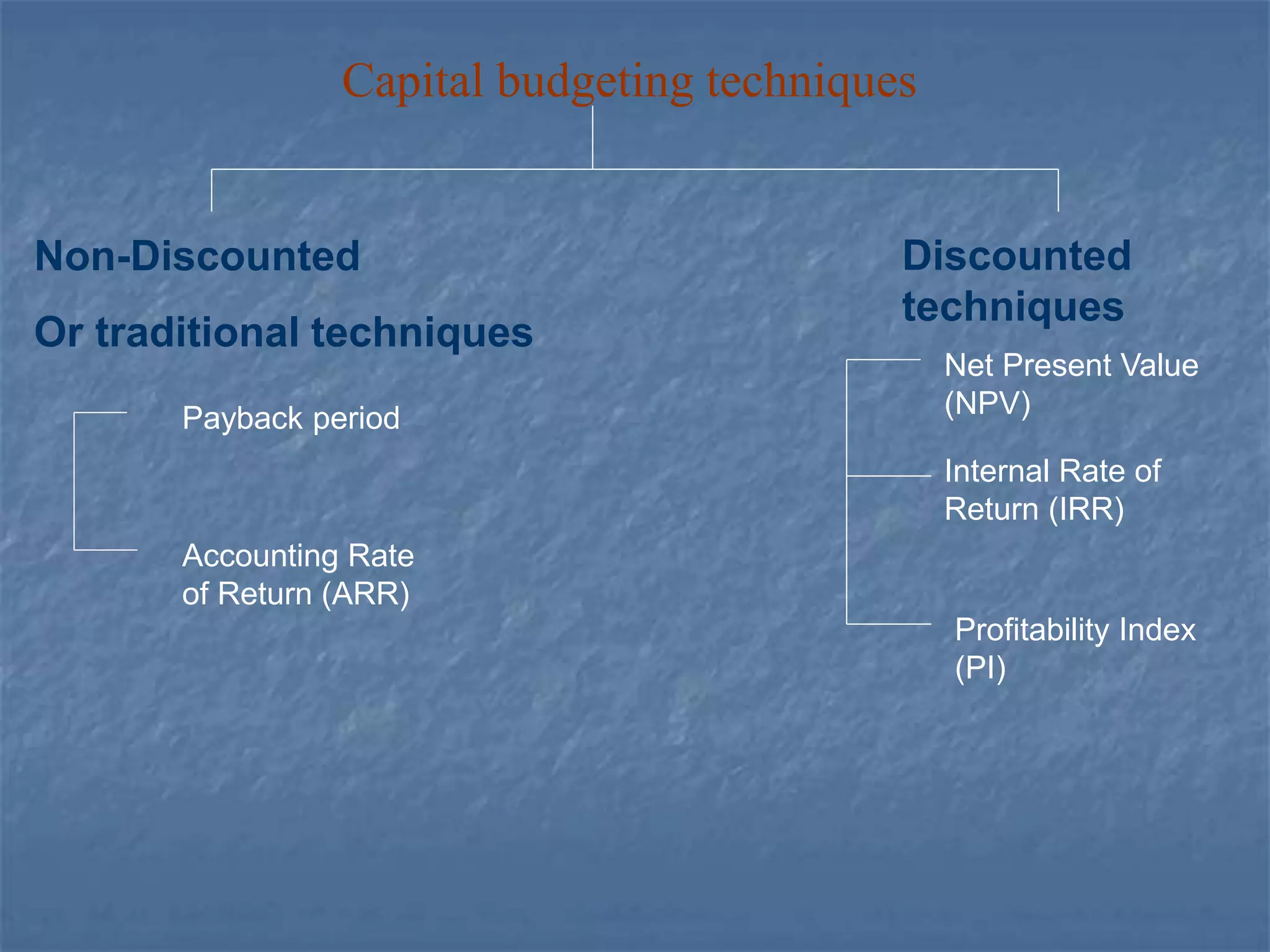

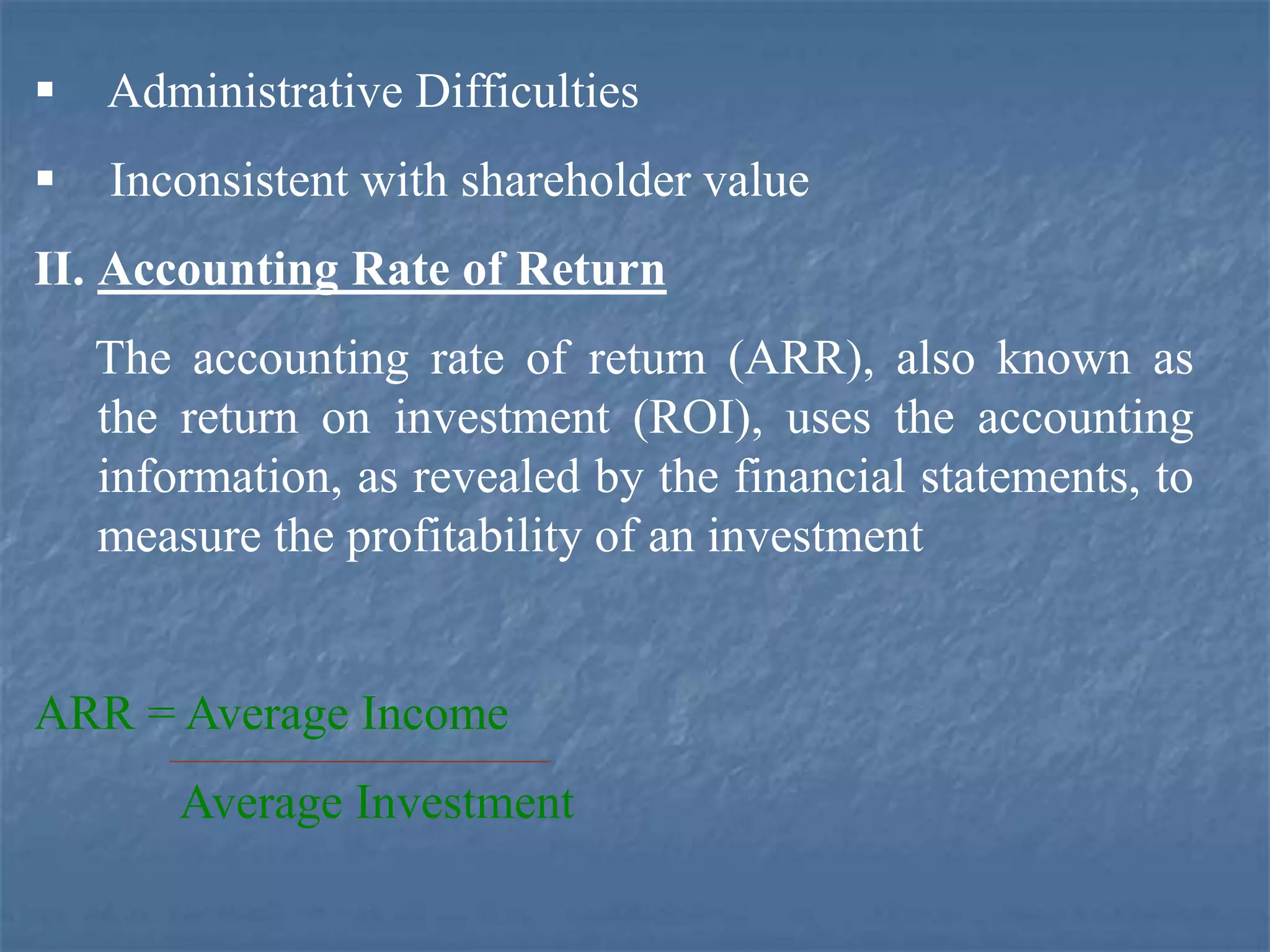

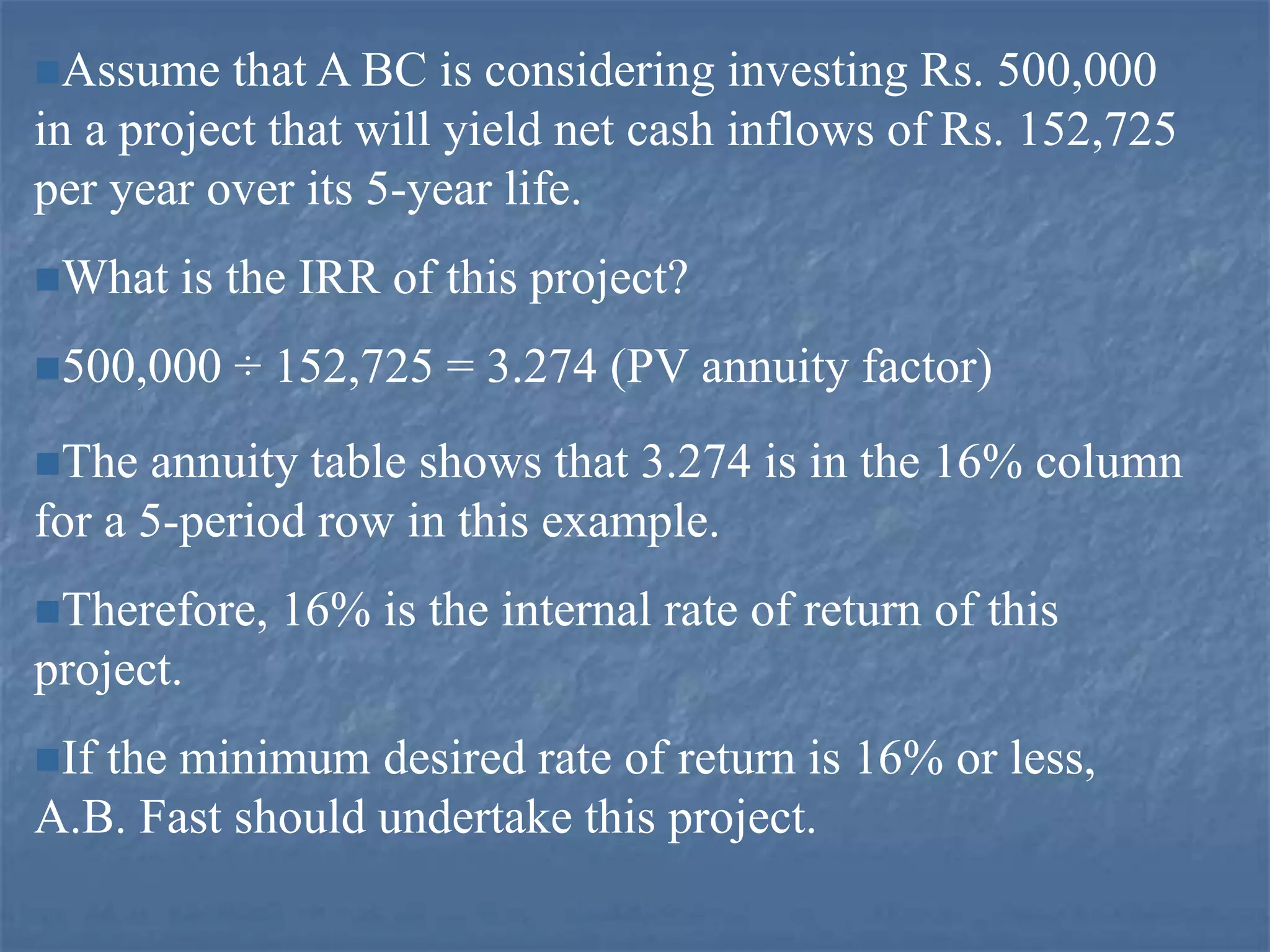

Capital budgeting is the process of evaluating long-term investments and projects. It involves analyzing potential additions to fixed assets that require large expenditures and have long-term impacts on the firm's future. Key techniques for evaluating projects include net present value (NPV), internal rate of return (IRR), payback period, and accounting rate of return. These methods discount future cash flows to determine a project's true profitability while accounting for risk and the time value of money. Capital budgeting analysis helps firms select projects that maximize shareholder wealth.