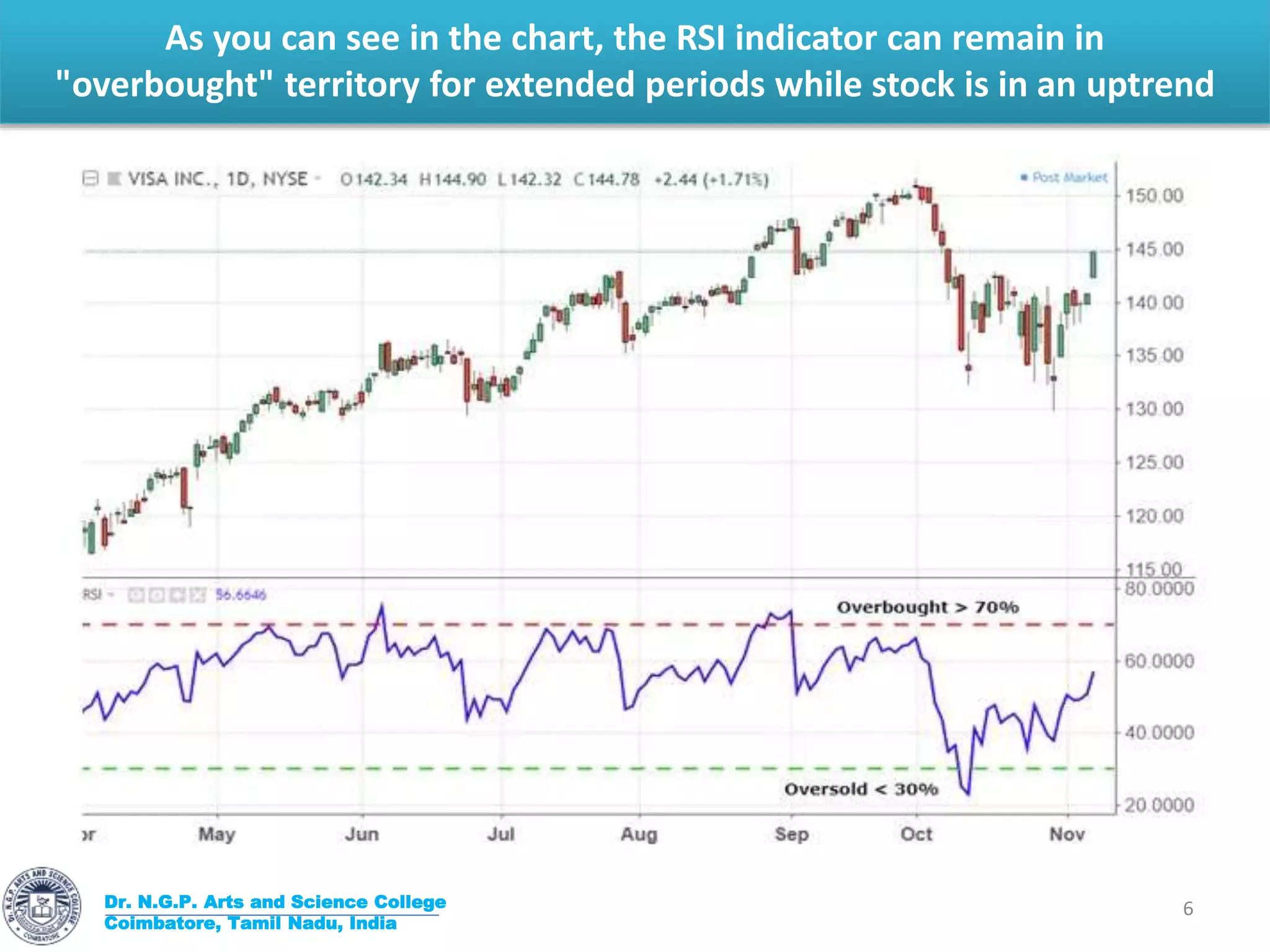

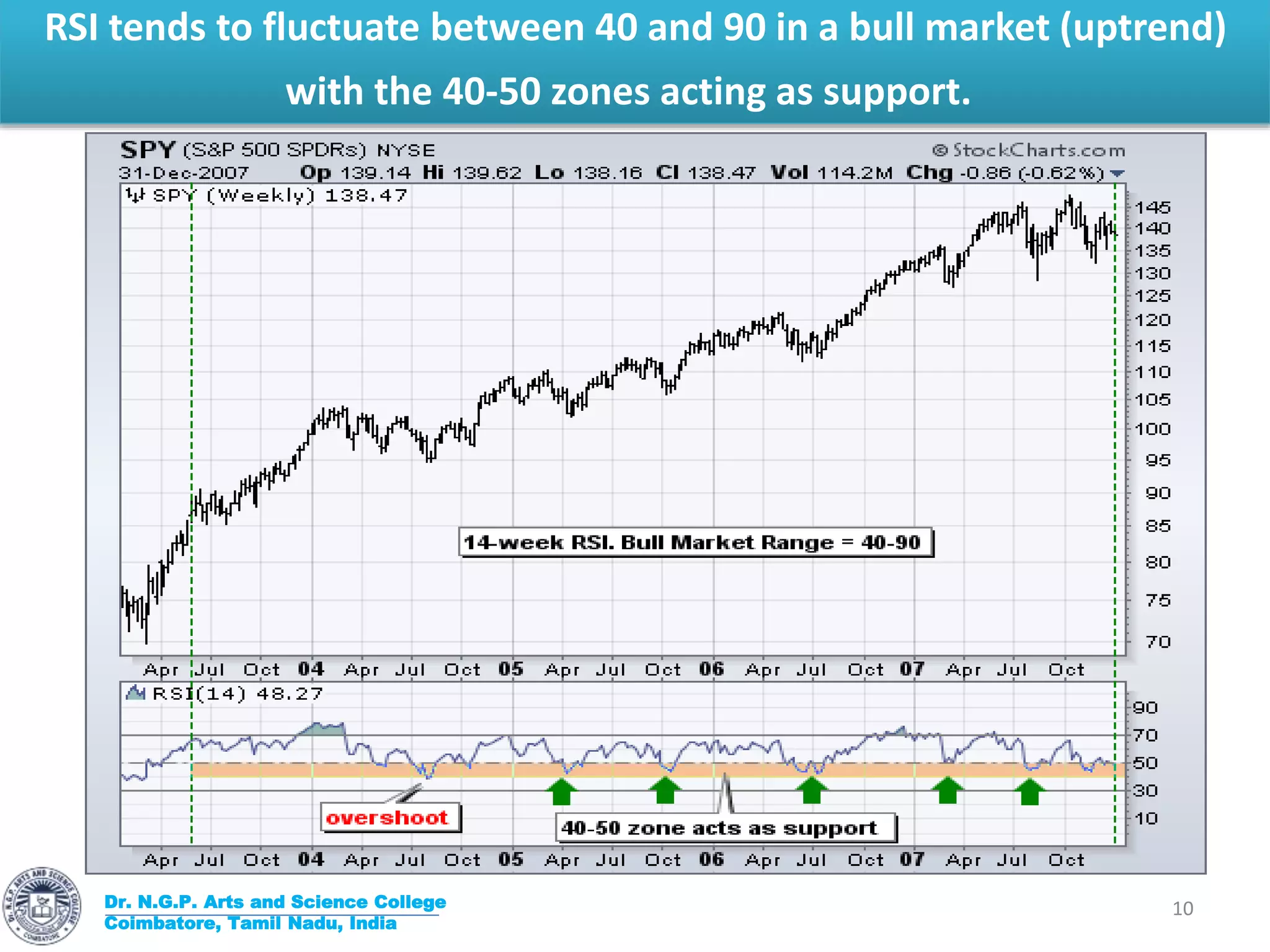

The Relative Strength Index (RSI) is a momentum indicator developed by J. Welles Wilder to measure the magnitude of recent price changes and evaluate whether a stock or asset is overbought or oversold. The RSI is calculated based on average gains and losses over the past 14 periods. Wilder considered the RSI to be indicating an overbought condition when above 70 and oversold below 30. The RSI can remain in overbought territory for extended periods during an uptrend. Divergences between price and RSI can also provide trading signals. Proper testing of a trading plan is important when using RSI to ensure it is fully trusted.