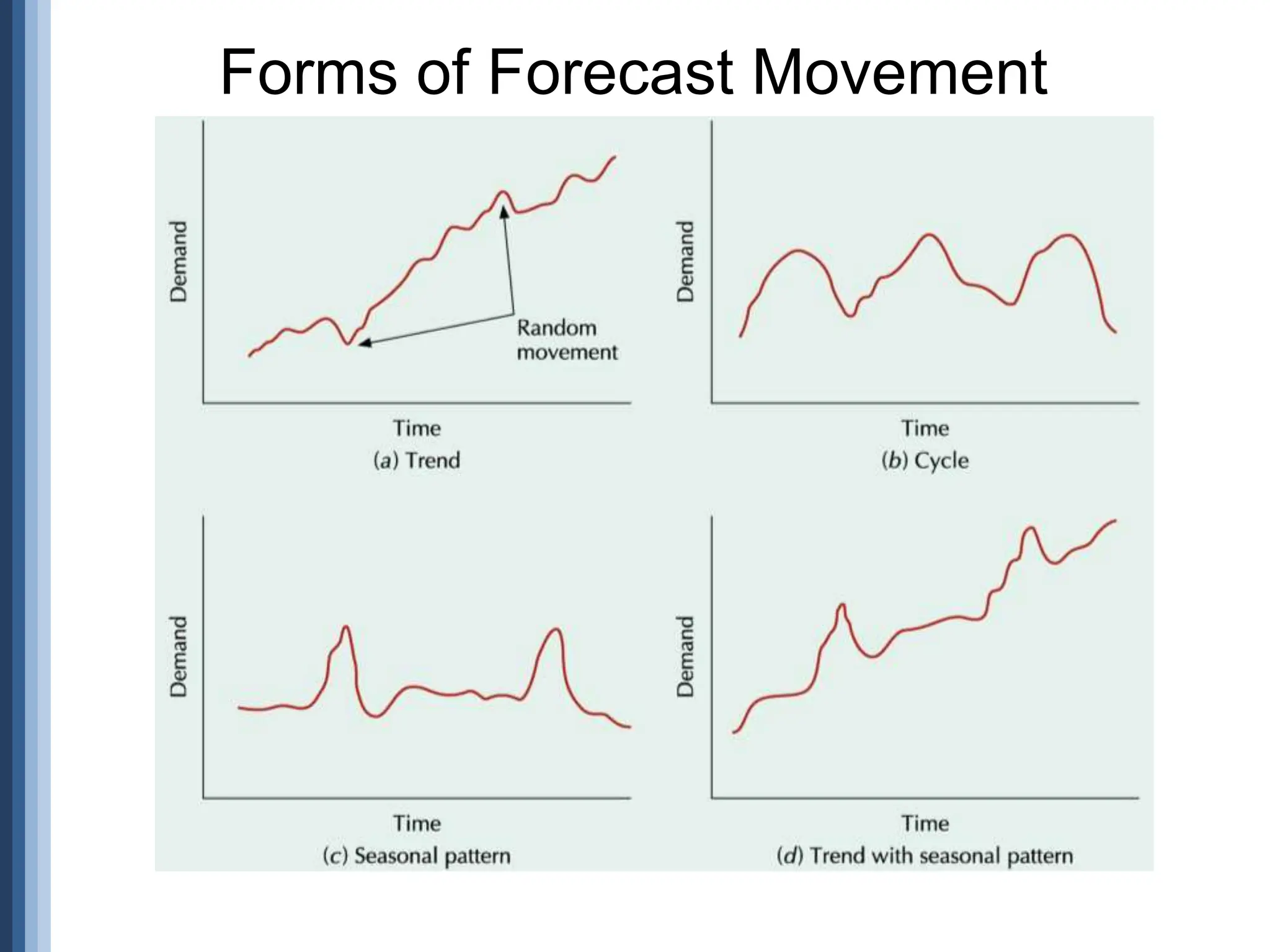

The document outlines the strategic role of forecasting in supply chain management, detailing various forecasting methods and their components, including time series and regression techniques. It emphasizes the importance of forecast accuracy, the effects of errors, and the need for ongoing monitoring and adjustments in forecasting practices. Additionally, it discusses qualitative and quantitative forecasting approaches alongside practical applications using Excel.

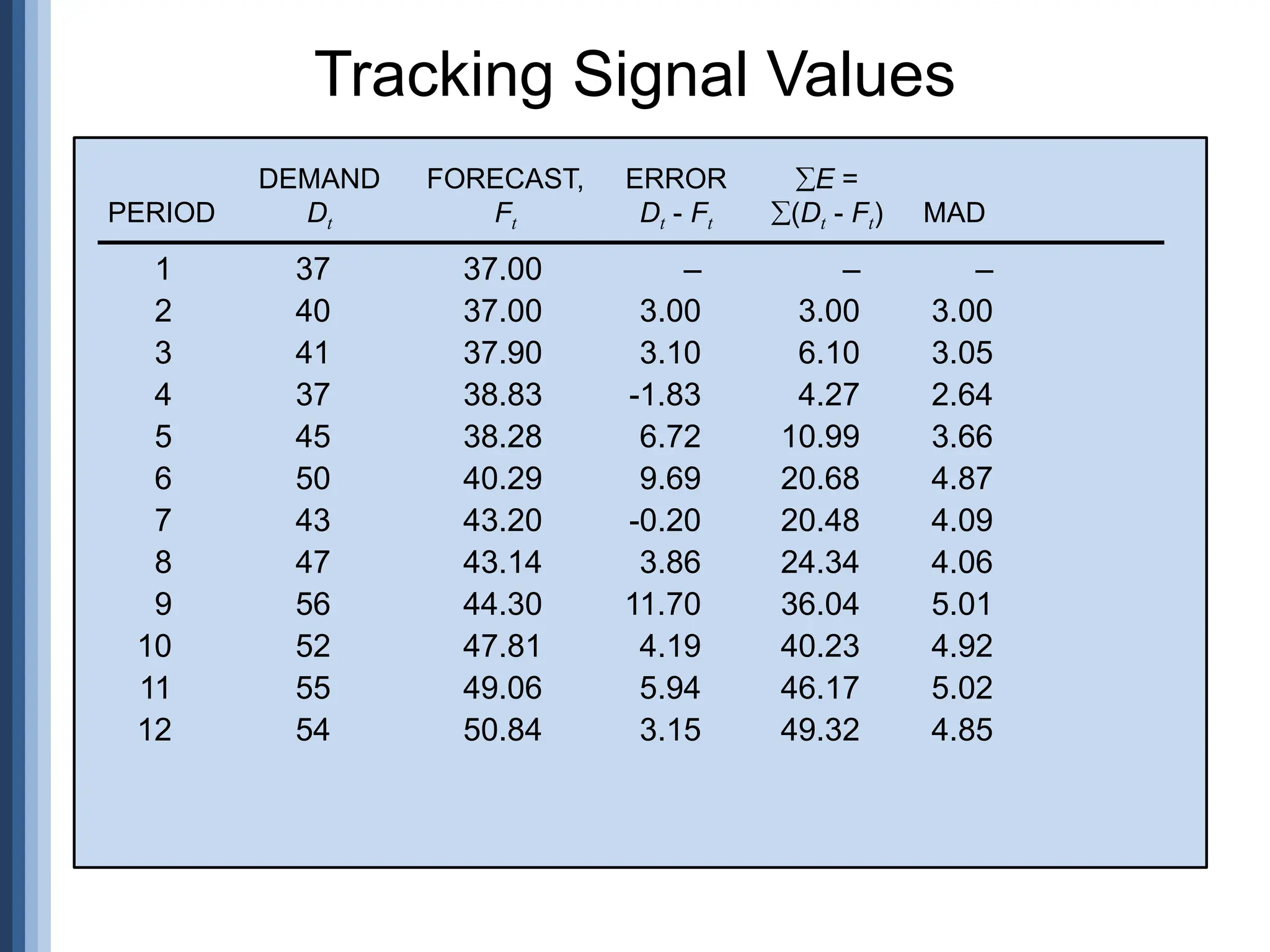

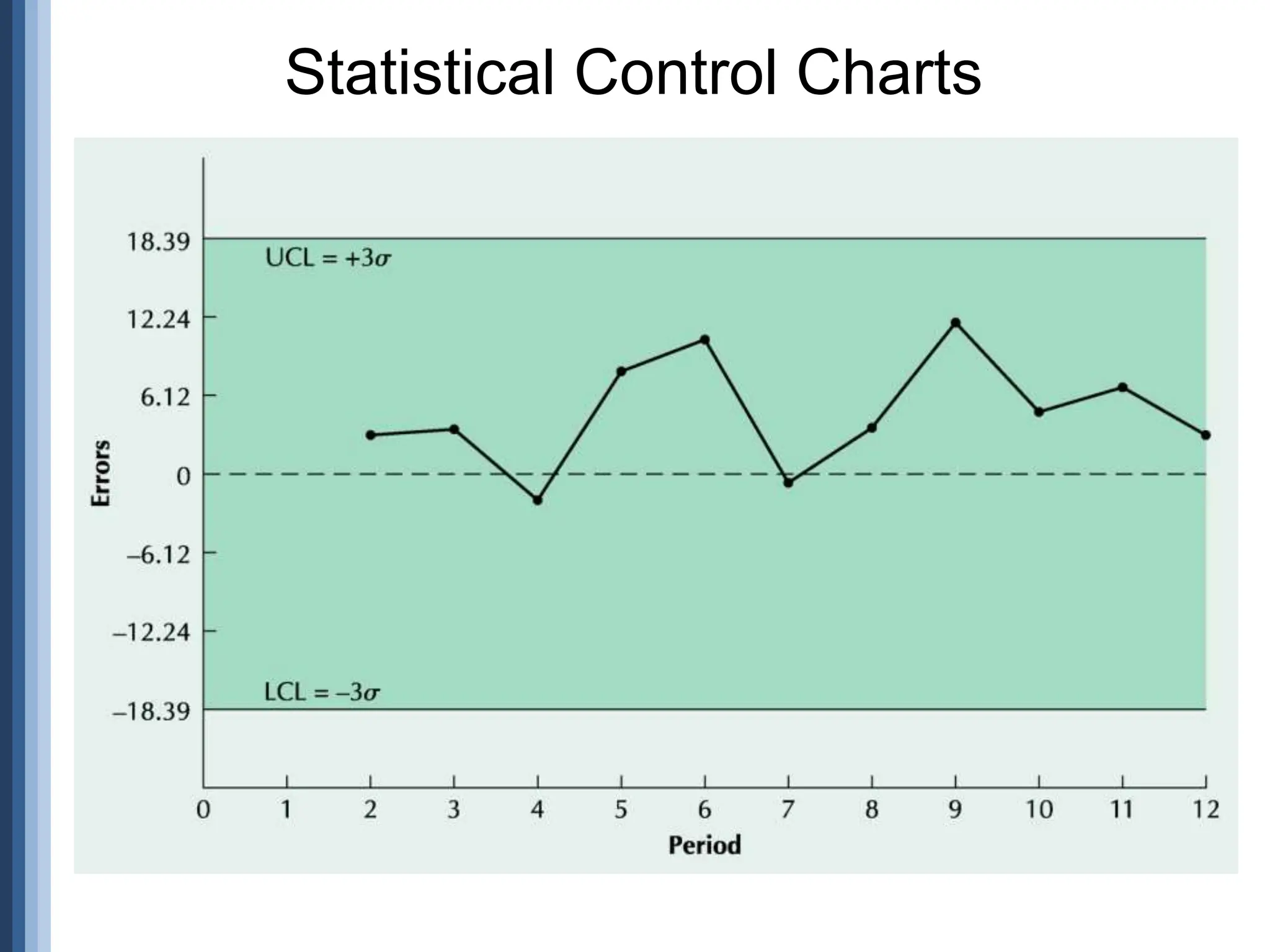

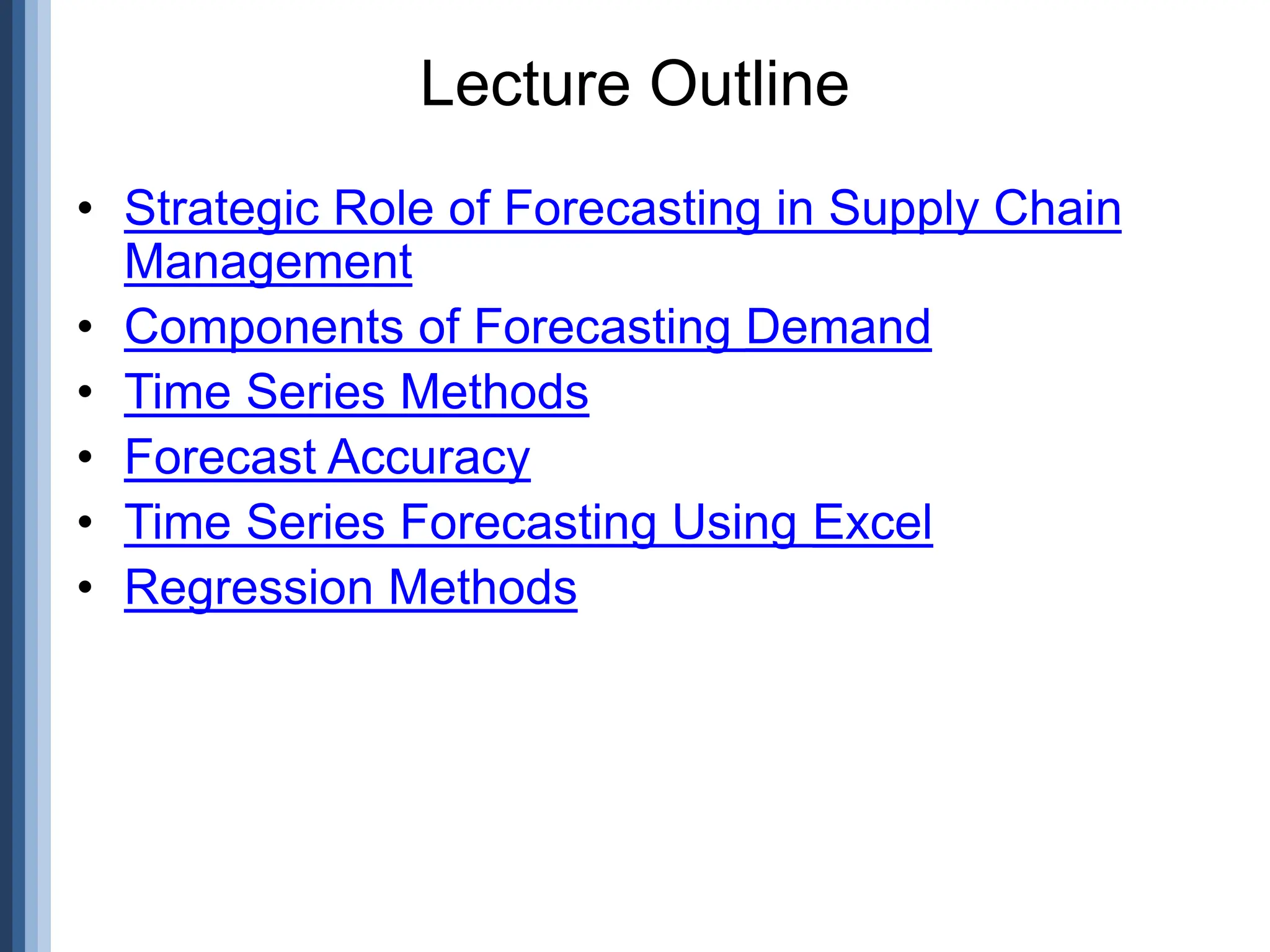

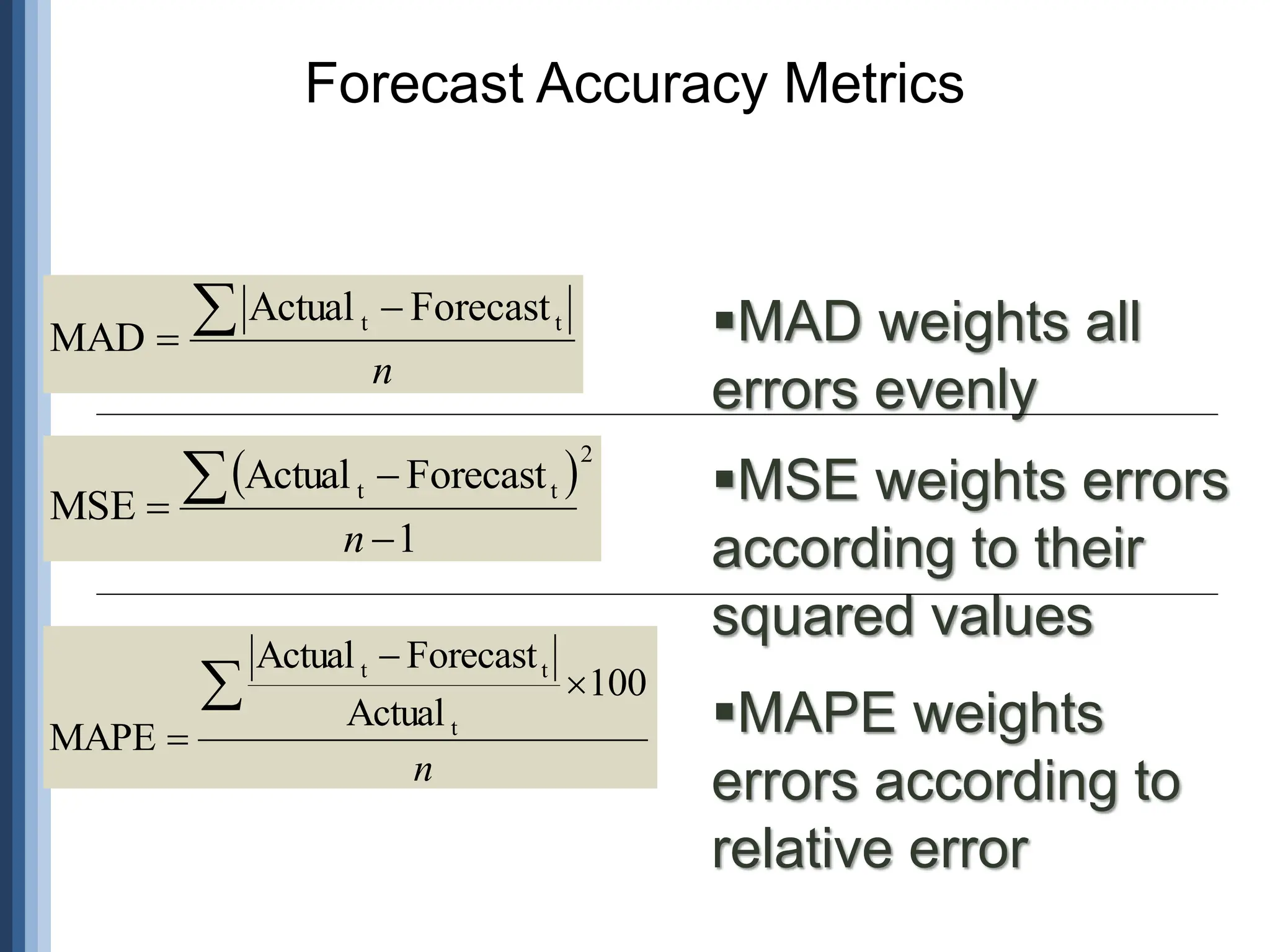

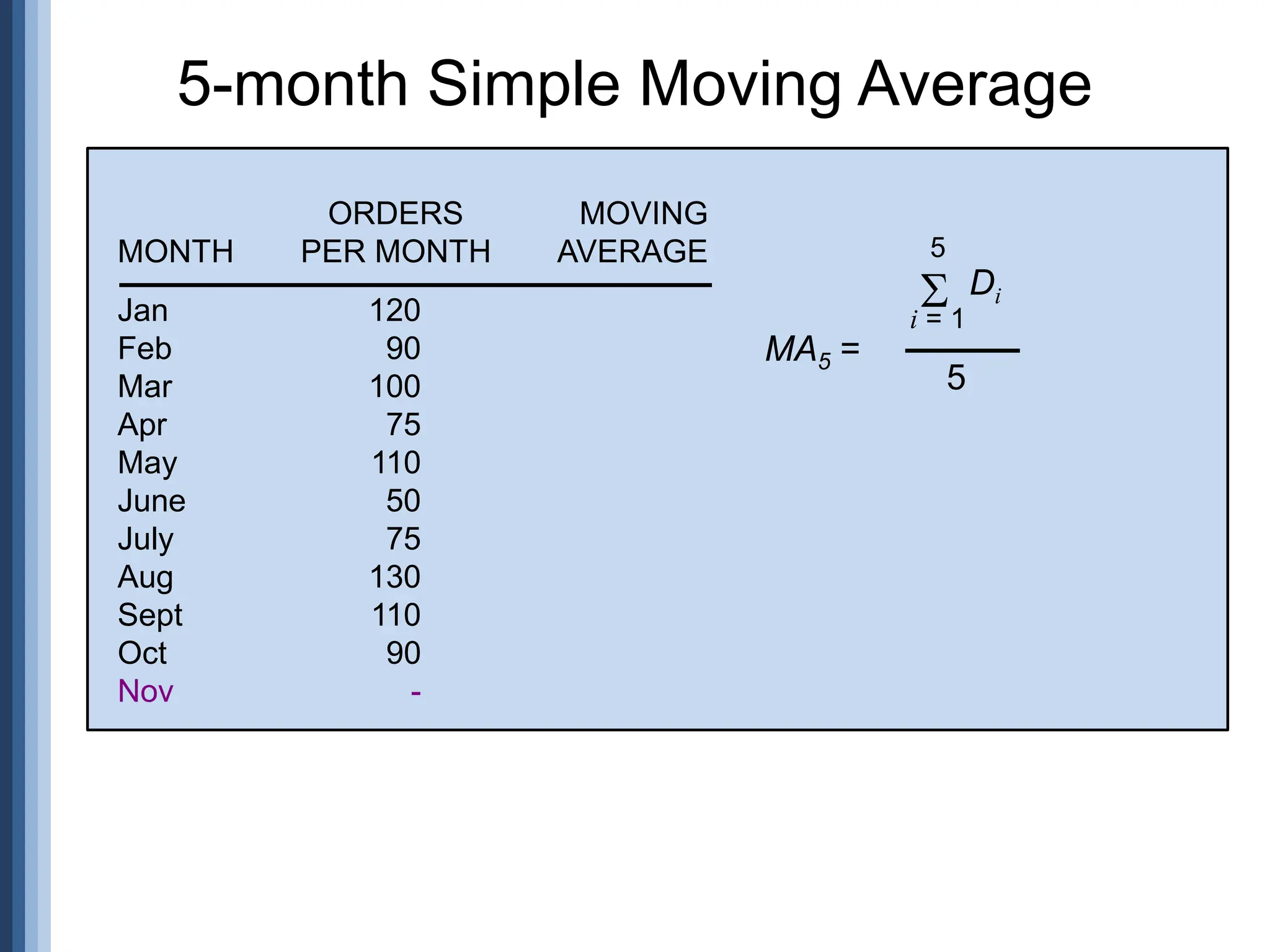

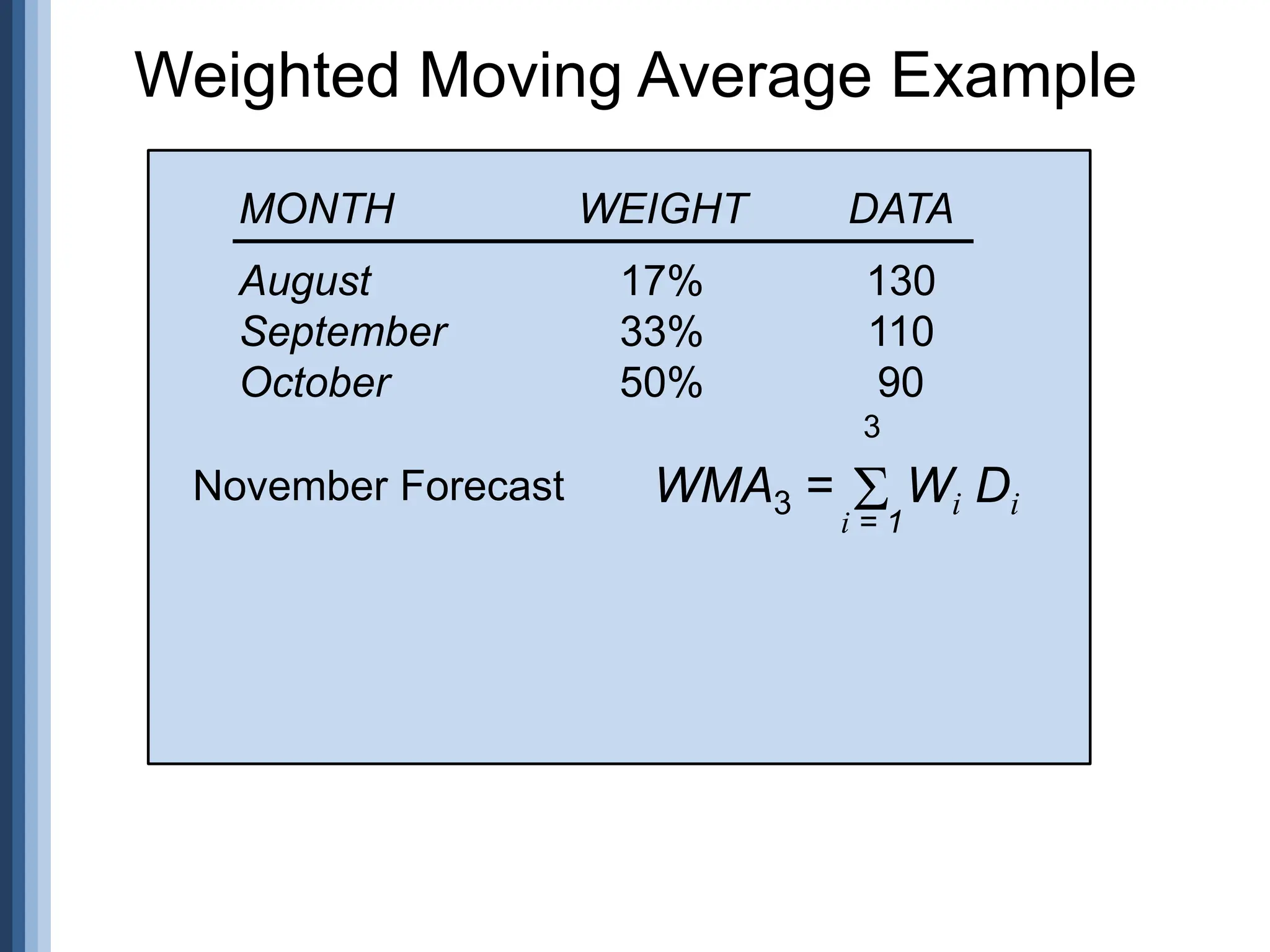

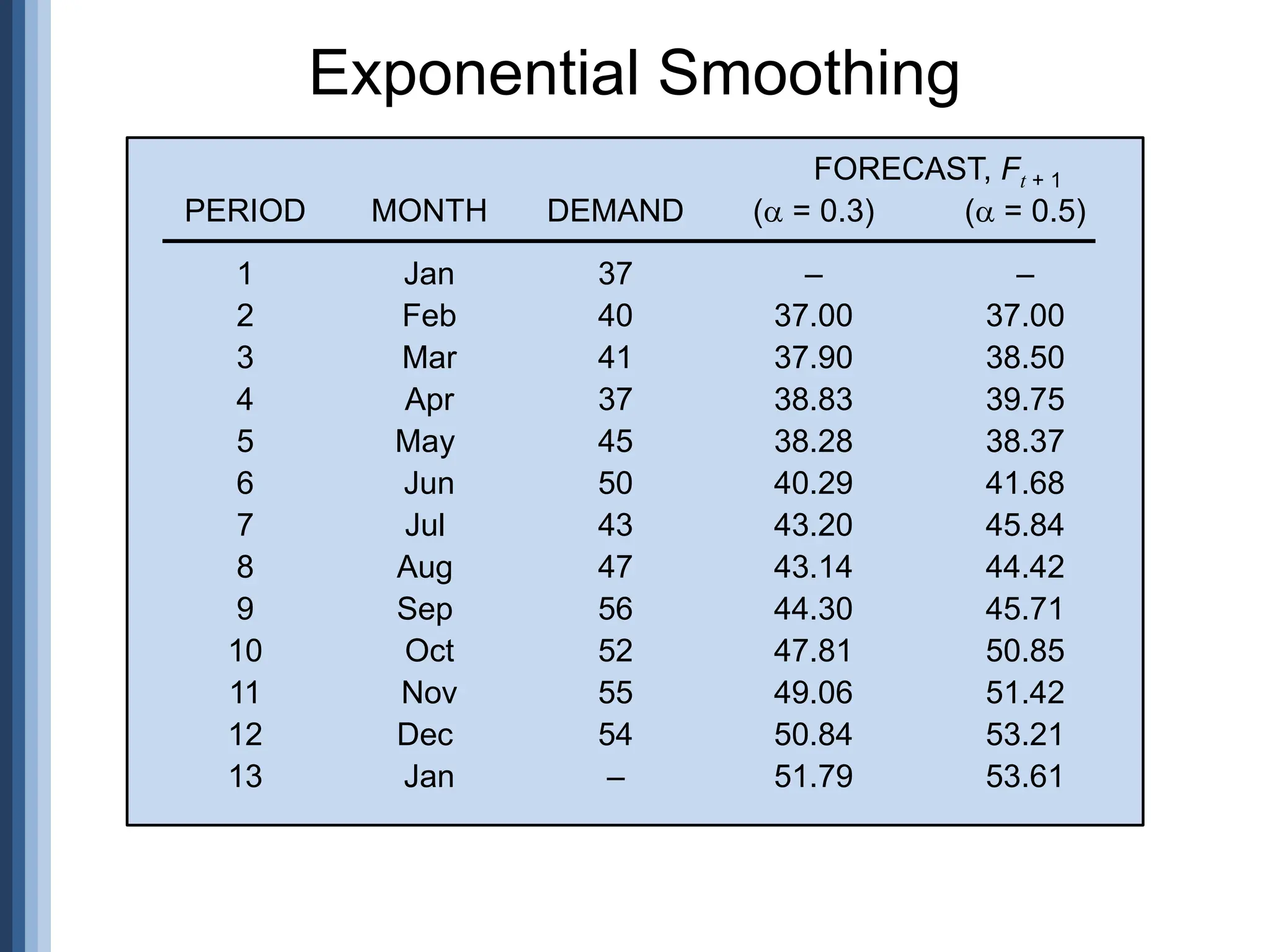

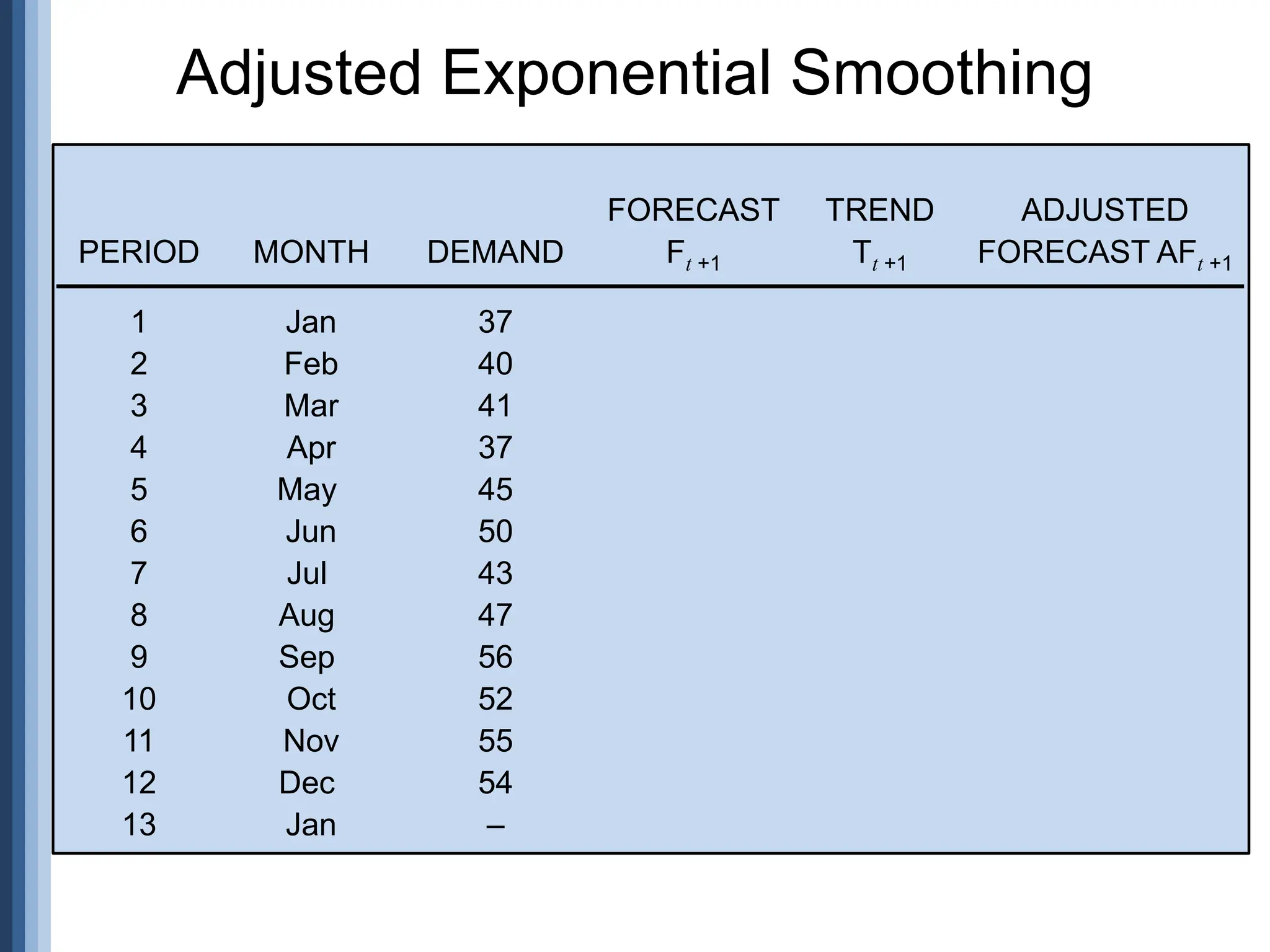

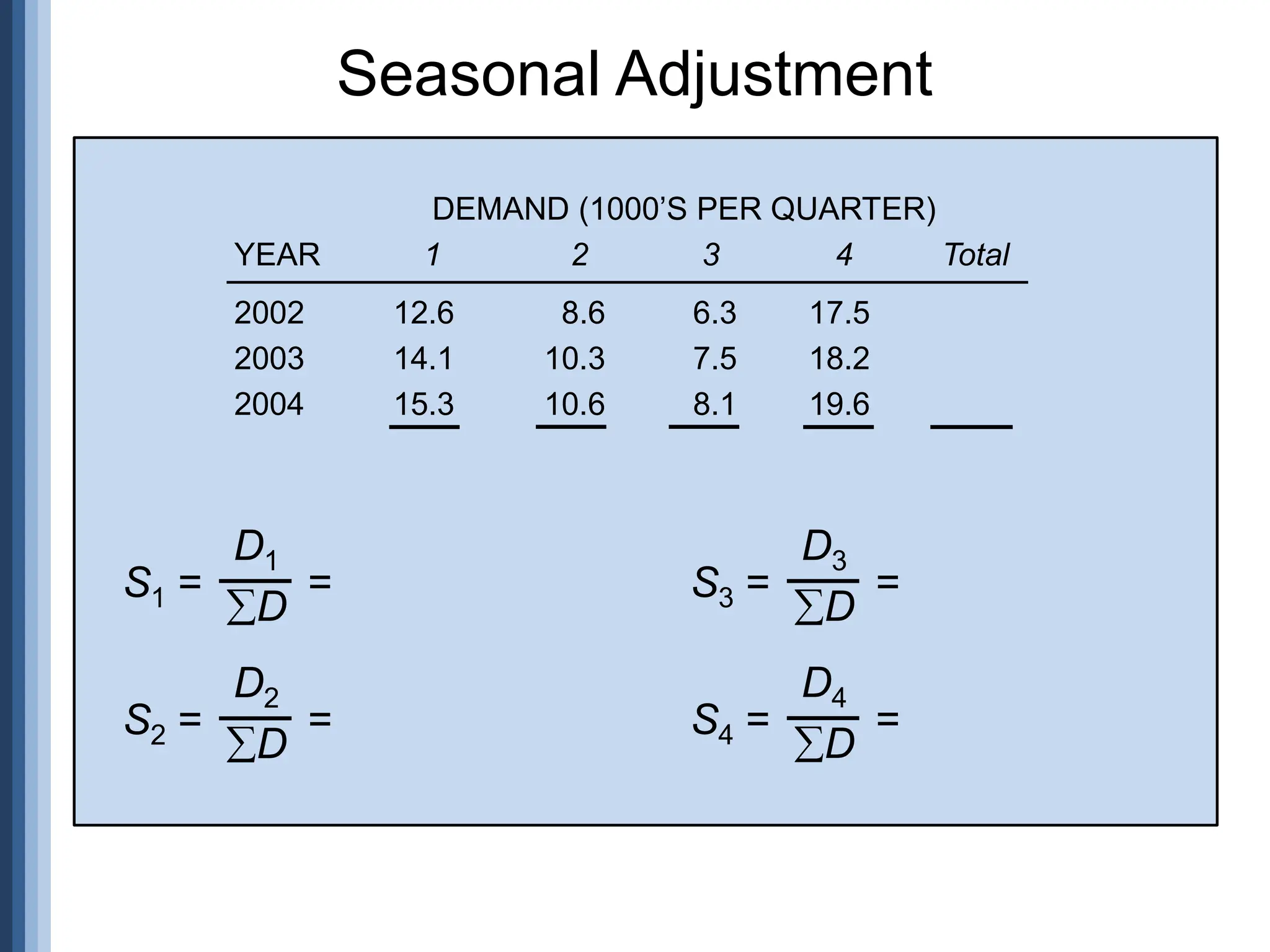

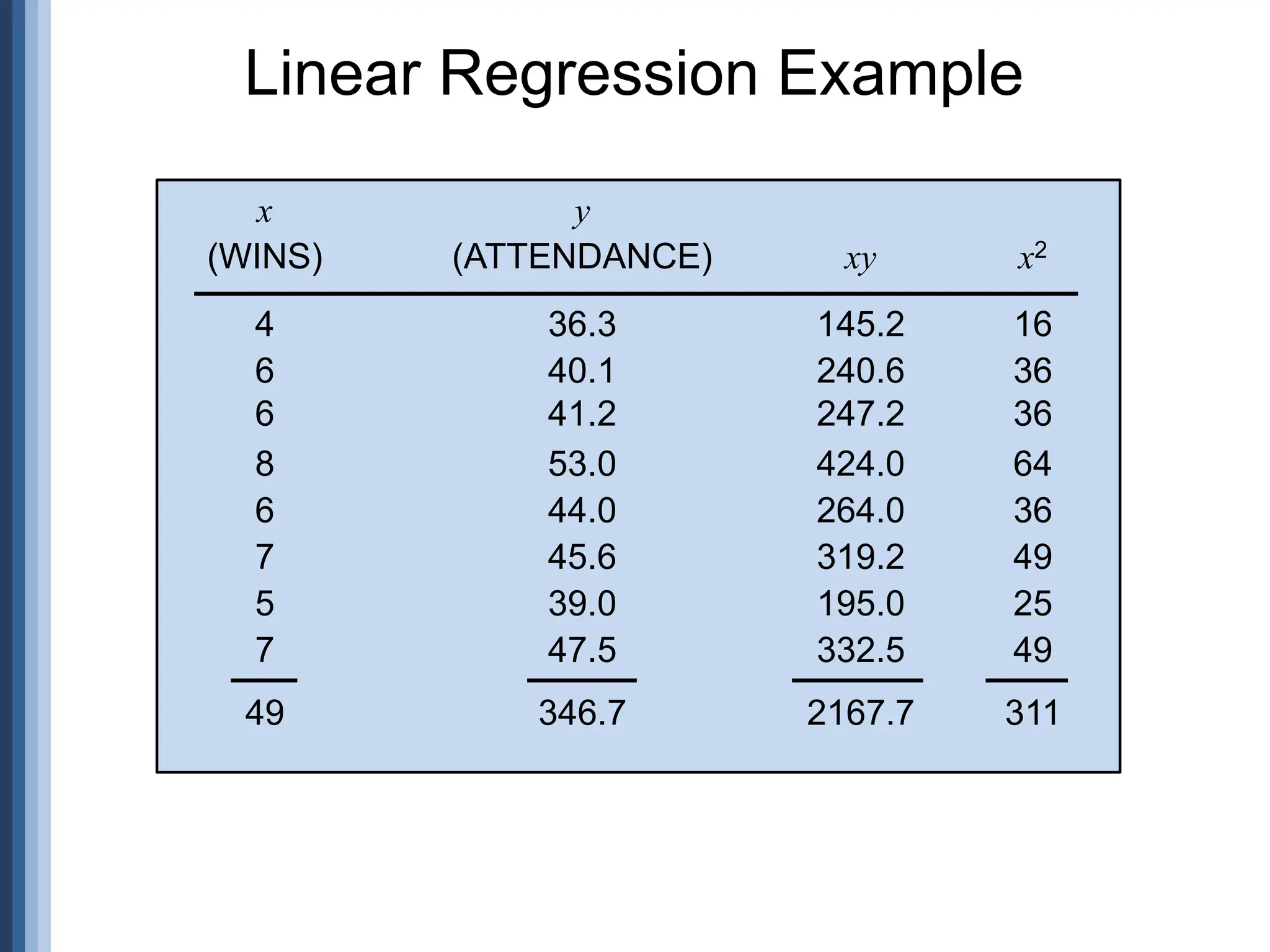

![Period

Actual

(A)

Forecast

(F)

(A-F)

Error |Error| Error2 [|Error|/Actual]x100

1 107 110 -3 3 9 2.80%

2 125 121 4 4 16 3.20%

3 115 112 3 3 9 2.61%

4 118 120 -2 2 4 1.69%

5 108 109 1 1 1 0.93%

Sum 13 39 11.23%

n = 5 n-1 = 4 n = 5

MAD MSE MAPE

= 2.6 = 9.75 = 2.25%

Forecast Error Calculation](https://image.slidesharecdn.com/11forecasting-240731115559-be84be10/75/Forecasting-ppt-in-quality-management-ME-13-2048.jpg)

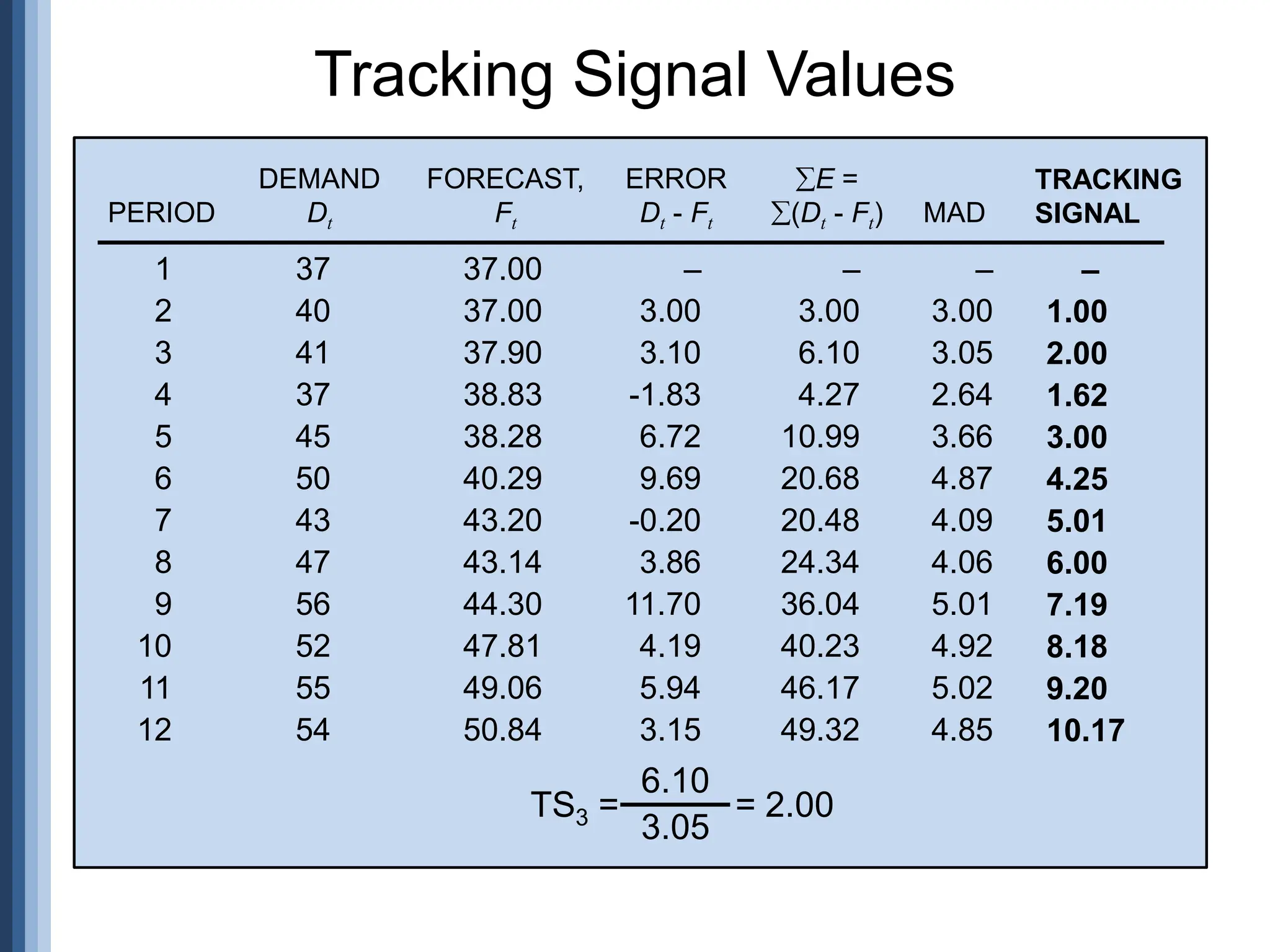

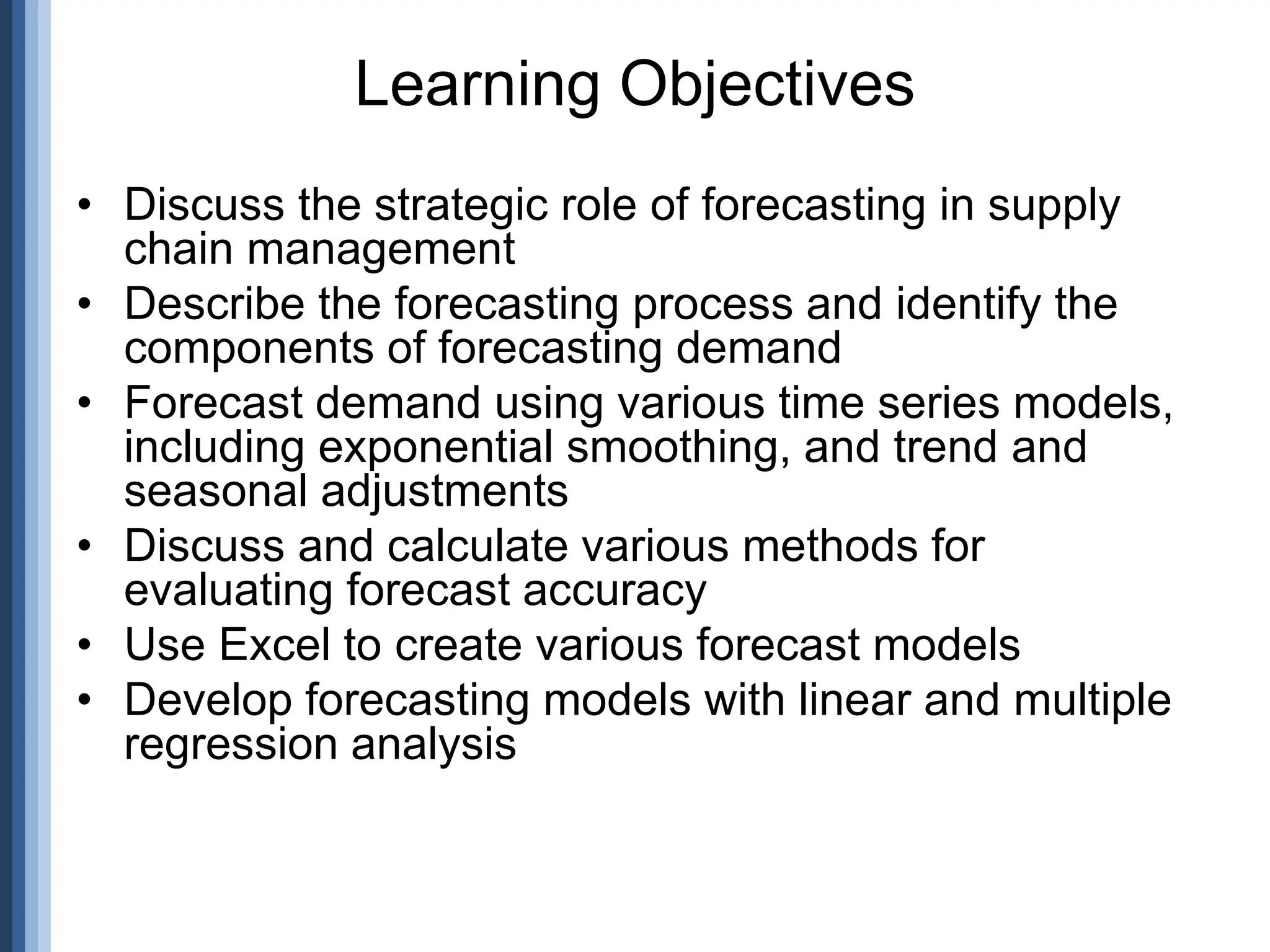

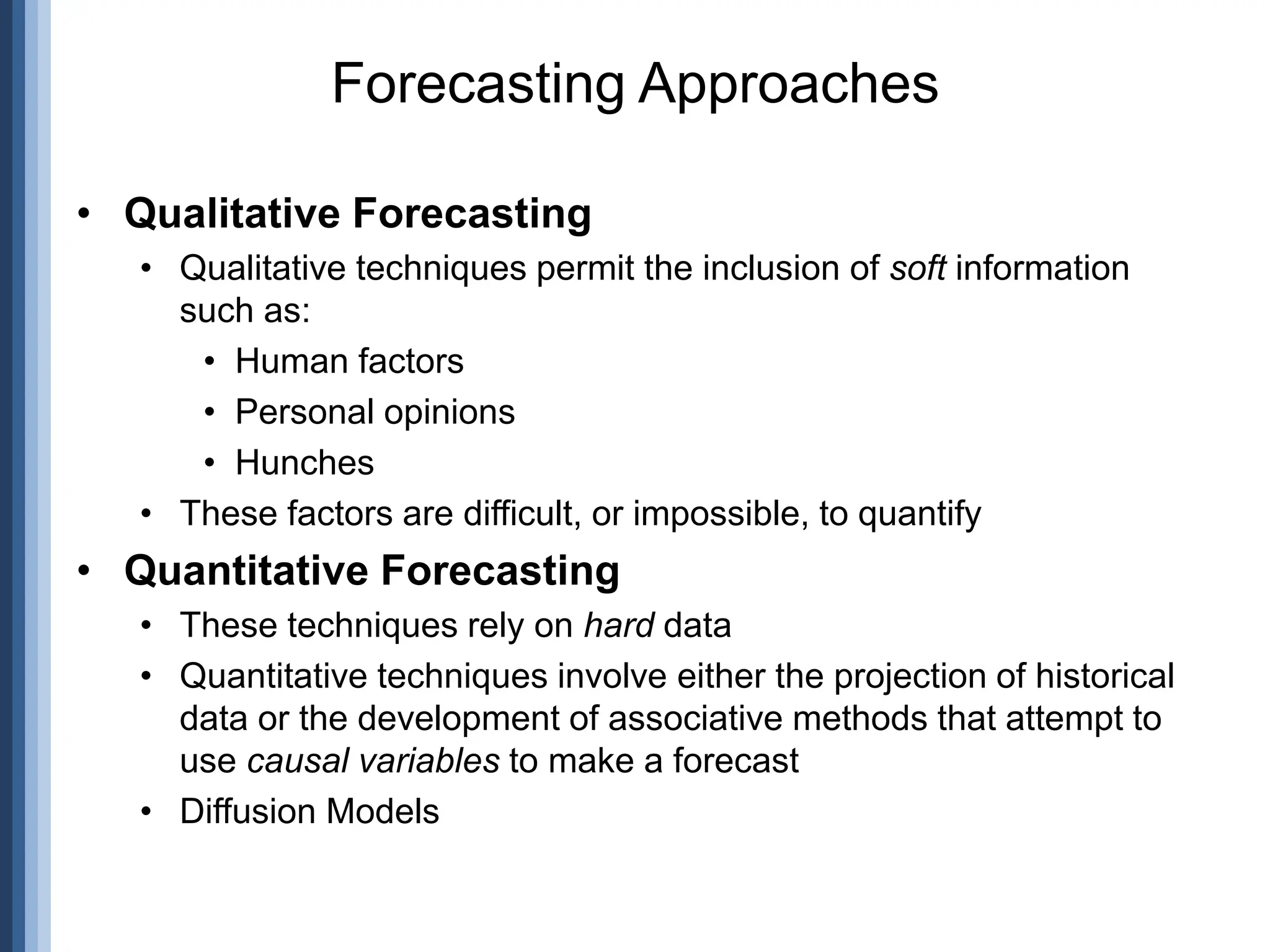

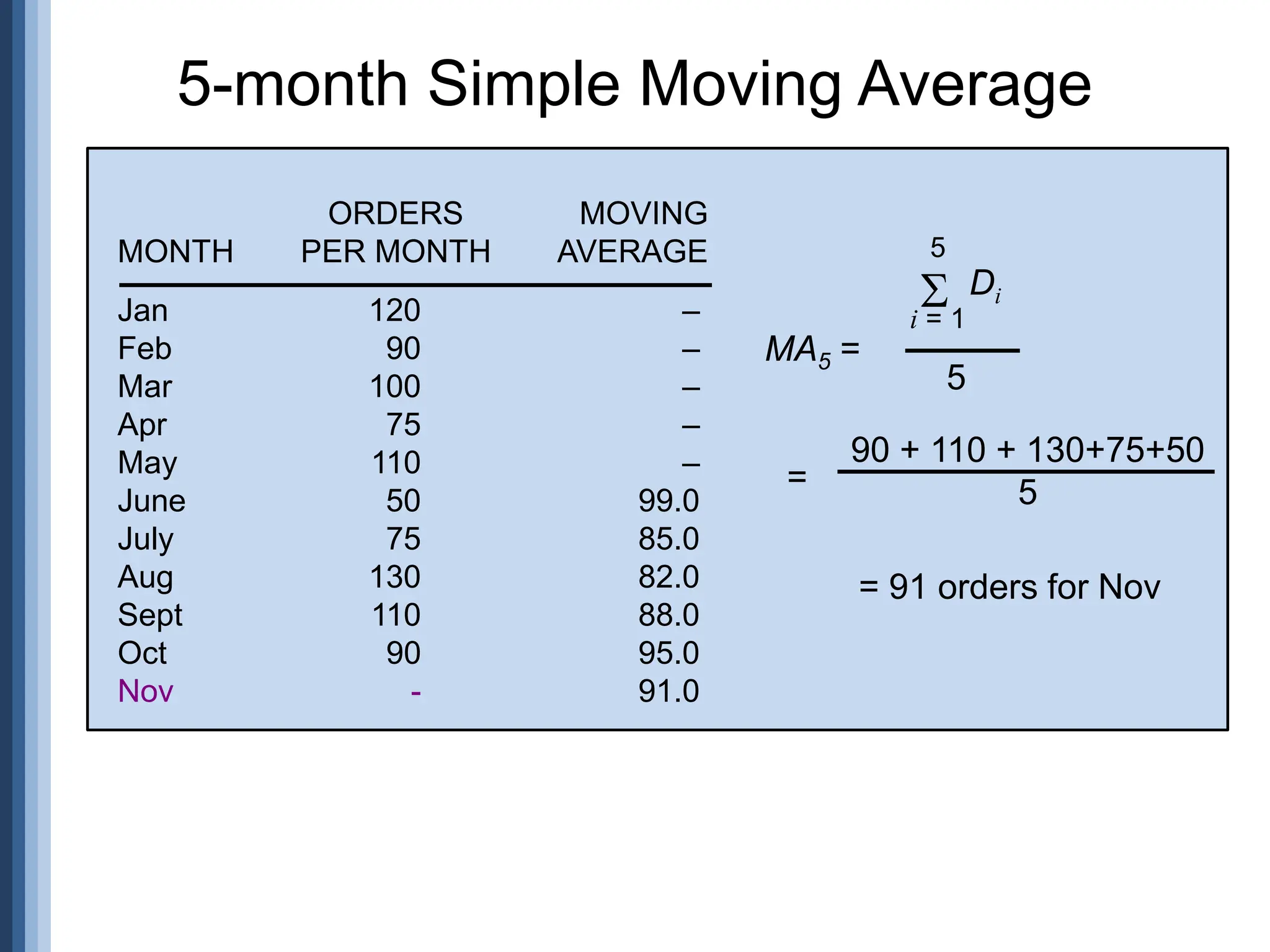

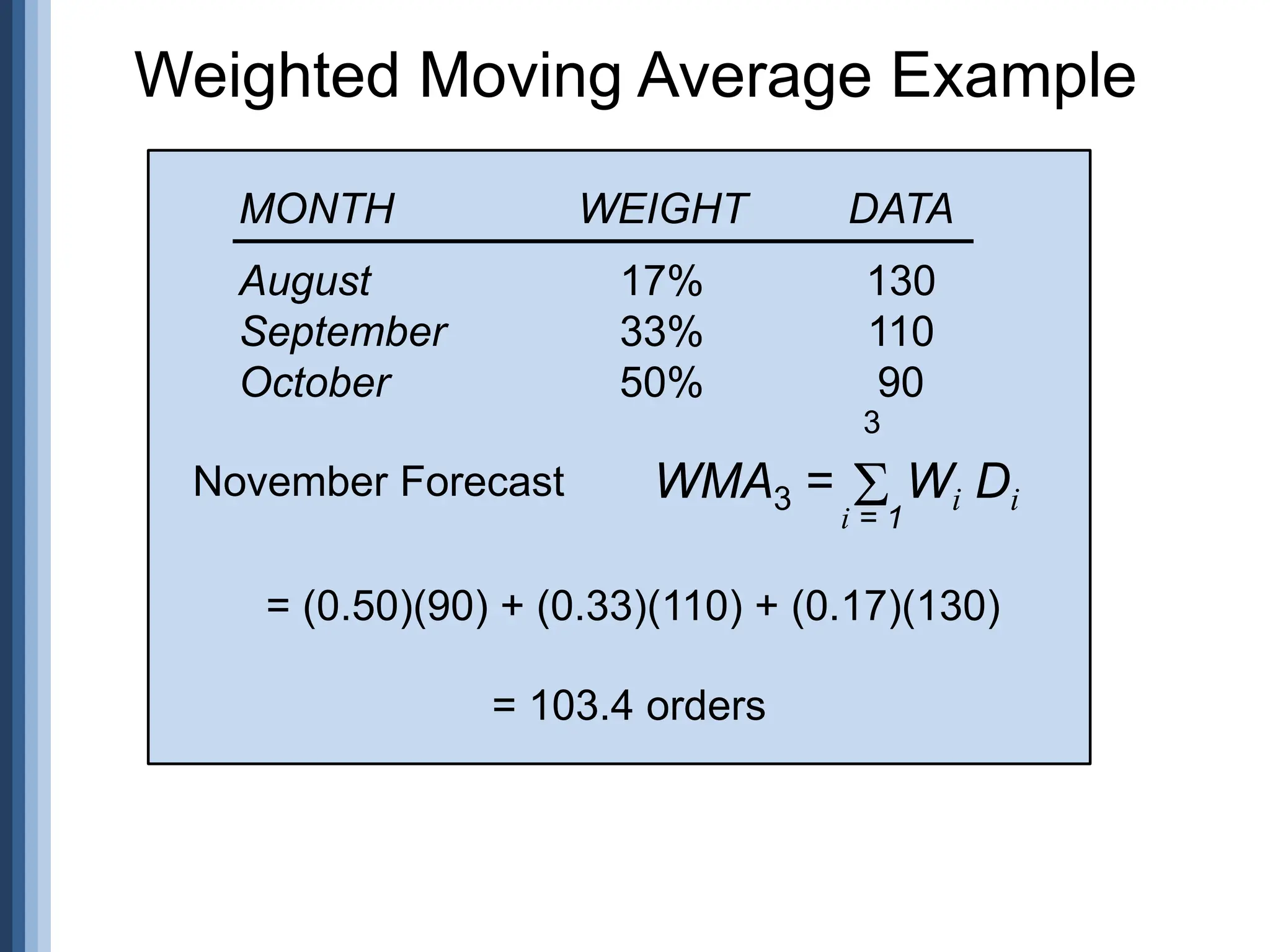

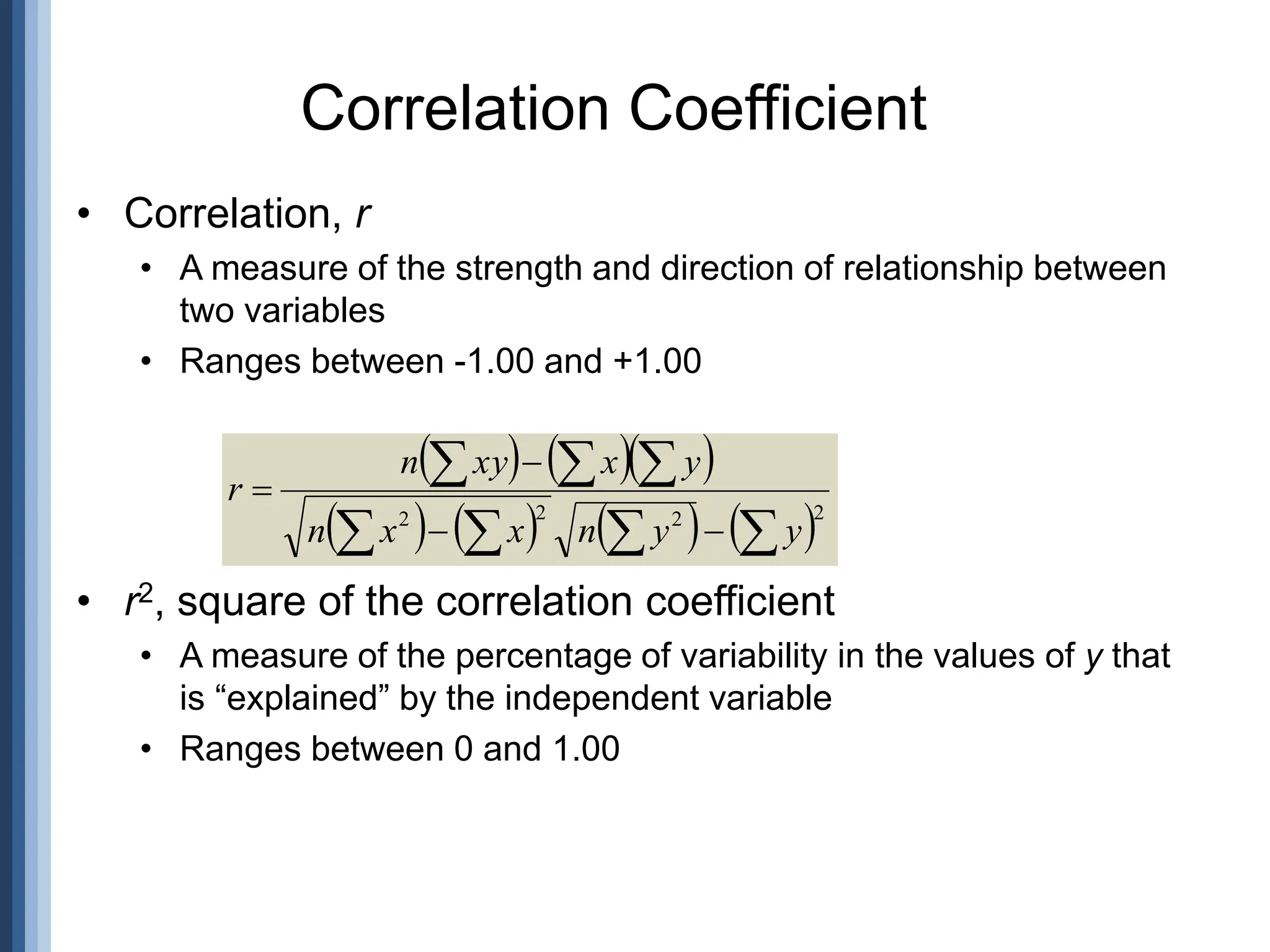

![n xy - x y

[n x2 - ( x)2] [n y2 - ( y)2]

r =

Computing Correlation](https://image.slidesharecdn.com/11forecasting-240731115559-be84be10/75/Forecasting-ppt-in-quality-management-ME-64-2048.jpg)

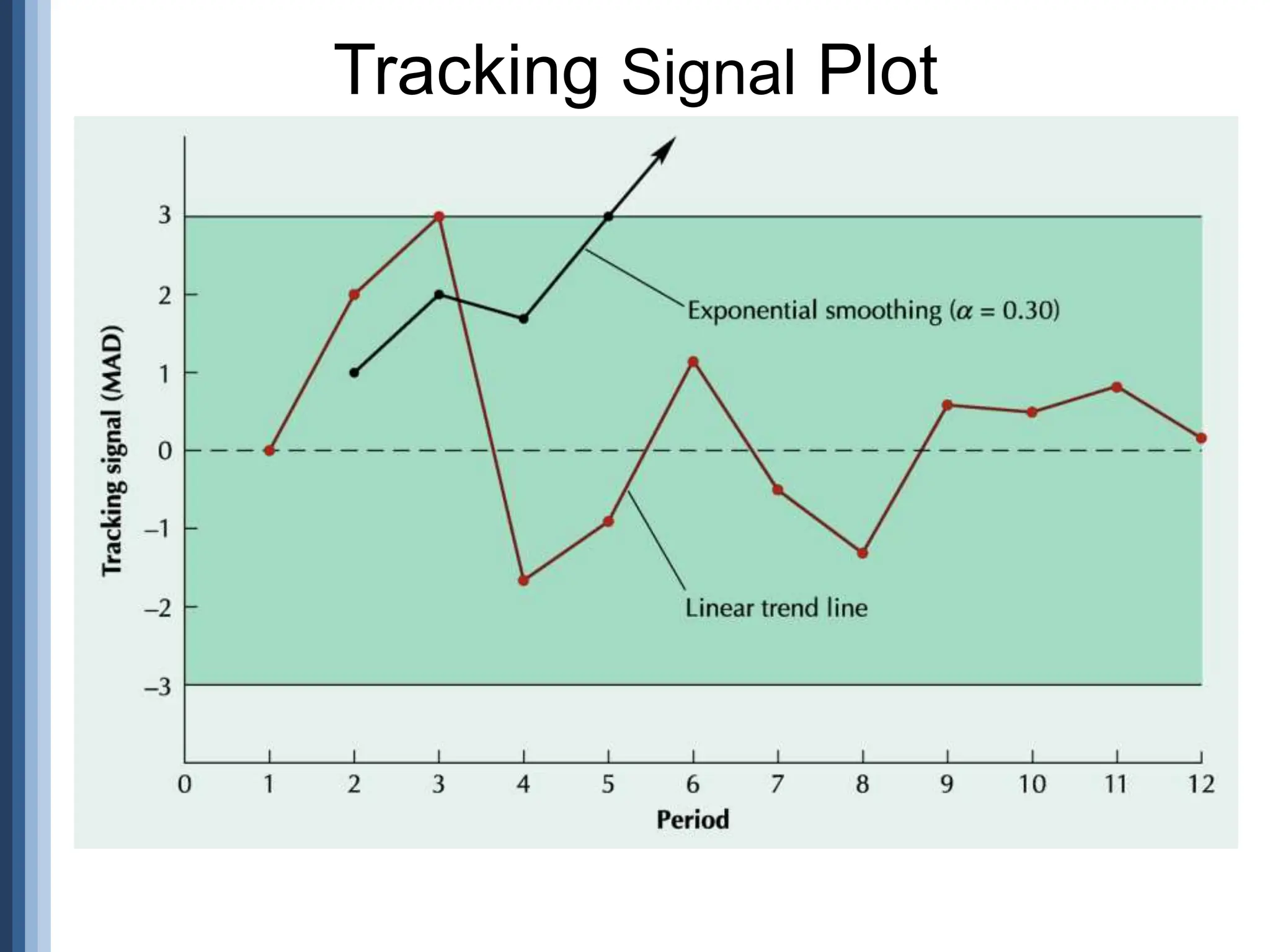

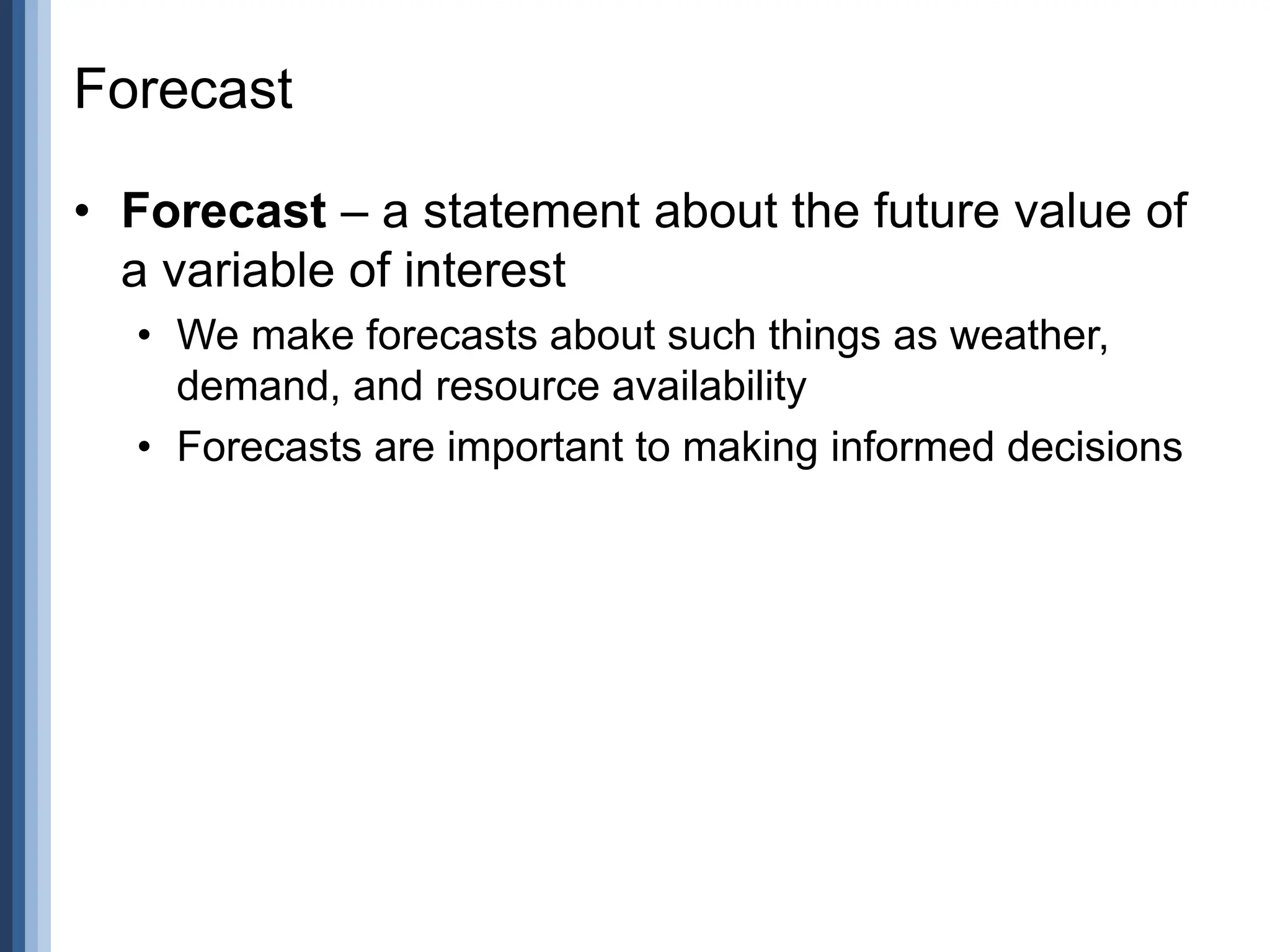

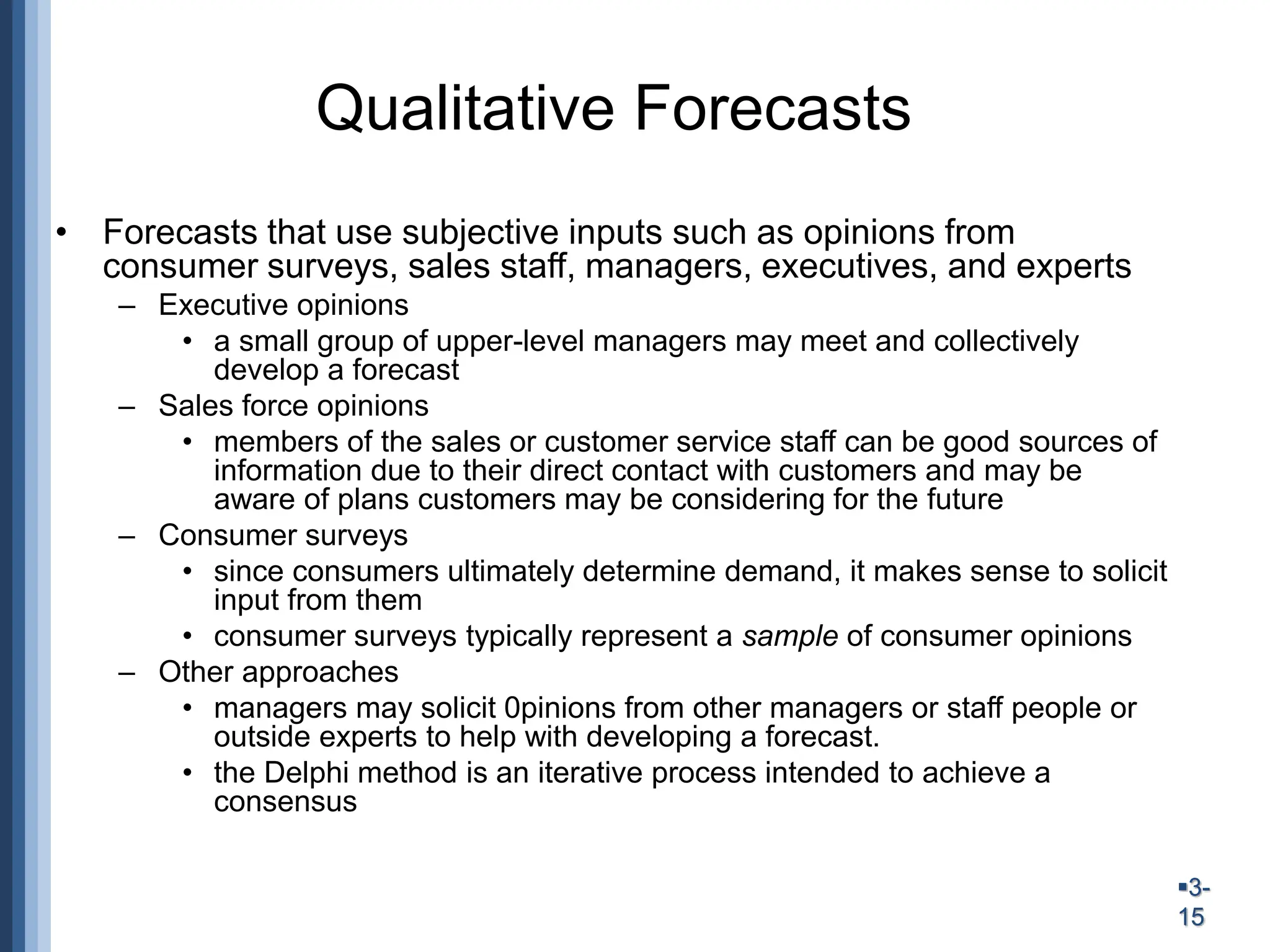

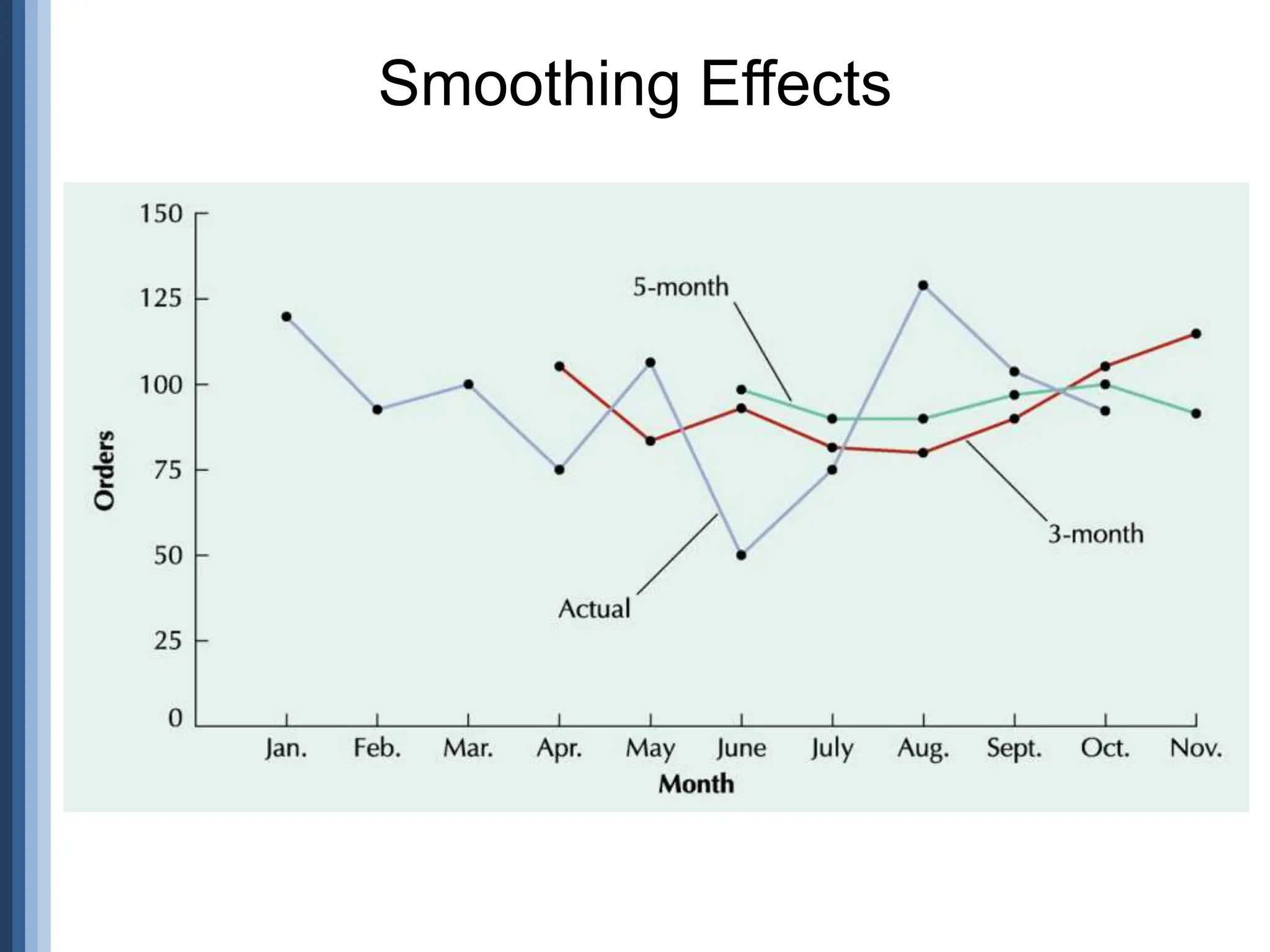

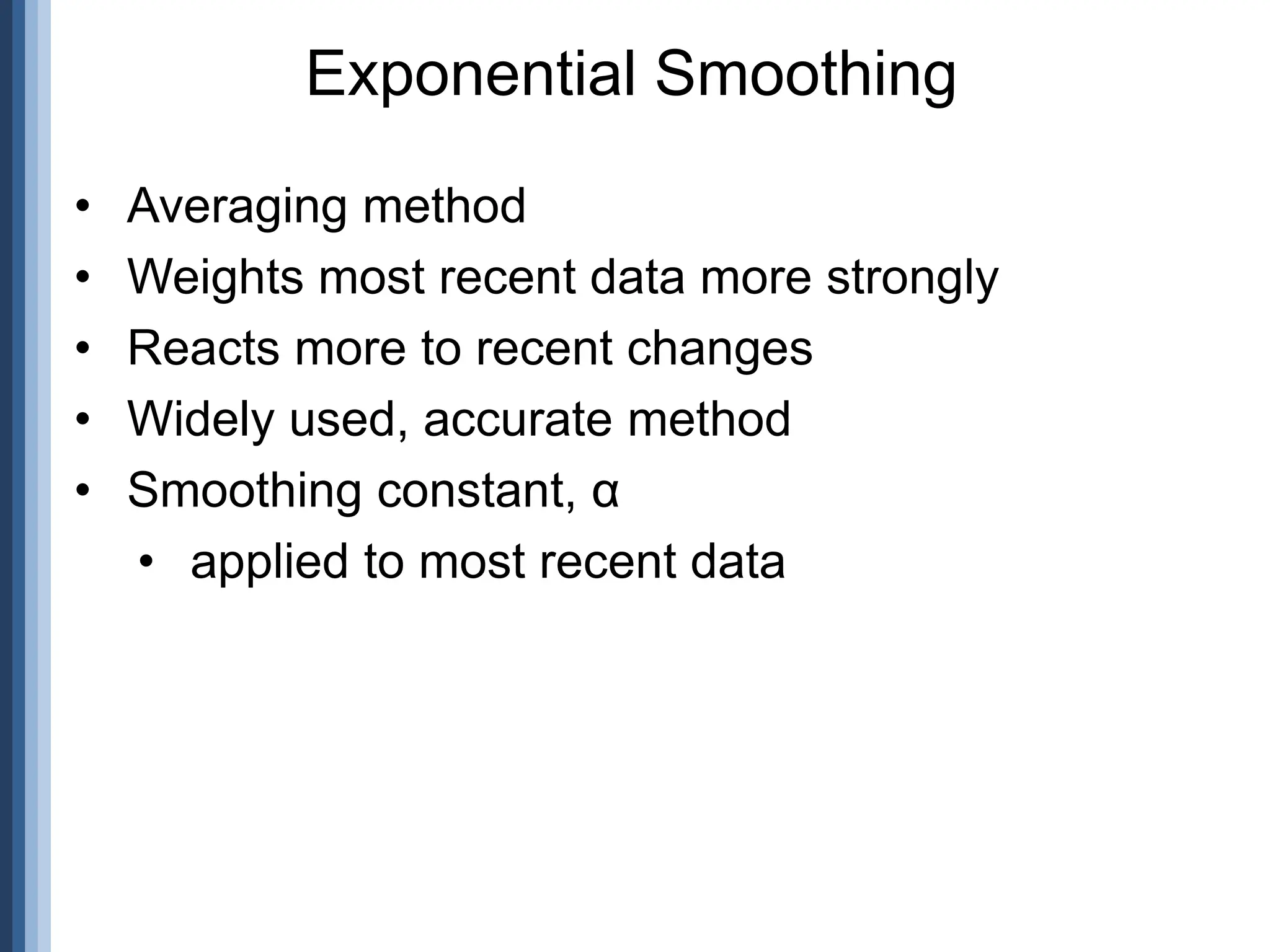

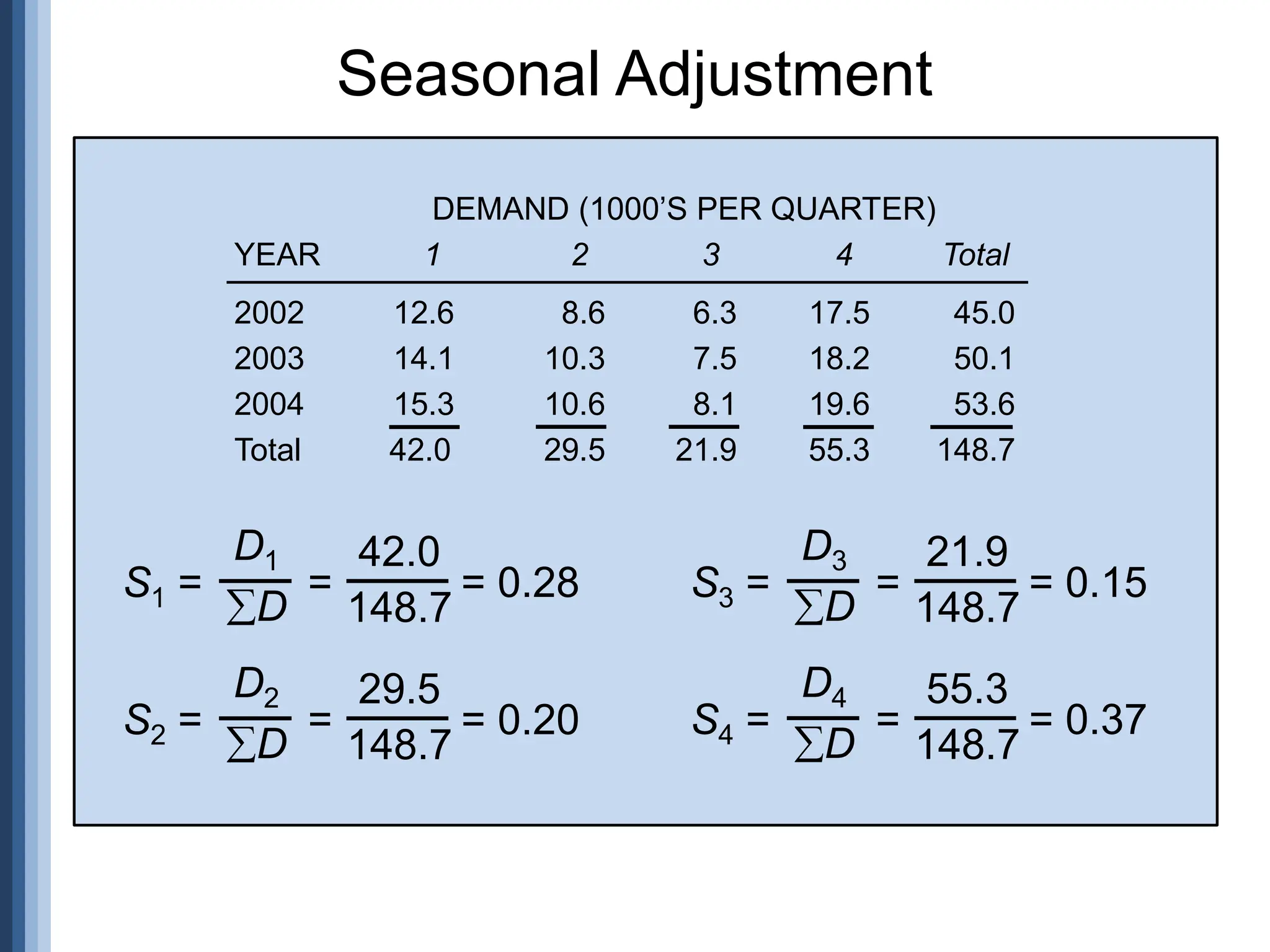

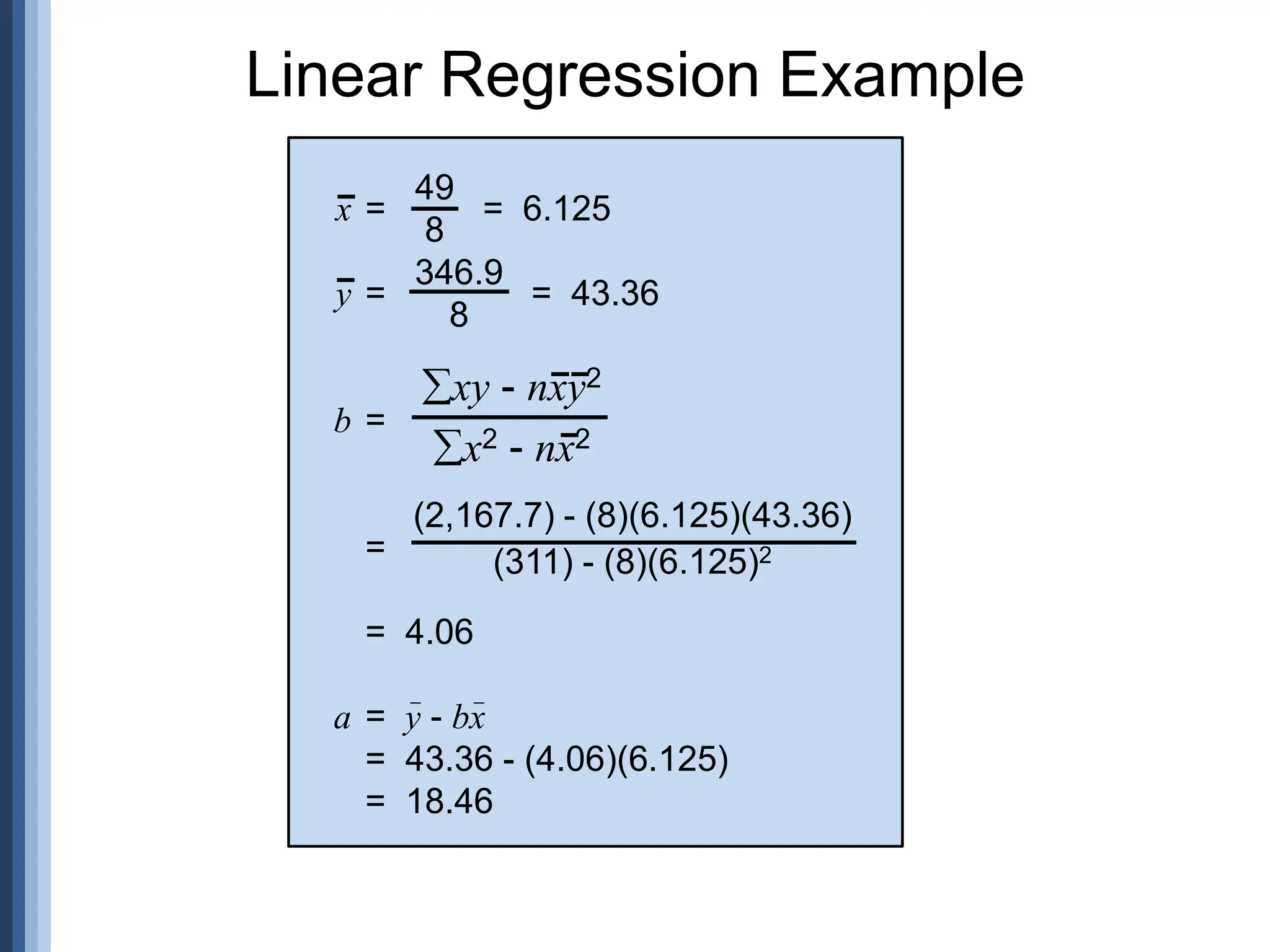

![n xy - x y

[n x2 - ( x)2] [n y2 - ( y)2]

r =

Coefficient of determination

r2 = (0.947)2 = 0.897

r =

(8)(2,167.7) - (49)(346.9)

[(8)(311) - (49)2] [(8)(15,224.7) - (346.9)2]

r = 0.947

Computing Correlation](https://image.slidesharecdn.com/11forecasting-240731115559-be84be10/75/Forecasting-ppt-in-quality-management-ME-65-2048.jpg)