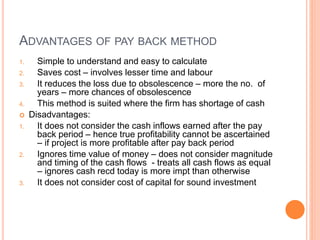

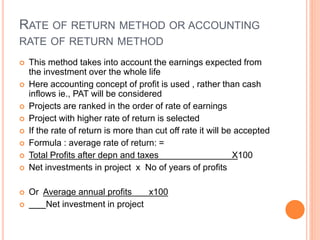

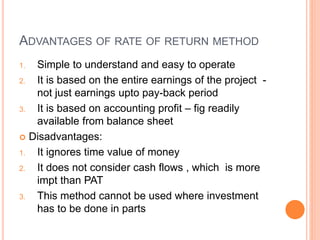

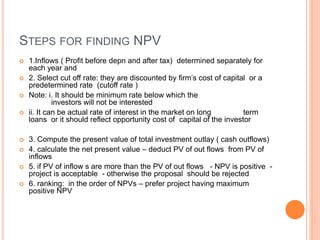

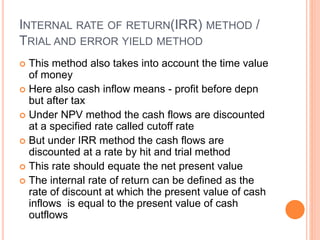

Capital budgeting is the process of making investment decisions in long-term capital expenditures that are expected to provide benefits over multiple years. Some key methods used for capital budgeting decisions are the payback period, rate of return, net present value, internal rate of return, and profitability index methods. These methods analyze the costs and benefits of potential capital projects over their lifetimes to evaluate their potential profitability and accept or reject investment proposals.