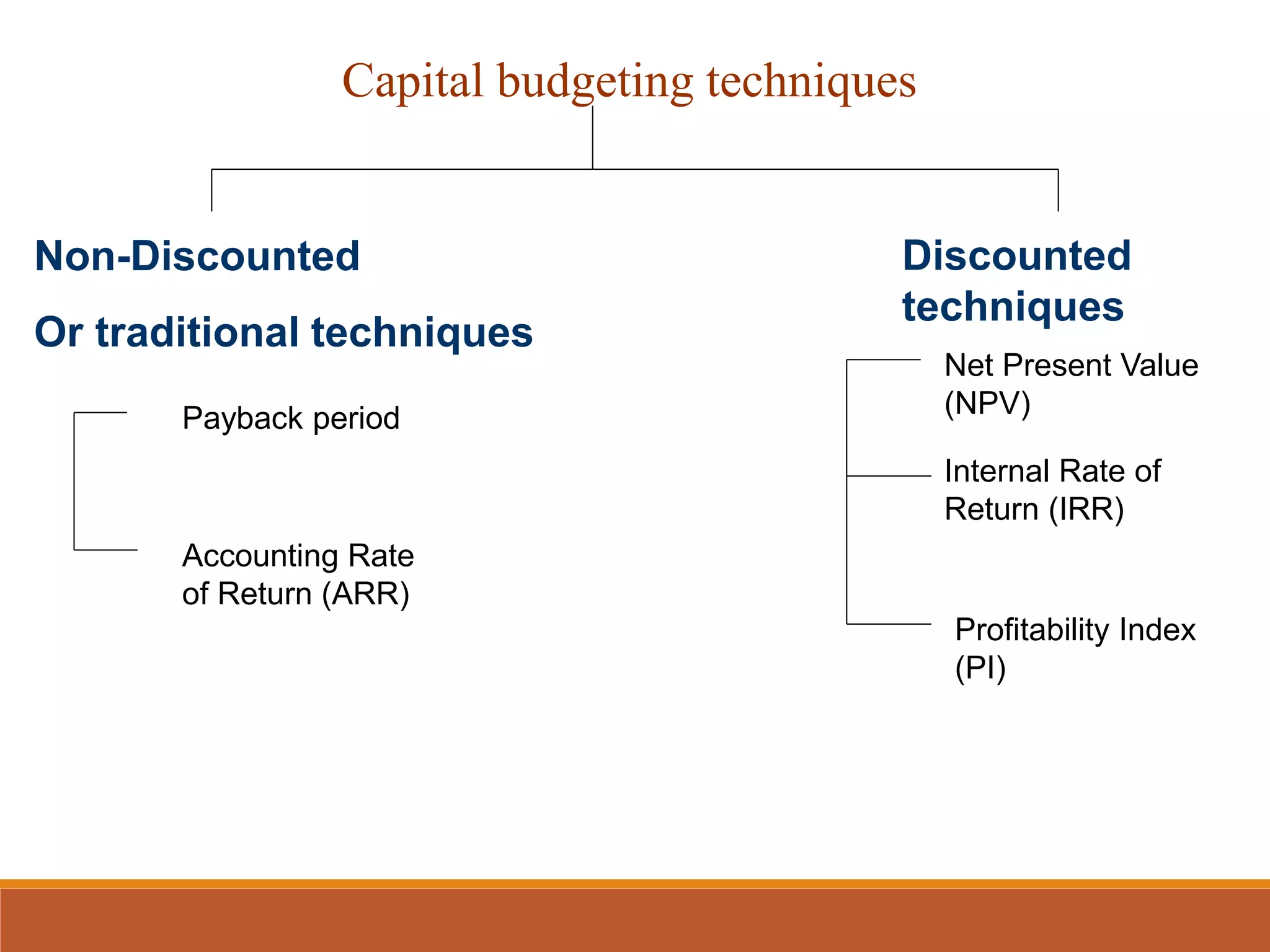

The document discusses capital budgeting as a critical process for evaluating long-term investments that align with shareholder wealth maximization. It highlights various techniques used in capital budgeting, including payback period, accounting rate of return, net present value, and internal rate of return, each with their own advantages and limitations. The significance of capital budgeting decisions is emphasized, noting their impact on a firm's profitability, risk exposure, and cash flow patterns.