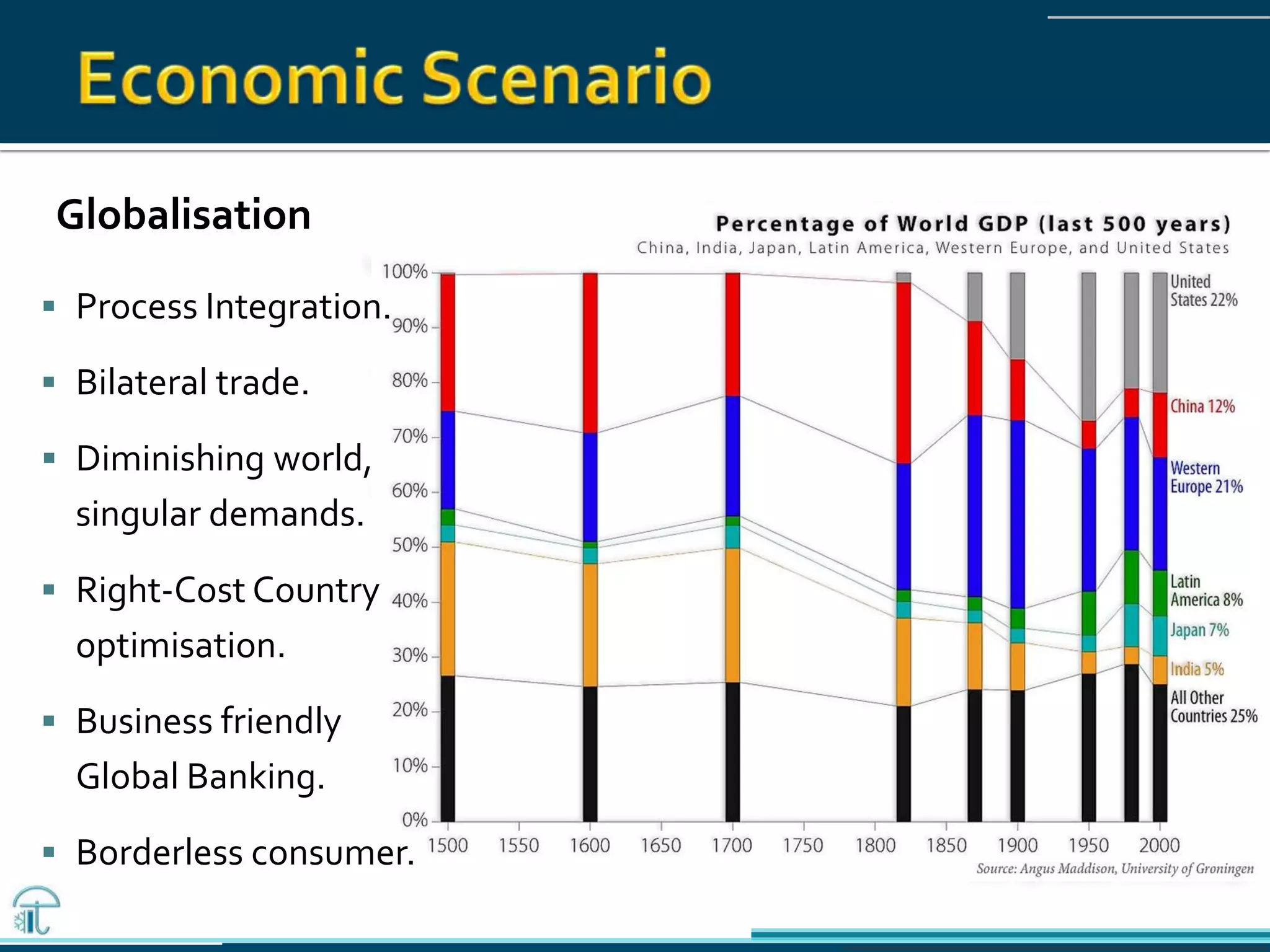

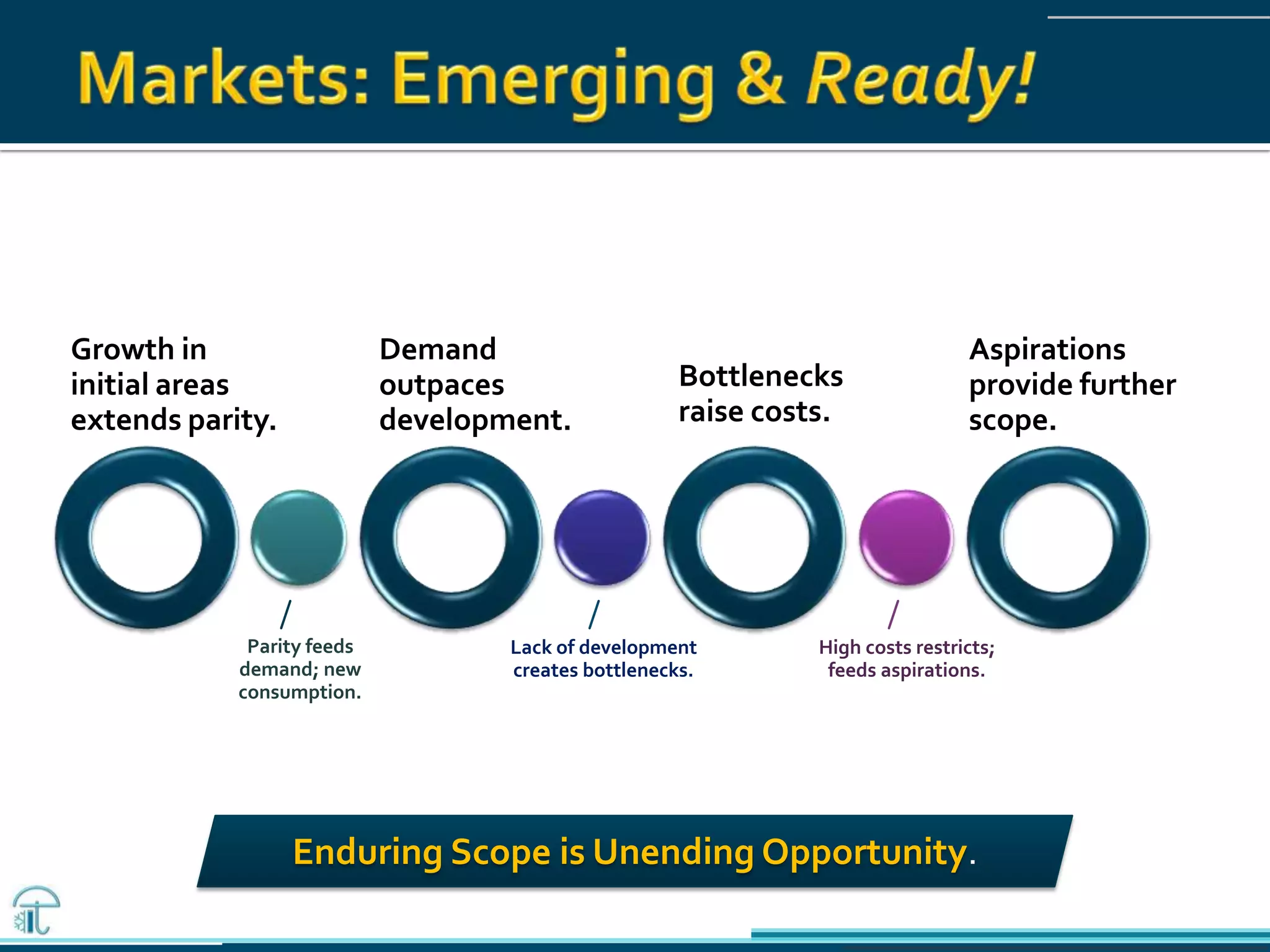

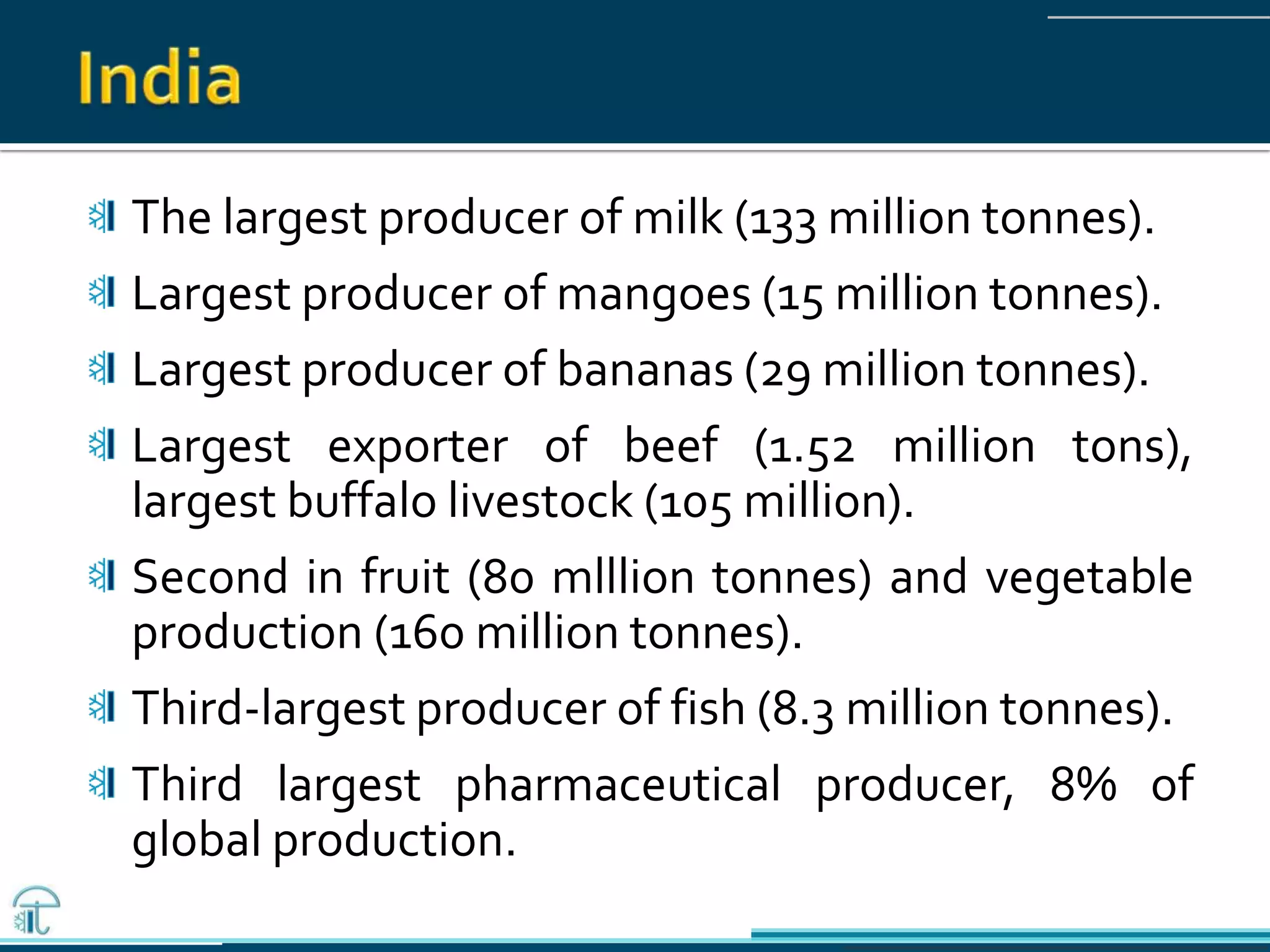

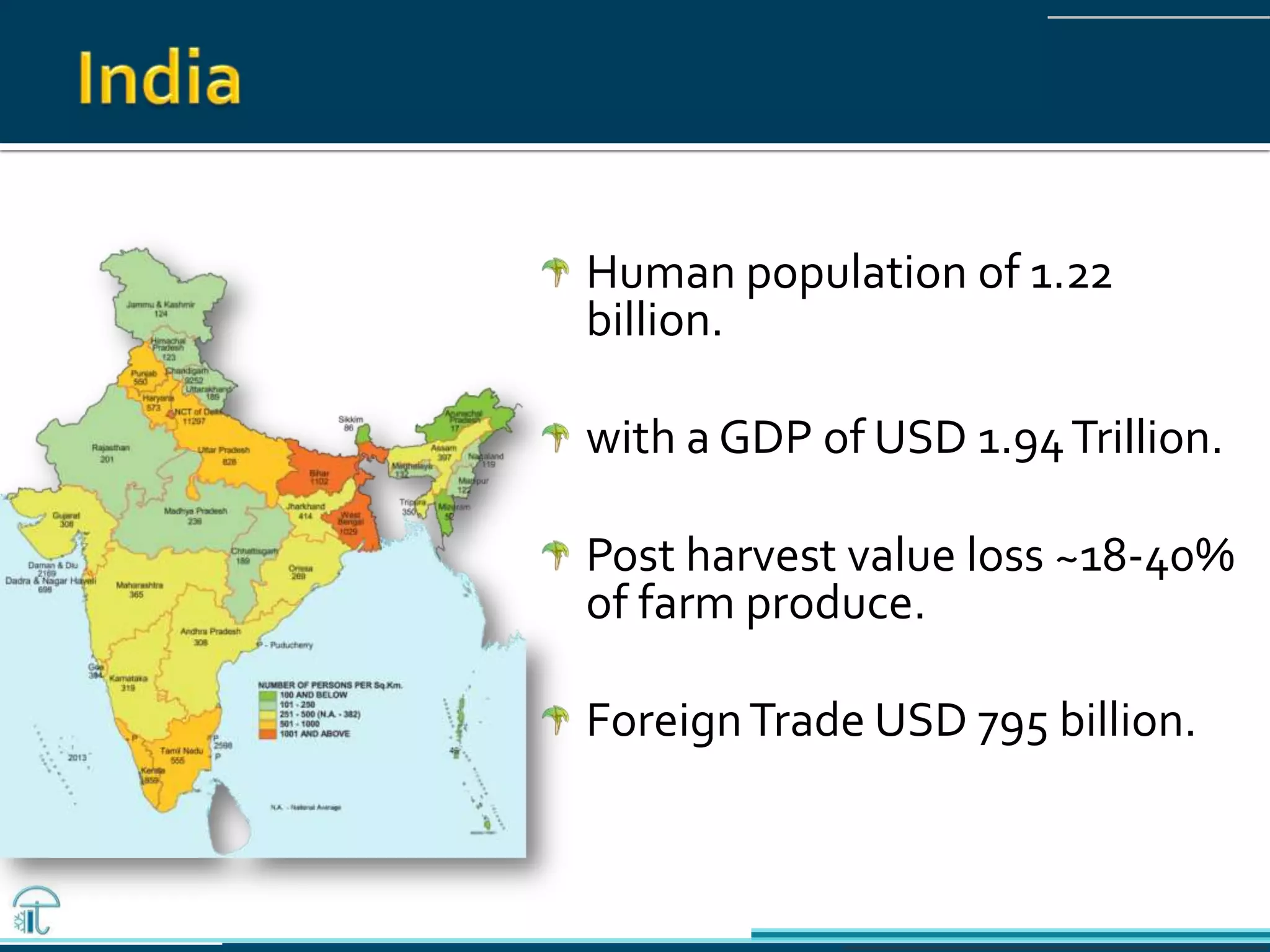

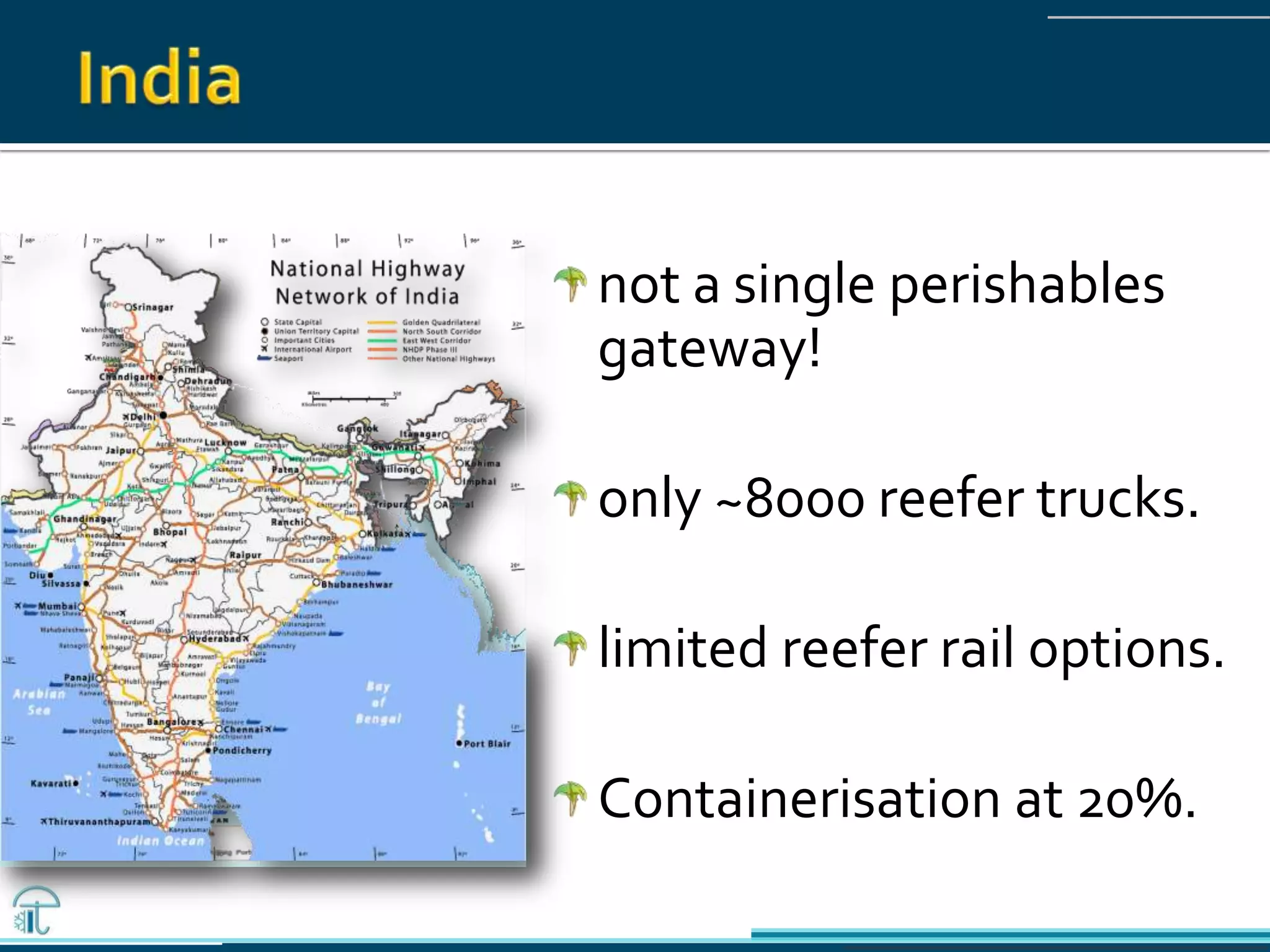

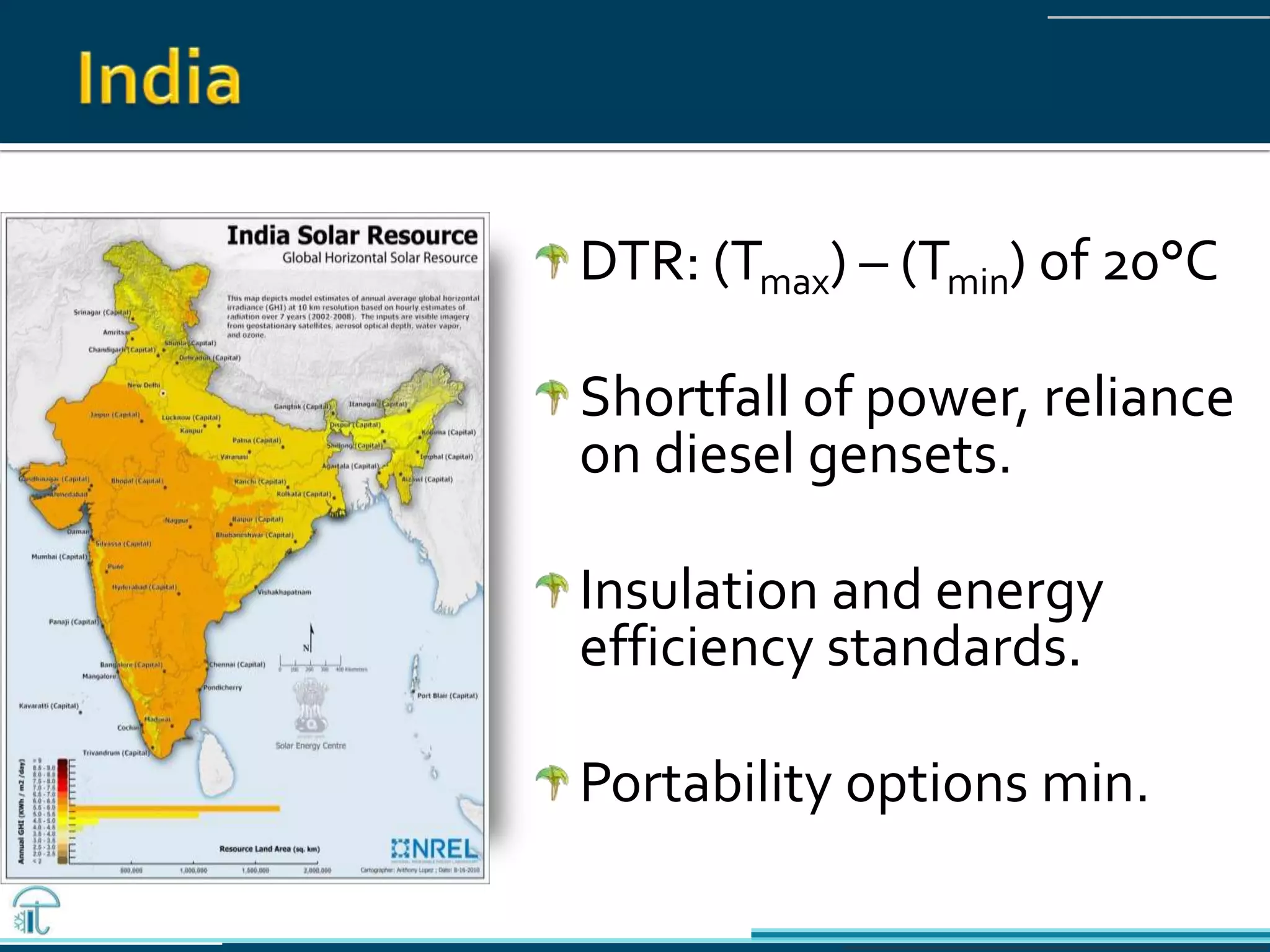

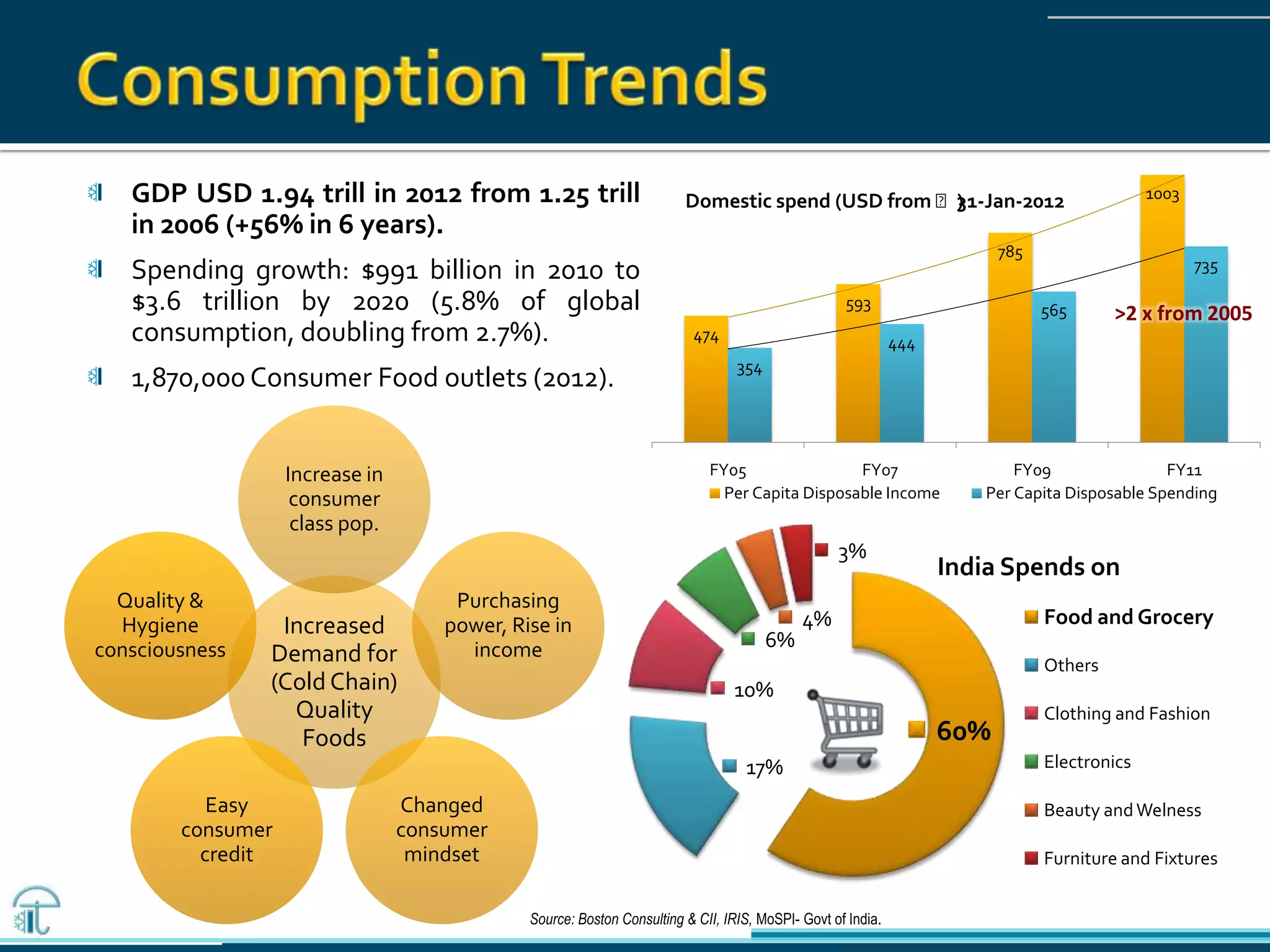

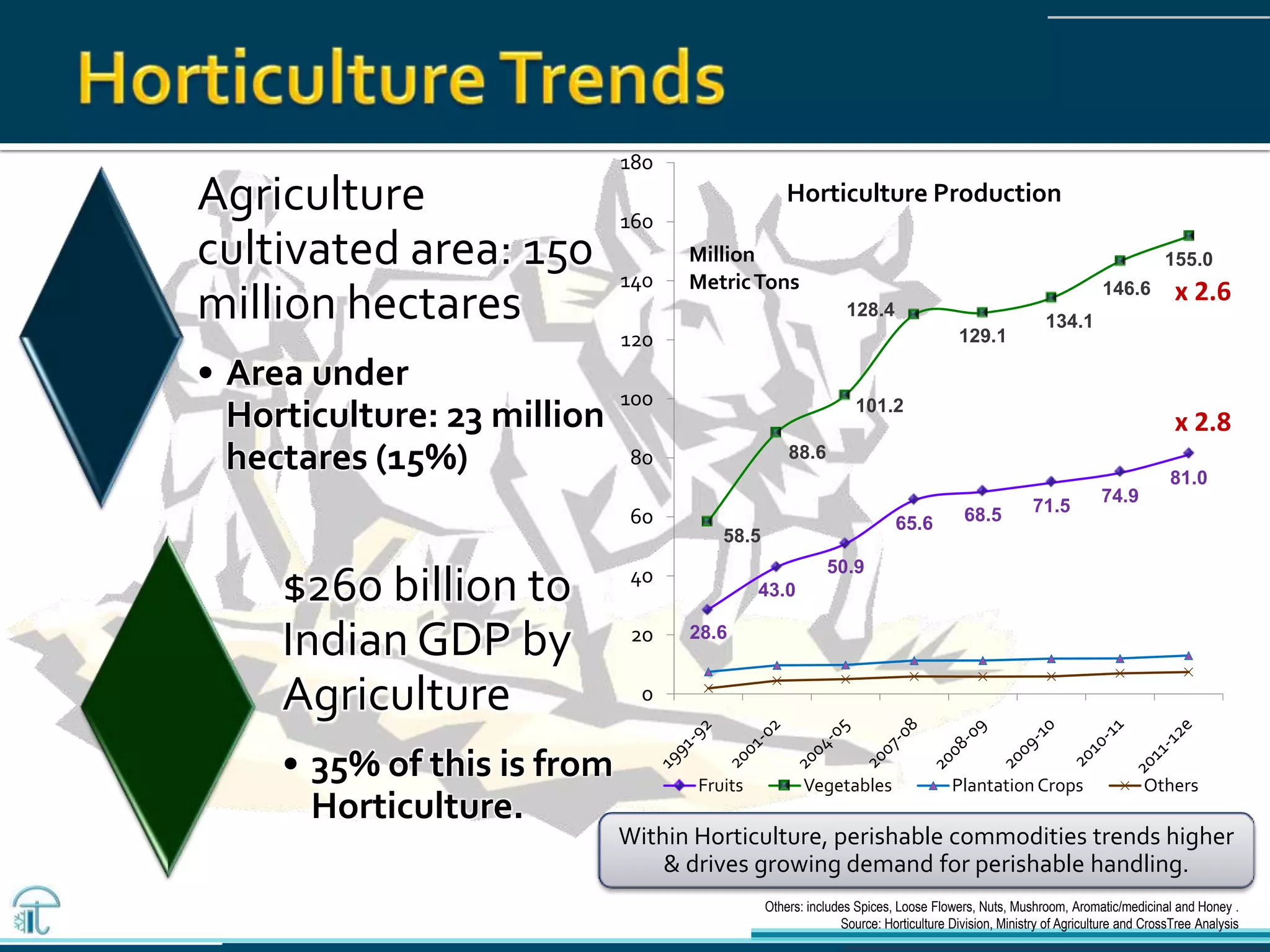

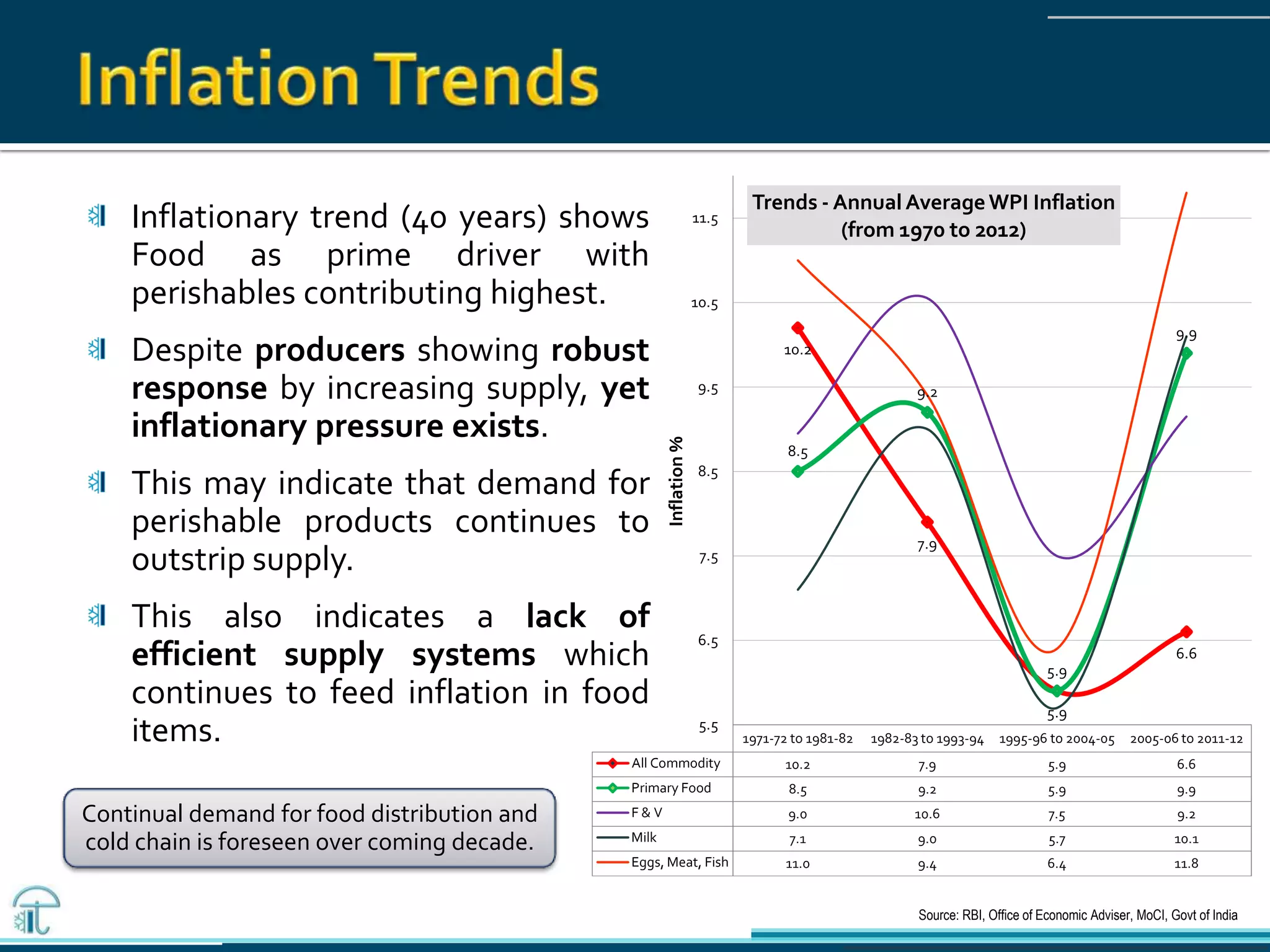

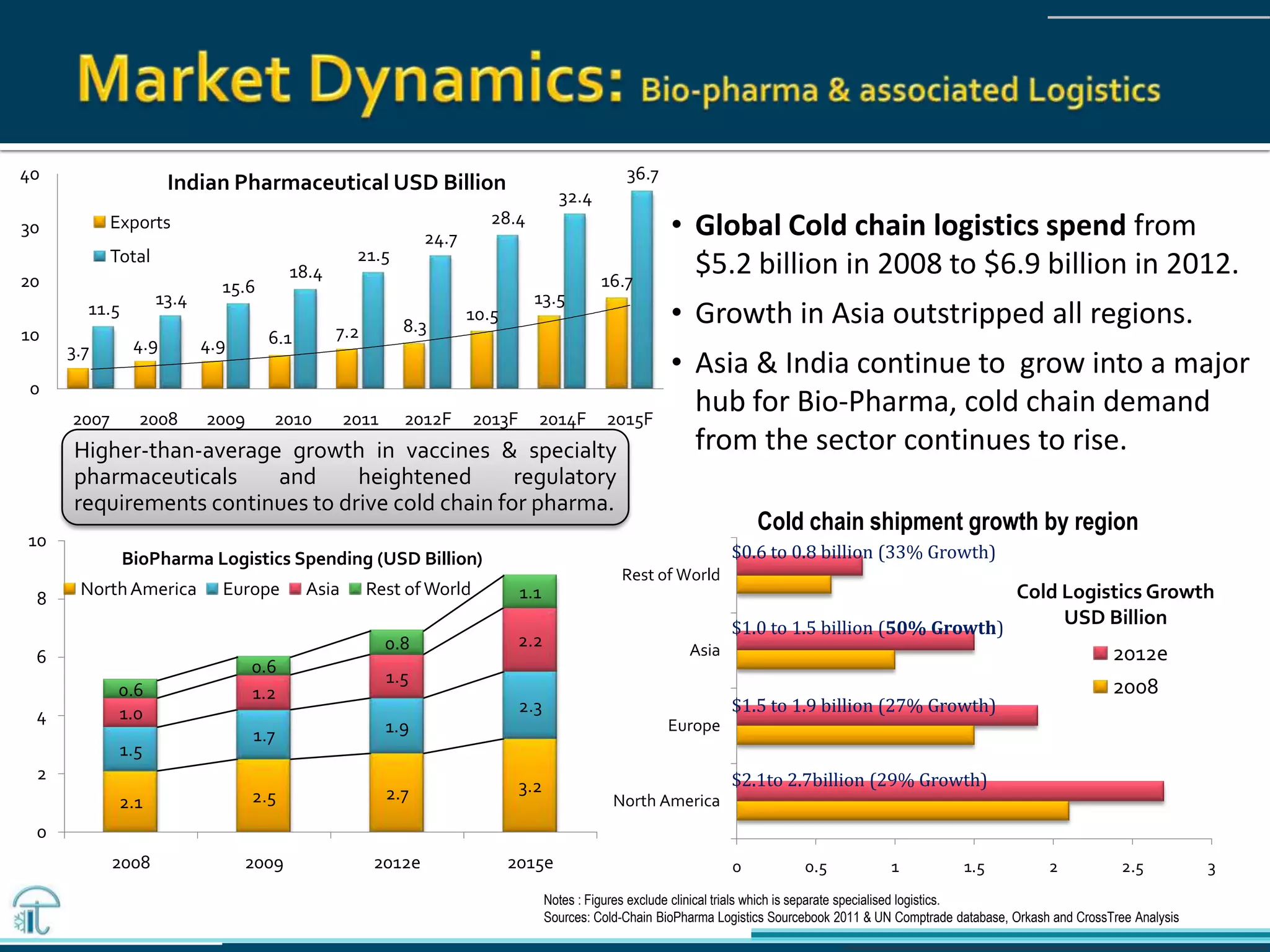

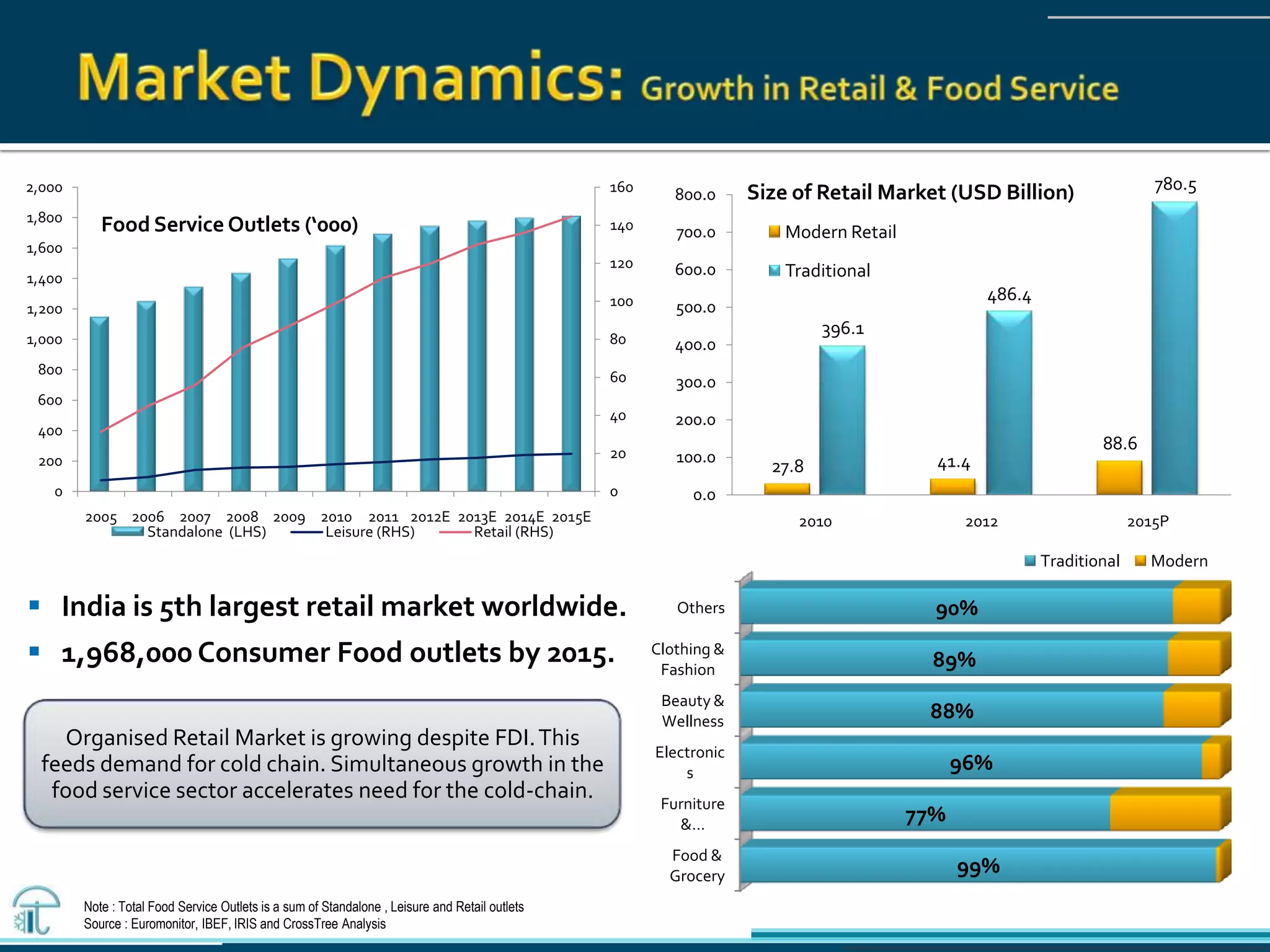

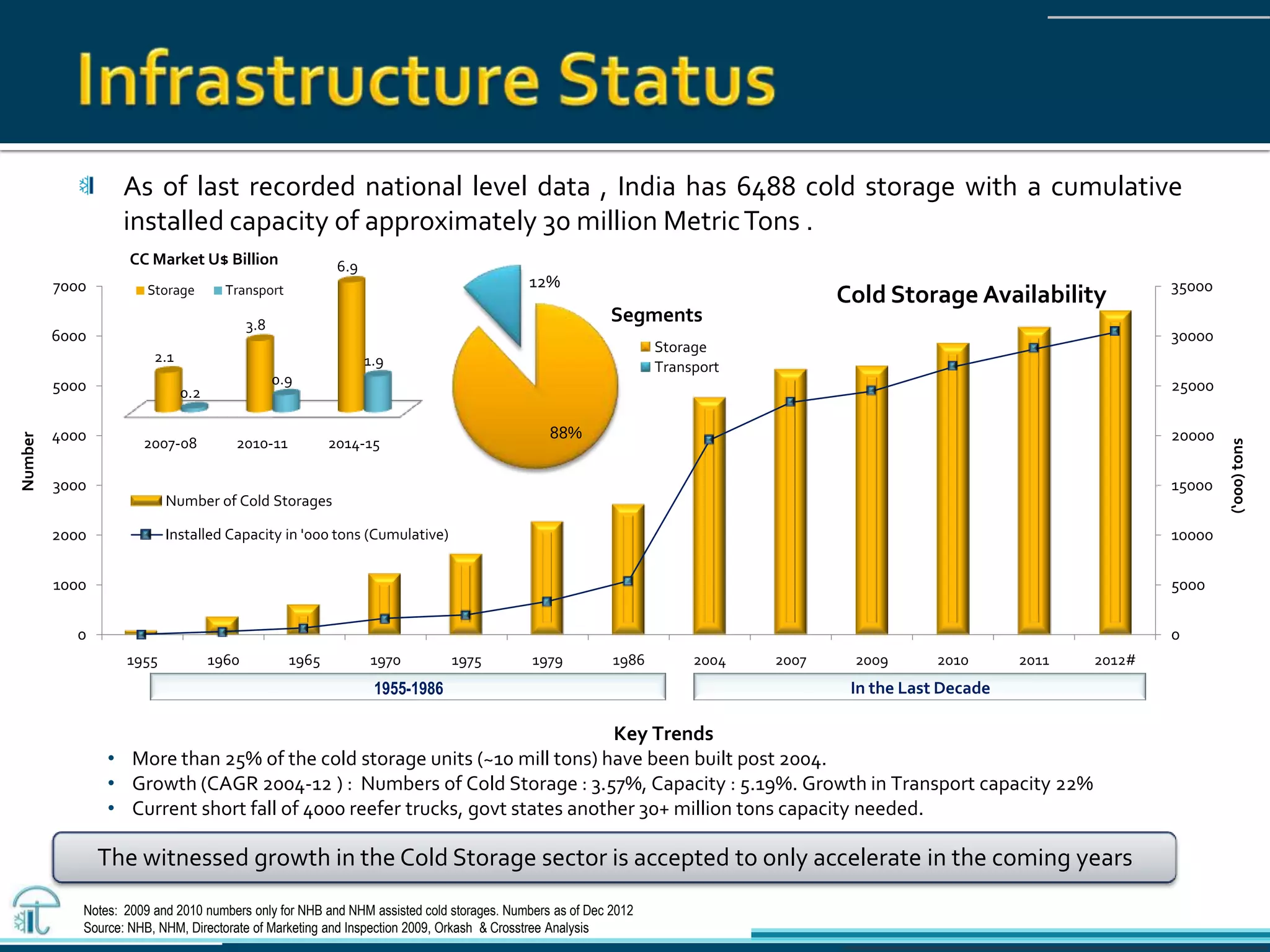

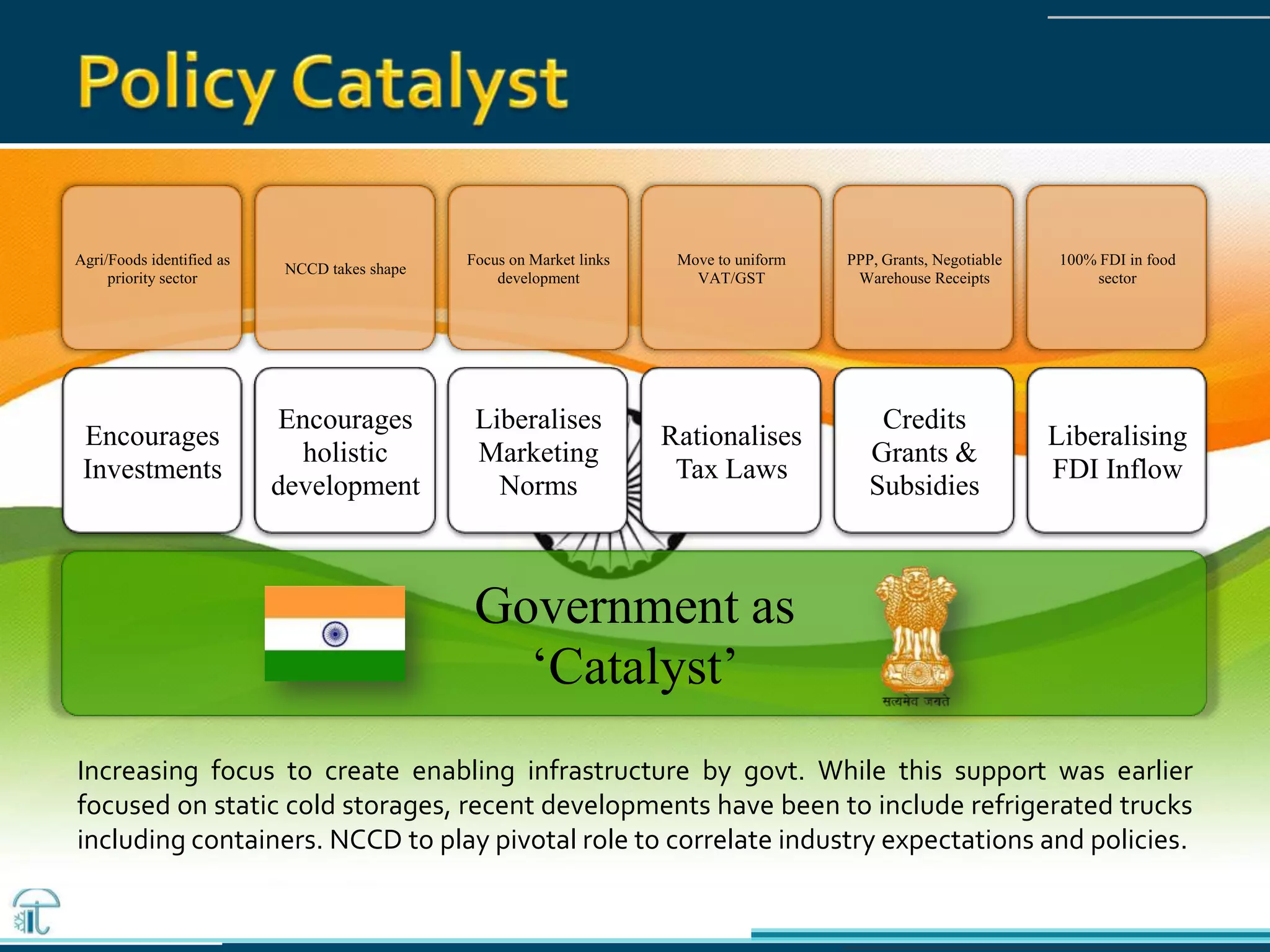

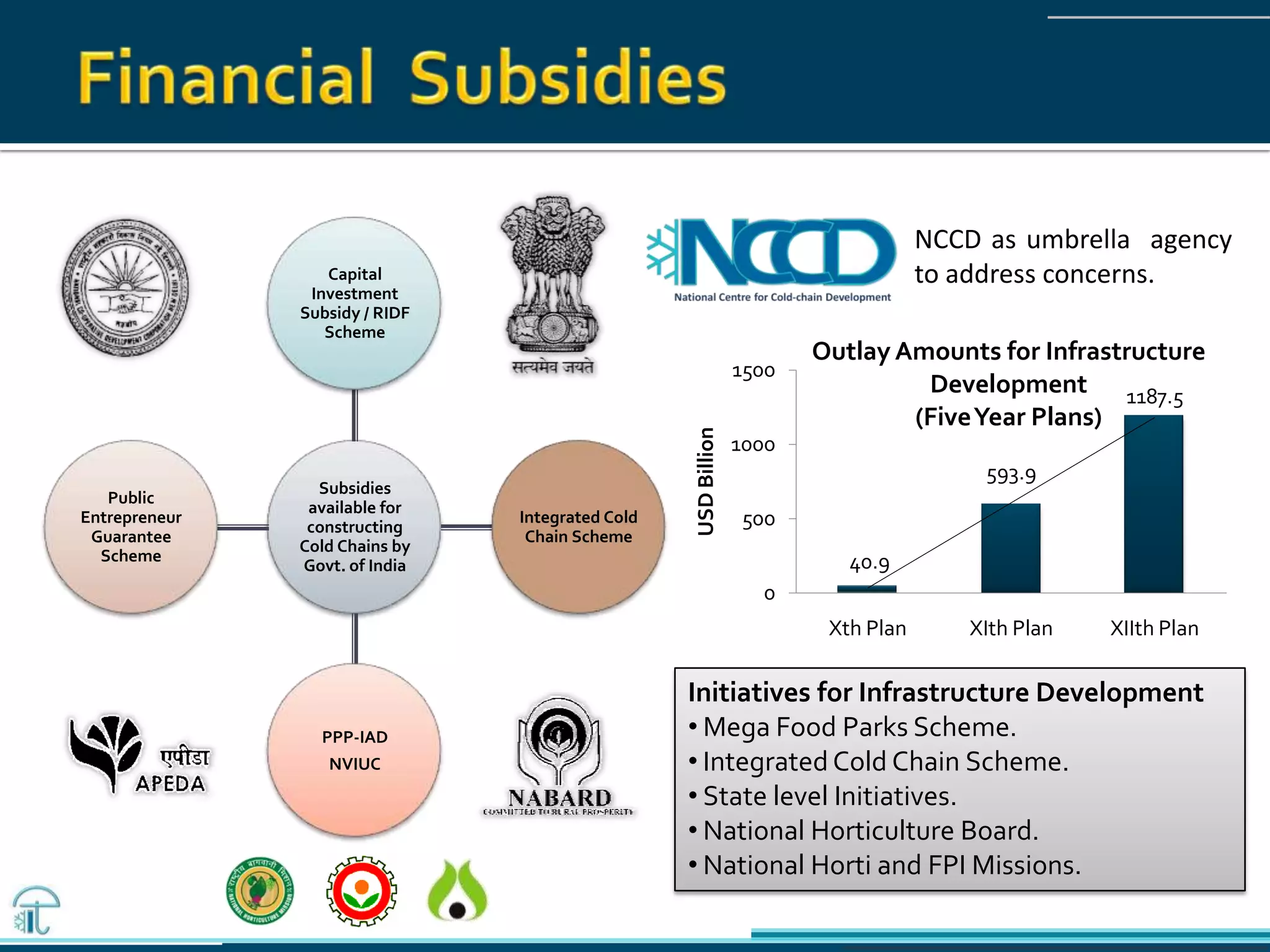

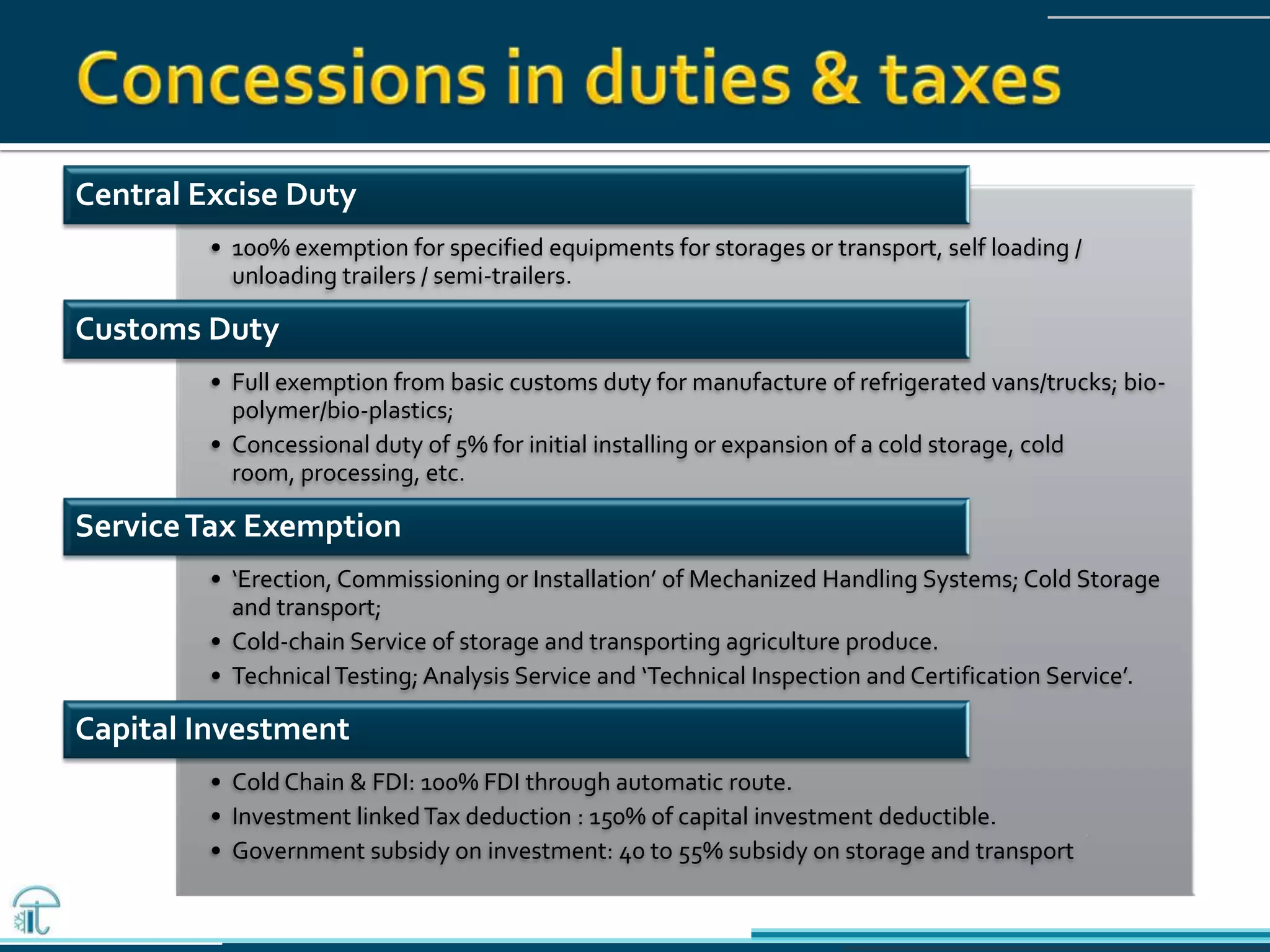

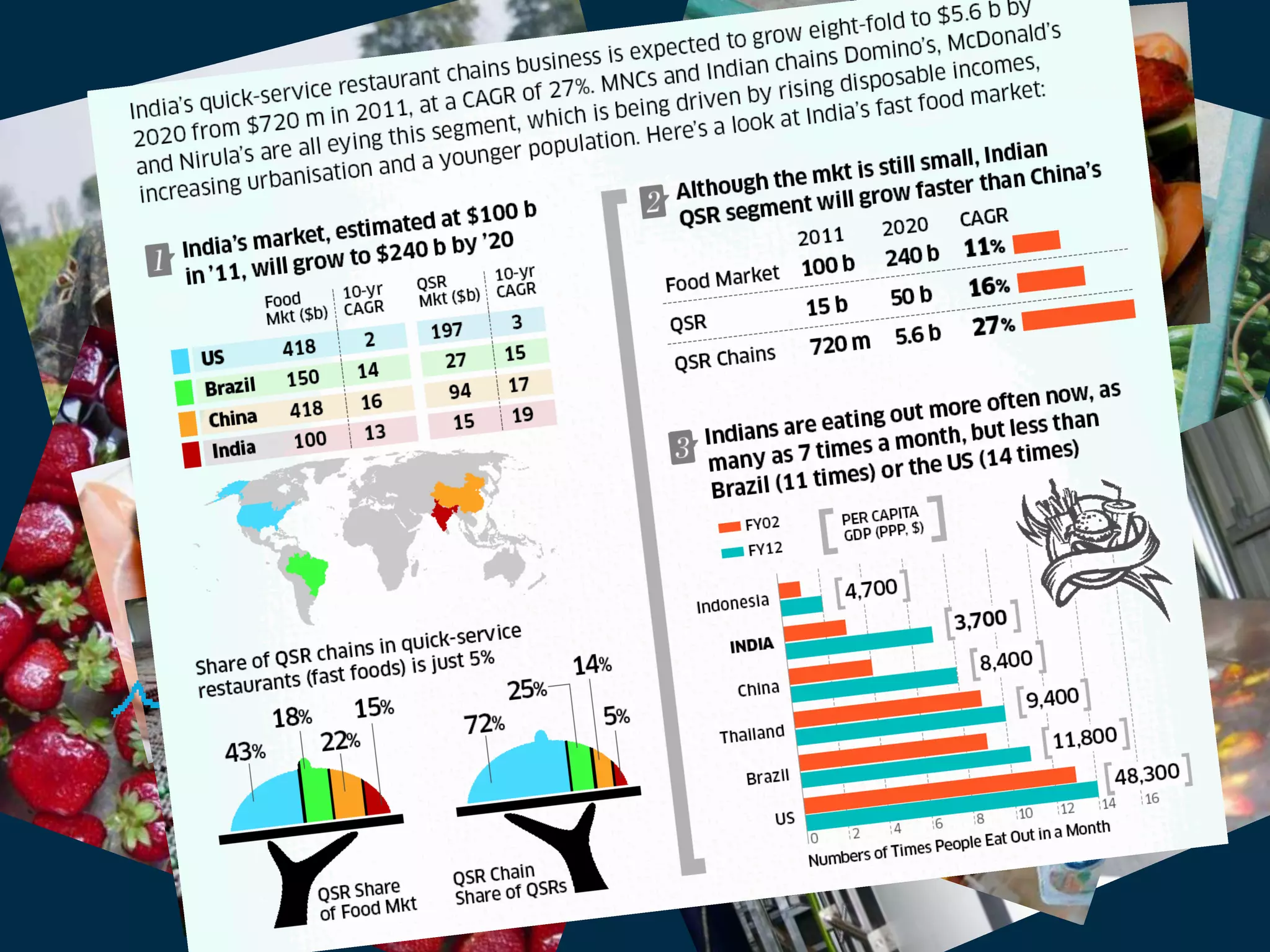

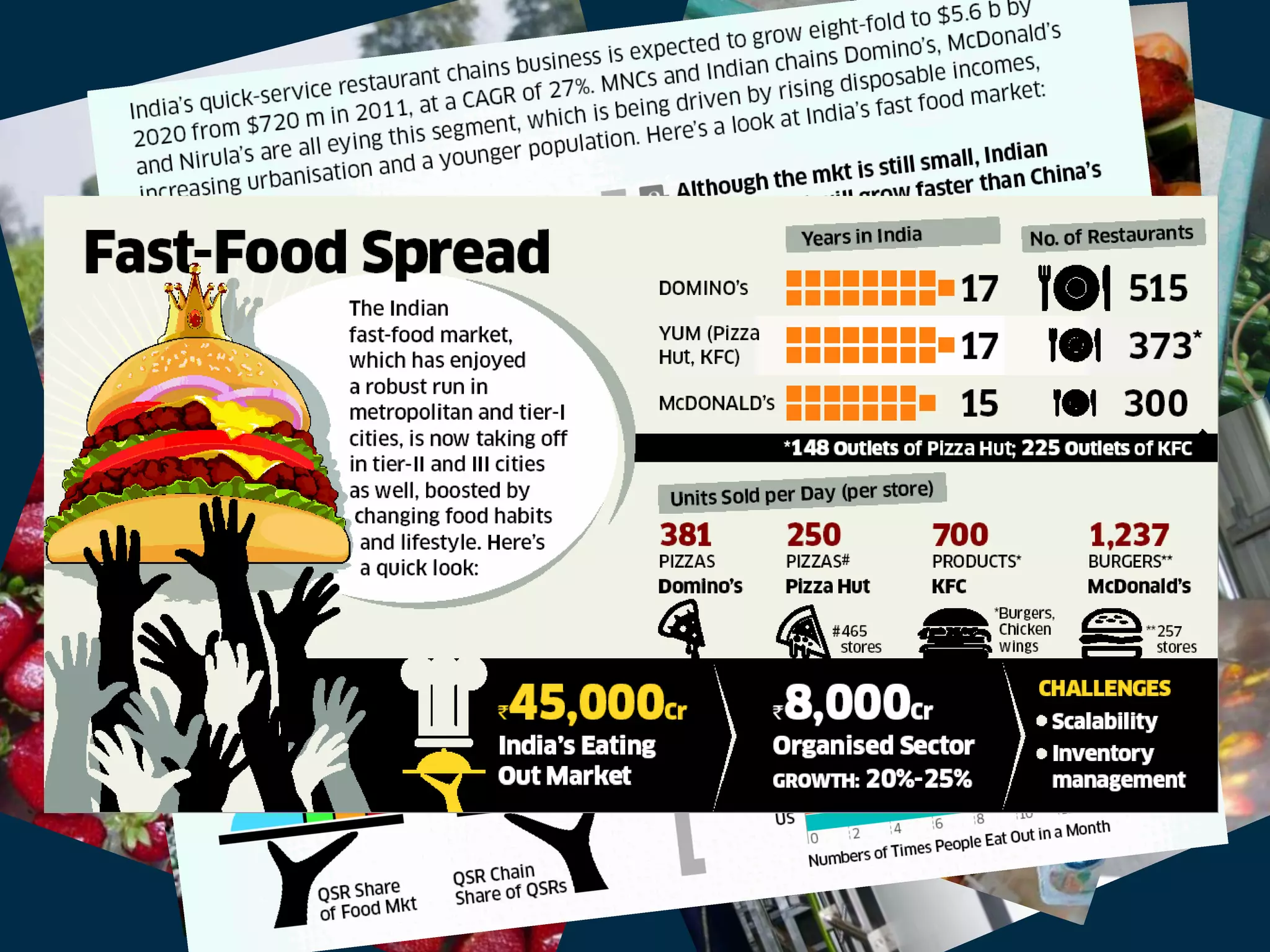

The document discusses the evolution and current state of cold chain logistics in India, highlighting its significance due to rapid urbanization, increasing consumer demand, and the country's agricultural output. It outlines the challenges faced by the sector, including inadequate infrastructure and high post-harvest losses, while emphasizing the government's role in facilitating investment and development in cold chain systems. Projected growth in the retail and food sectors is driving the need for efficient cold chain solutions, positioning India for significant advancements in this area.