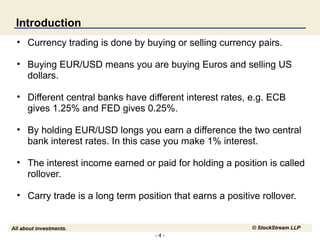

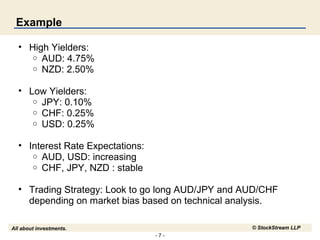

This document discusses the carry trade investment strategy. The carry trade involves taking long positions in higher-yielding currencies and short positions in lower-yielding currencies to profit from interest rate differentials. It recommends identifying currencies with the highest interest rate spreads, assessing interest rate expectations, and using technical analysis to enter trades near support levels and hold positions until fundamentals change. The example suggests going long the higher-yielding AUD against the lower-yielding JPY and CHF based on their relative interest rates and rate outlooks.