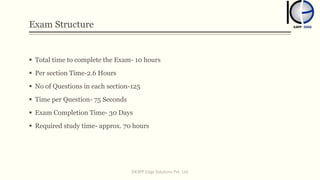

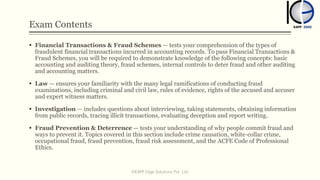

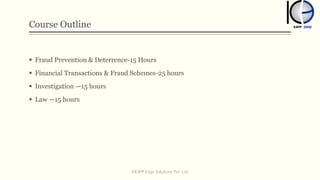

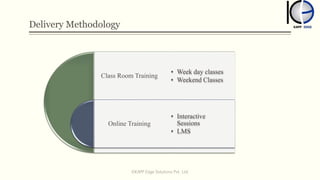

This document provides information about KAPP Edge Solutions' Certified Fraud Examiner (CFE) preparation course. The CFE credential is a preferred qualification in many fields that demonstrates expertise in fraud examination. The course covers topics tested on the CFE exam like financial transactions, fraud schemes, investigations, and law over 70 hours of study material and interactive sessions. It is designed for accounting professionals, bankers, and those in risk and compliance fields. The faculty member has over 13 years of industry experience and is a qualified CPA and CFE.