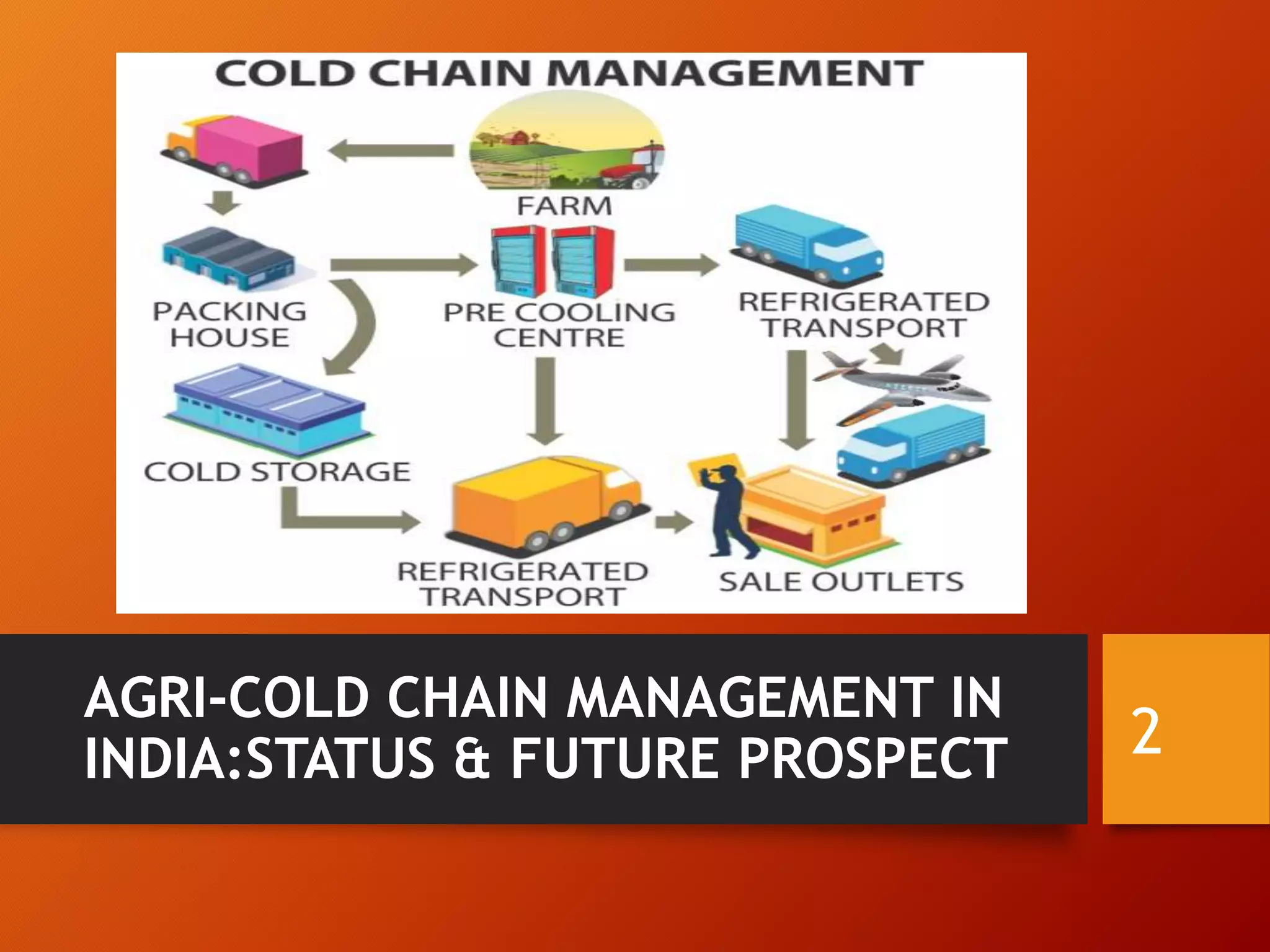

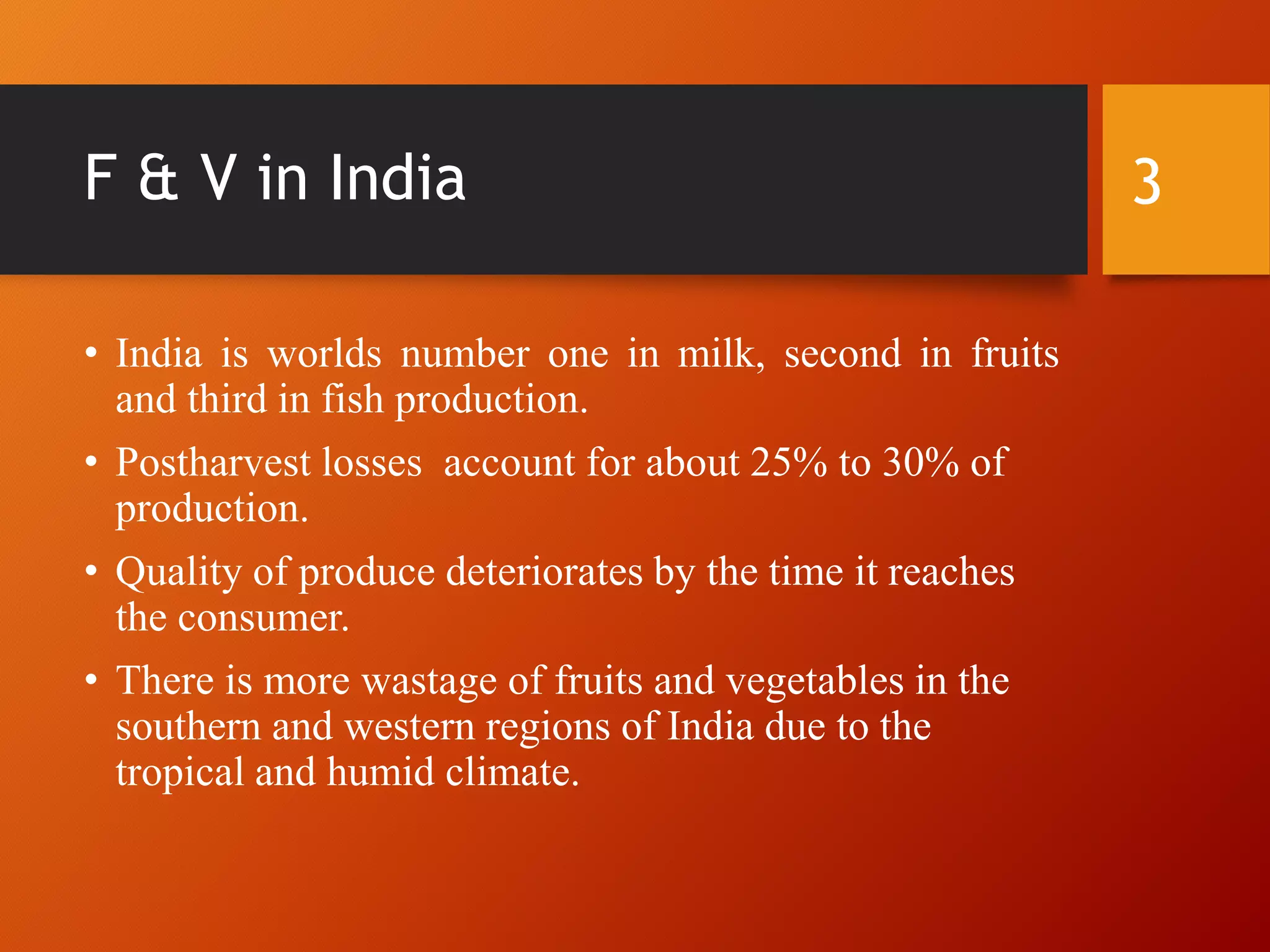

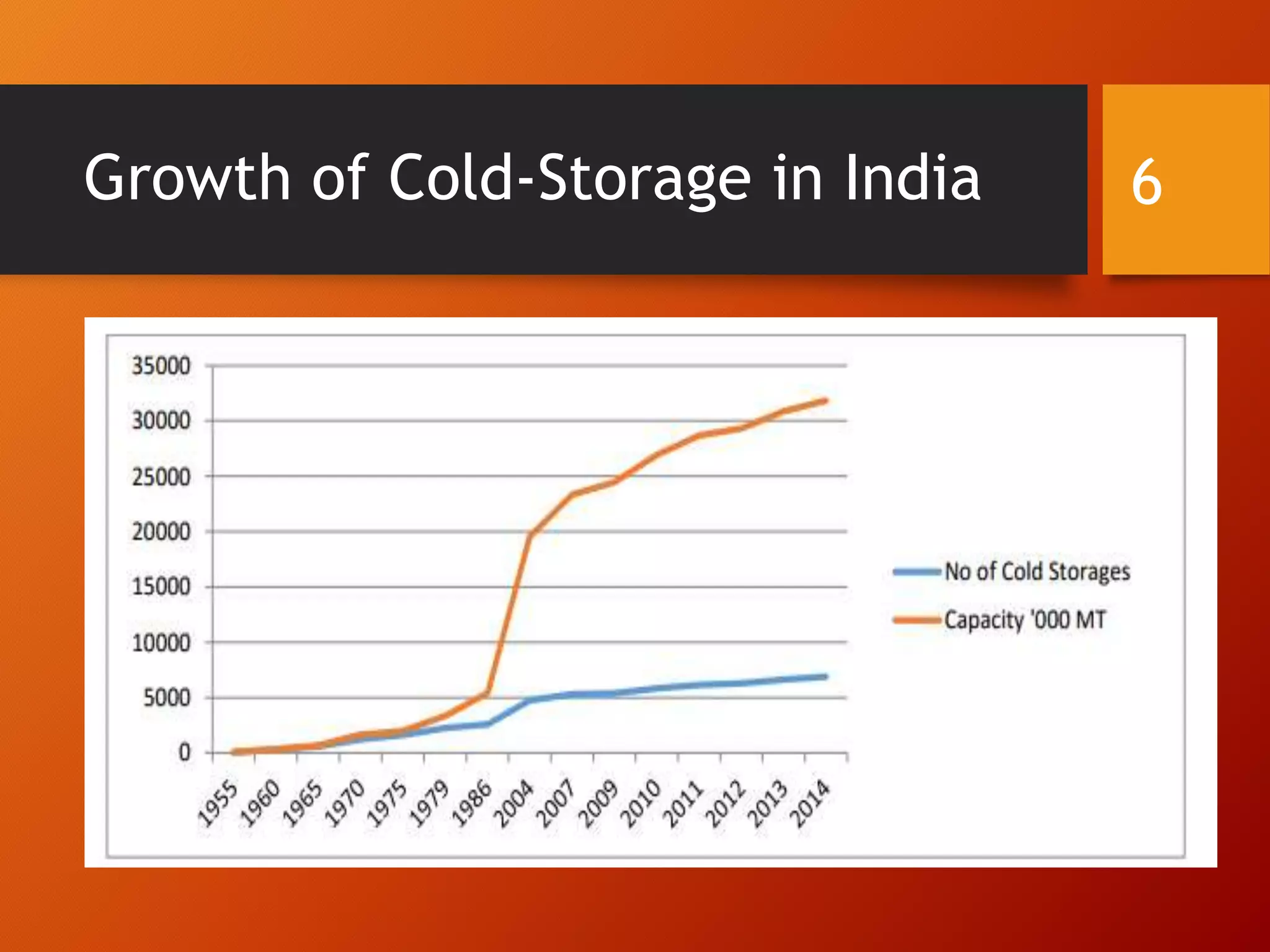

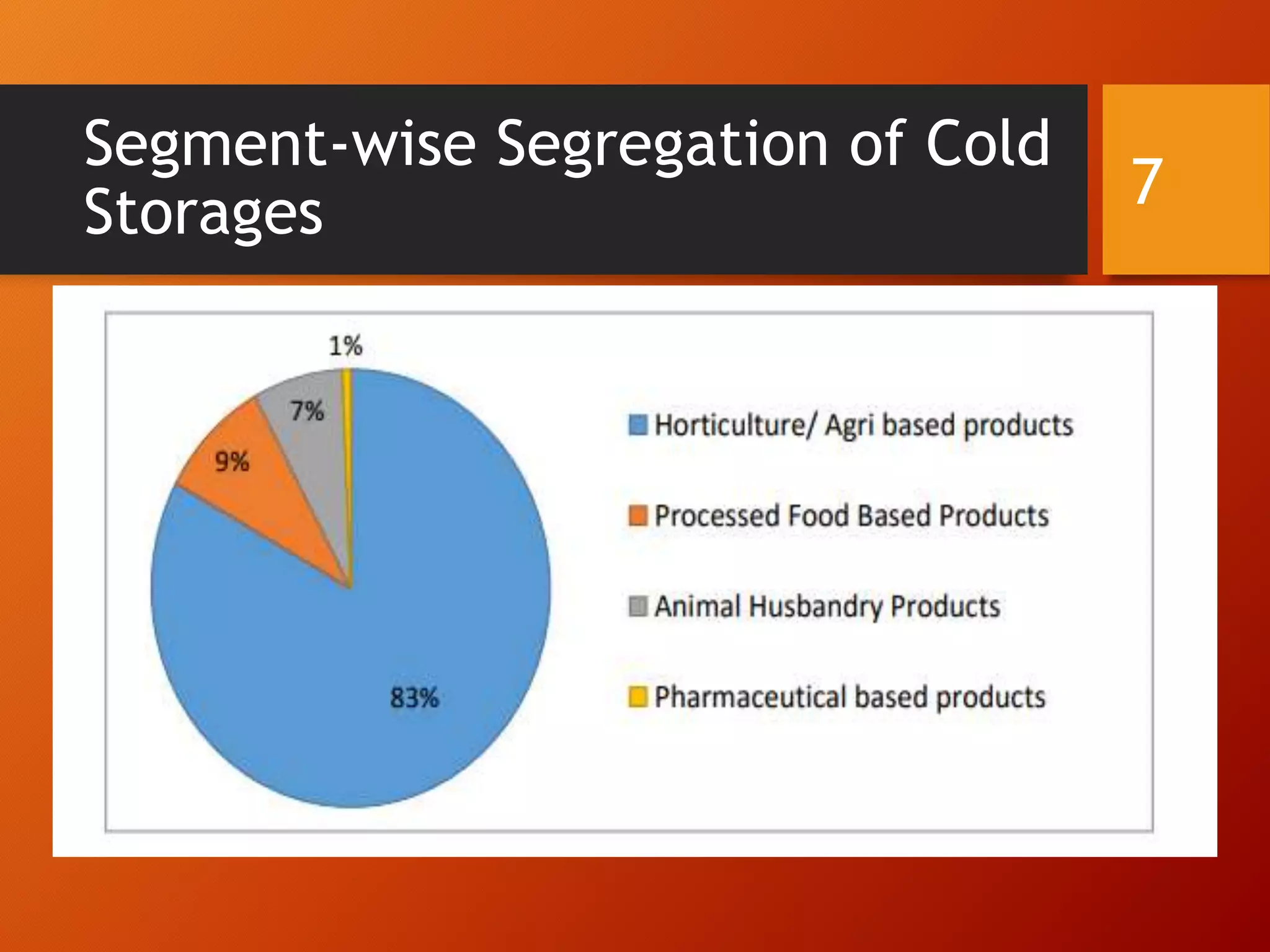

This document discusses the status and future prospects of cold chain management in India's agriculture industry. It notes that India is a top global producer of milk, fruits, and fish but suffers significant post-harvest losses of 25-30% due to lack of cold storage and supply chain infrastructure. The government has initiated policies to promote private investment in cold storage facilities and provide subsidies. However, cold chain capacity remains short by 10 million tons and unevenly distributed. The industry is expected to grow significantly with further government support and private sector involvement to reduce food wastage and improve quality and supply.