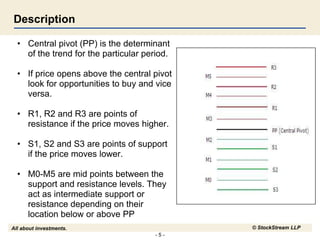

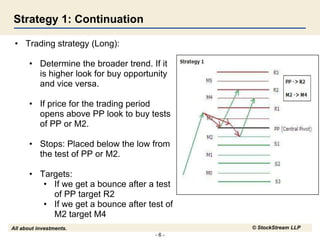

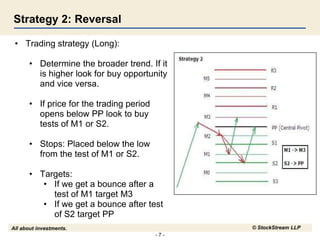

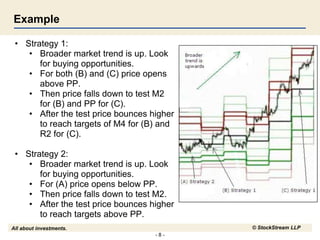

The document discusses pivot points as indicators of support and resistance in trading, explaining their calculation and significance for traders. It outlines two trading strategies based on market trends: continuation and reversal, providing specific guidelines for execution and target setting. It emphasizes the risks of trading and states that the content is for educational purposes only, advising consultation with a financial advisor.