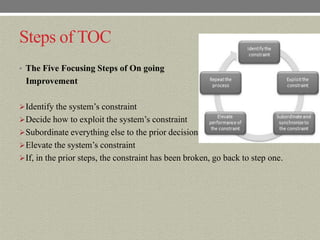

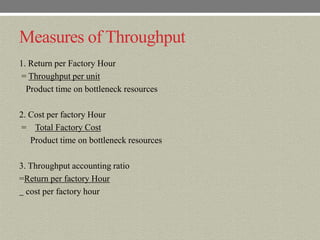

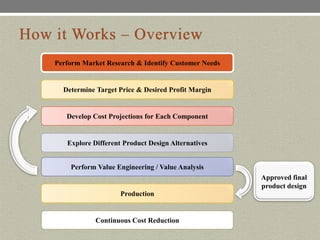

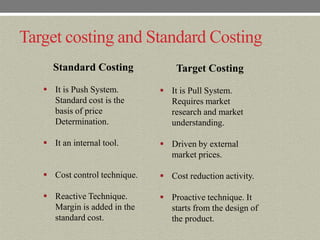

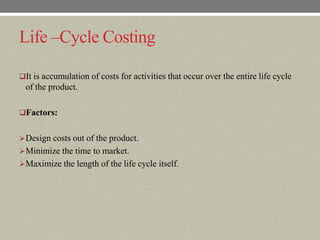

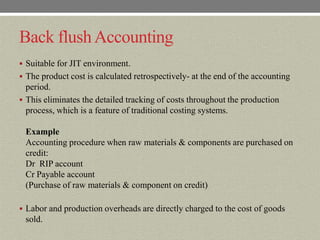

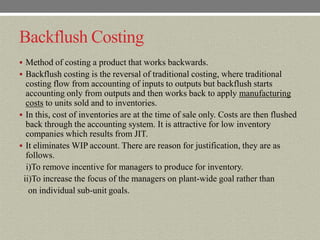

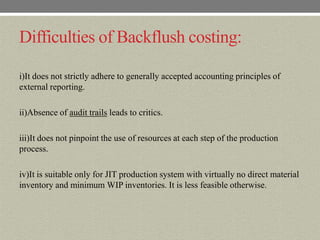

The document discusses several costing techniques including throughput accounting, theory of constraints (TOC), target costing, and backflush costing. Throughput accounting focuses on increasing throughput and reducing inventory and expenses. TOC identifies bottlenecks limiting throughput and ways to remove them. Target costing determines the maximum allowable cost for a new product based on the anticipated selling price and desired profit. Backflush costing calculates product costs retrospectively at the end of the accounting period without tracking costs throughout production.