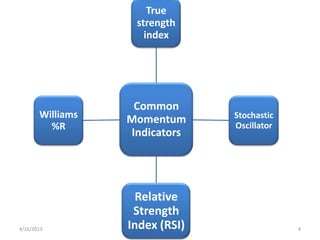

The document discusses several momentum indicators used in technical analysis:

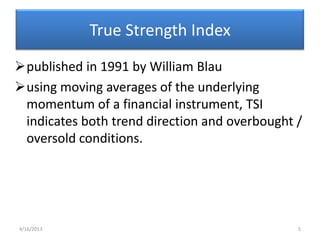

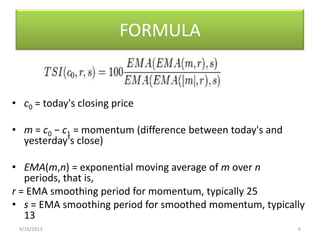

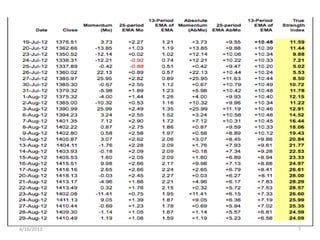

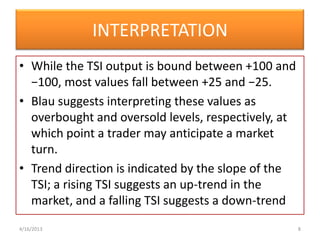

1) The True Strength Index (TSI) uses exponential moving averages of momentum to indicate trend direction and overbought/oversold conditions. Values between +25 and -25 suggest the market may turn.

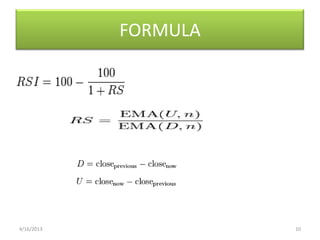

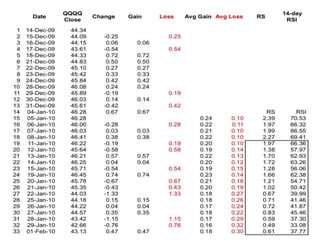

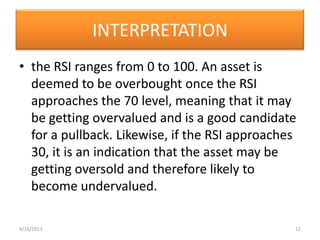

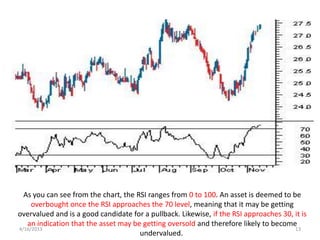

2) The Relative Strength Index (RSI) compares recent gains to recent losses to measure momentum. Values above 70 suggest an asset is overbought and below 30 means it is oversold.

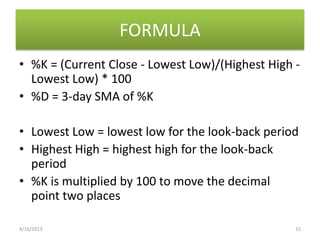

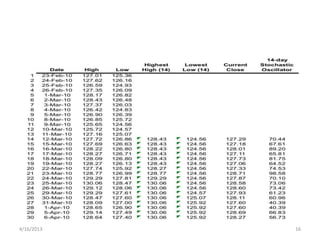

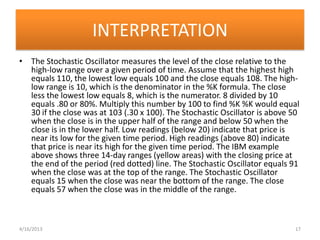

3) The Stochastic Oscillator compares the current close to the high-low range to indicate if a stock is near the high or low end of its recent trading range.

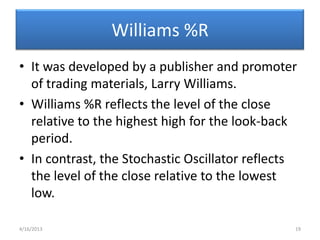

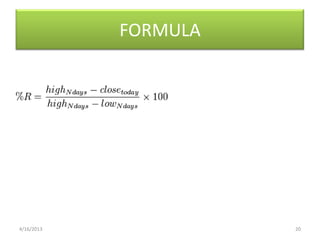

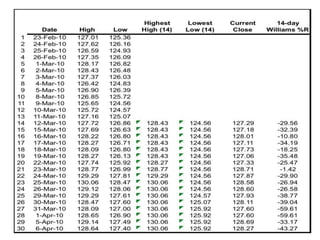

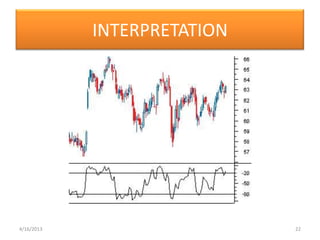

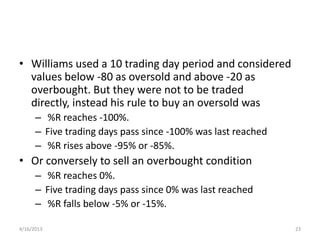

4) The Williams %R reflects the

![Relative Strength Index - RSI

• The RSI is presented on a graph above or

below the price chart. The indicator has an

upper line, typically at 70, a lower line at

30, and a dashed mid-line at 50. Wilder

recommended a smoothing period of 14 (see

EMA smoothing, i.e. α = 1/14 or N = 27).

• [edit]

4/16/2013 9](https://image.slidesharecdn.com/momentumindicatorsintech-analysis-130416104648-phpapp01/85/Momentum-indicators-in-tech-analysis-9-320.jpg)