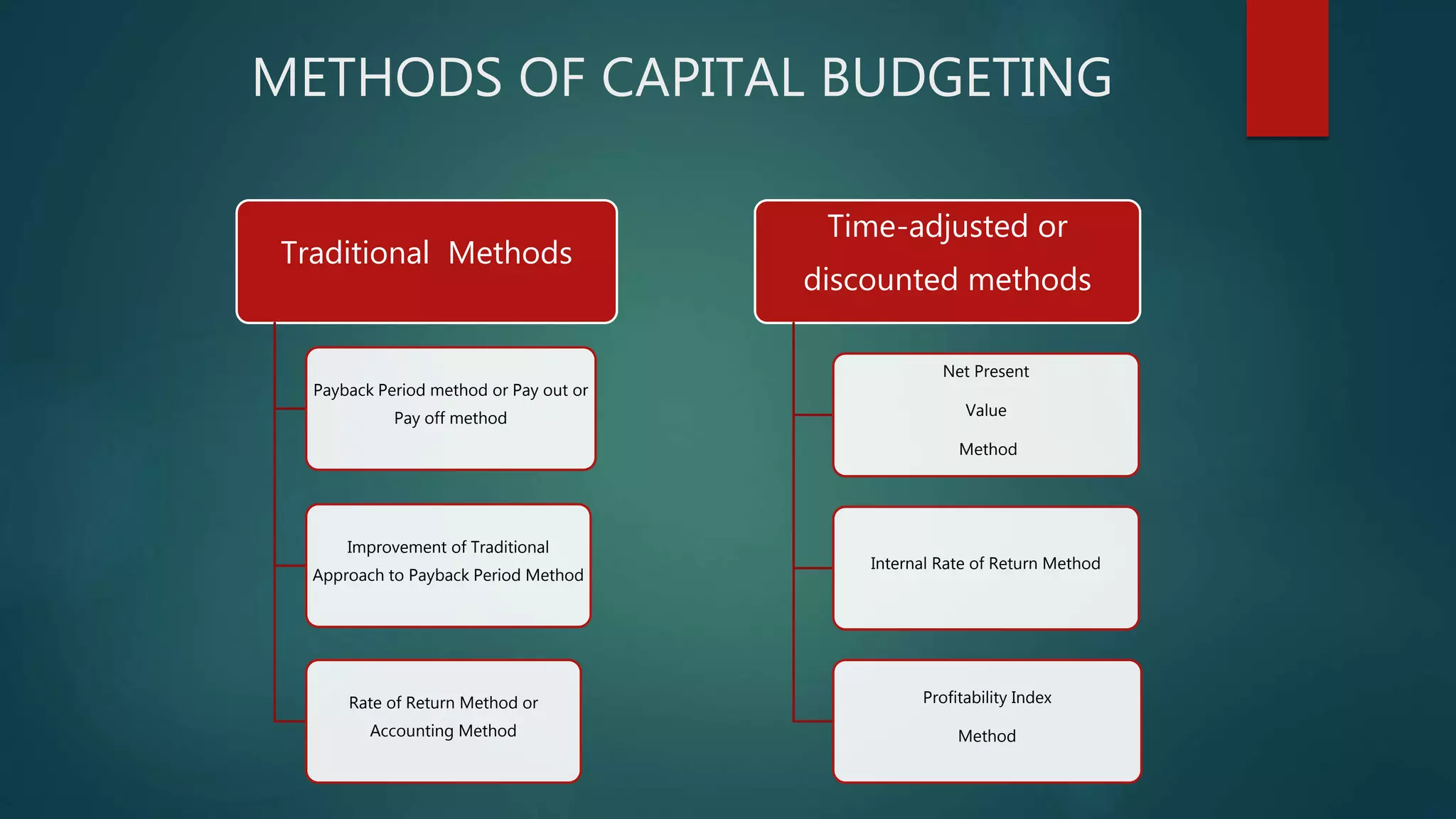

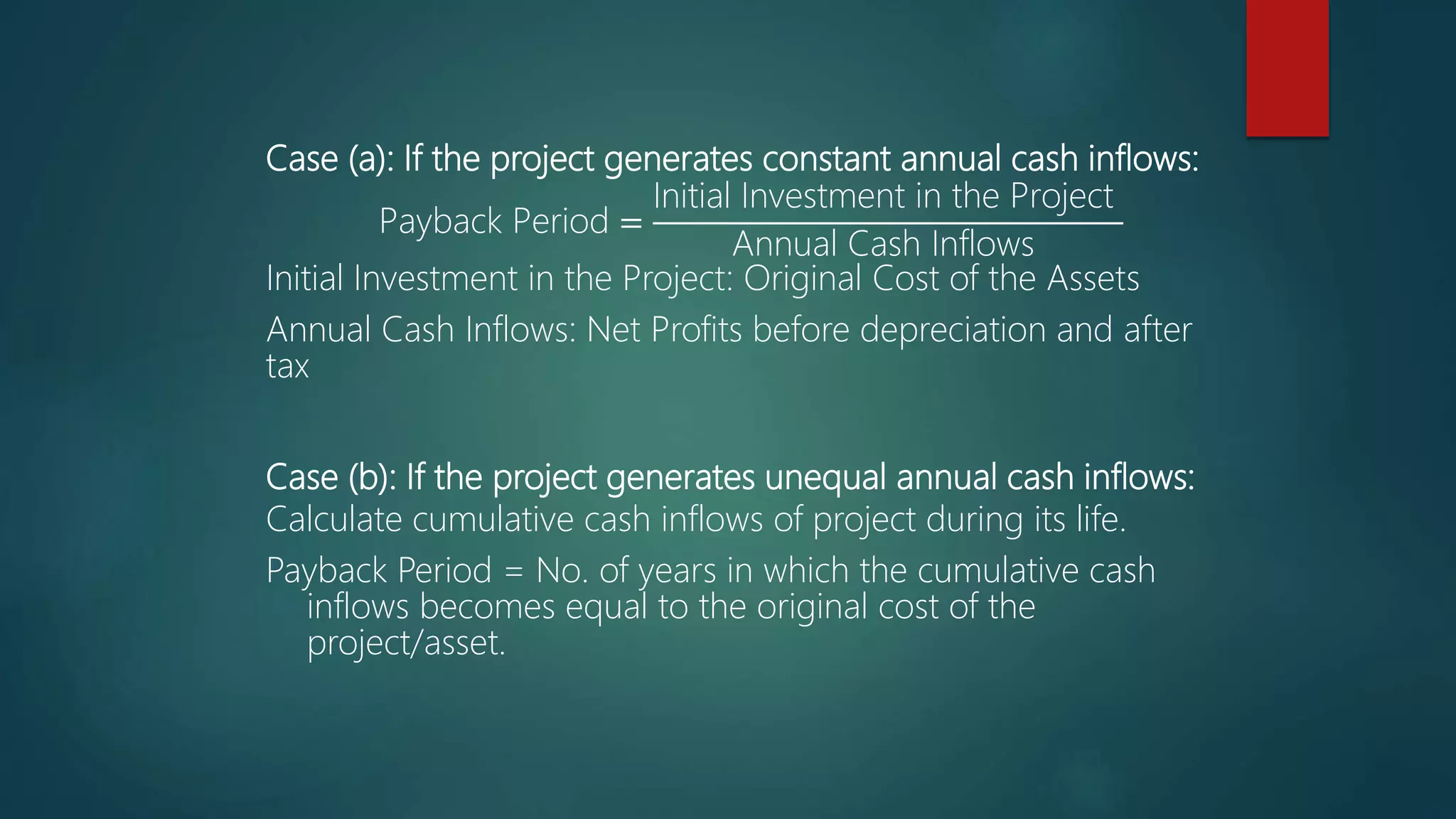

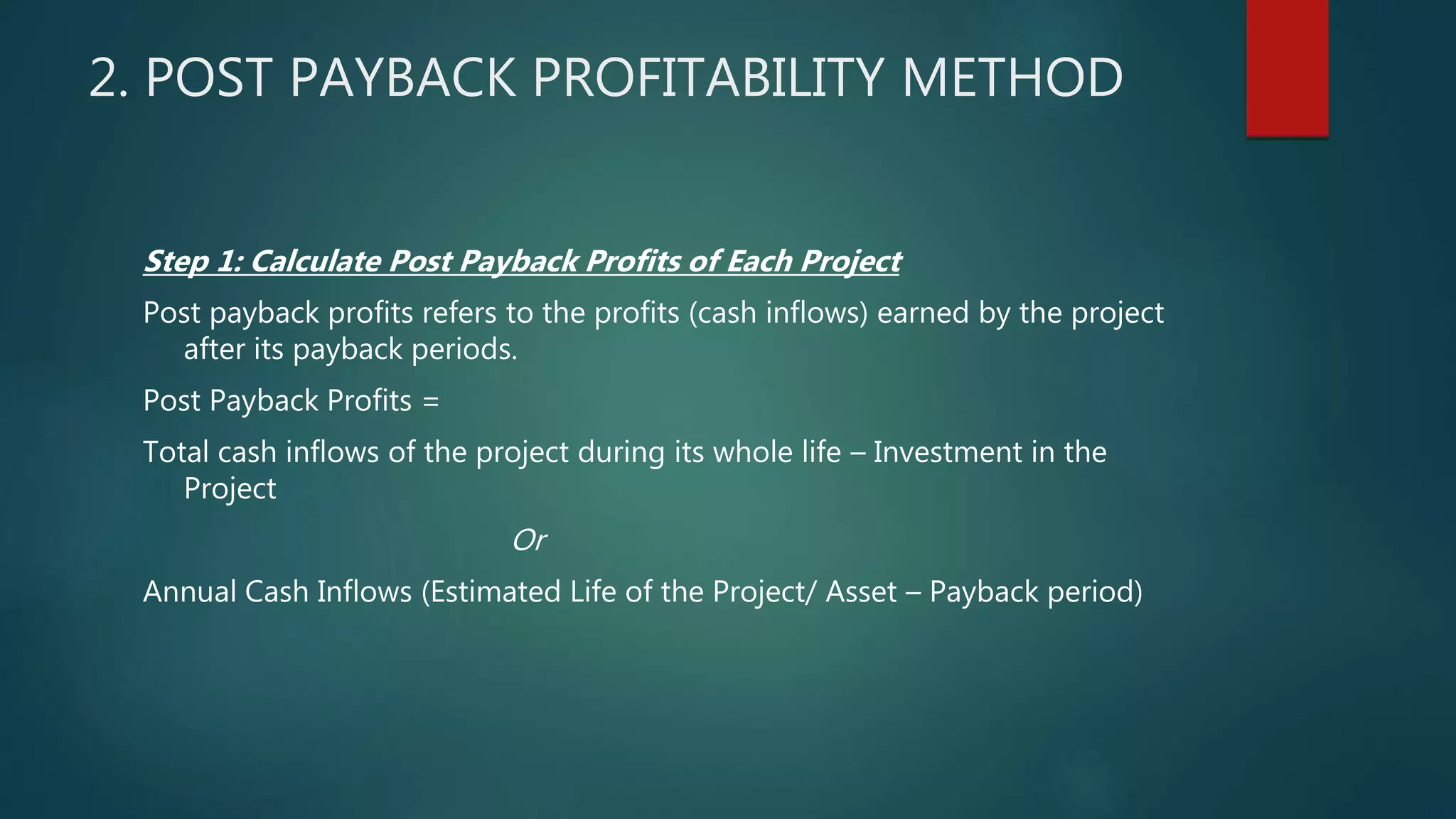

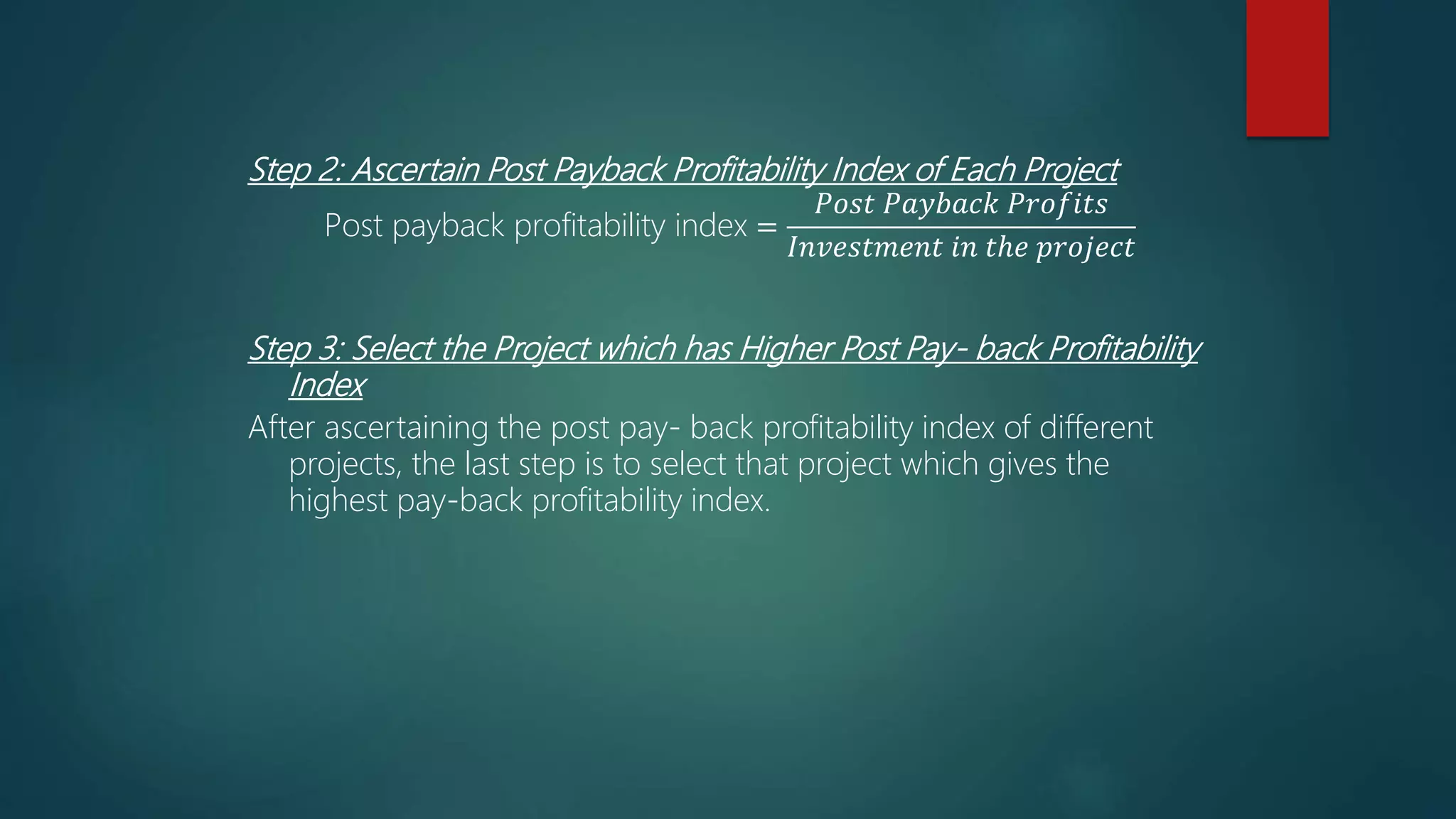

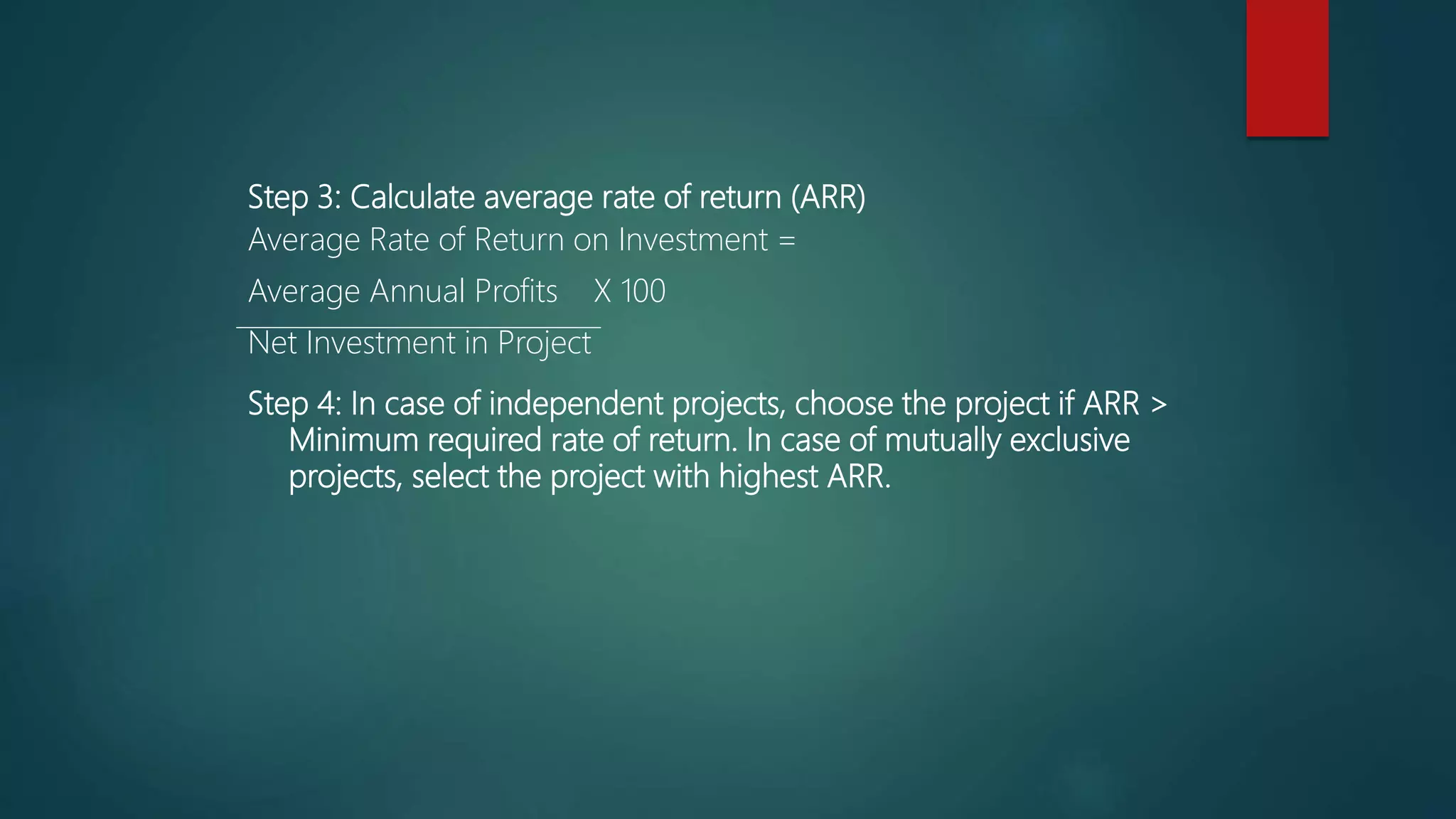

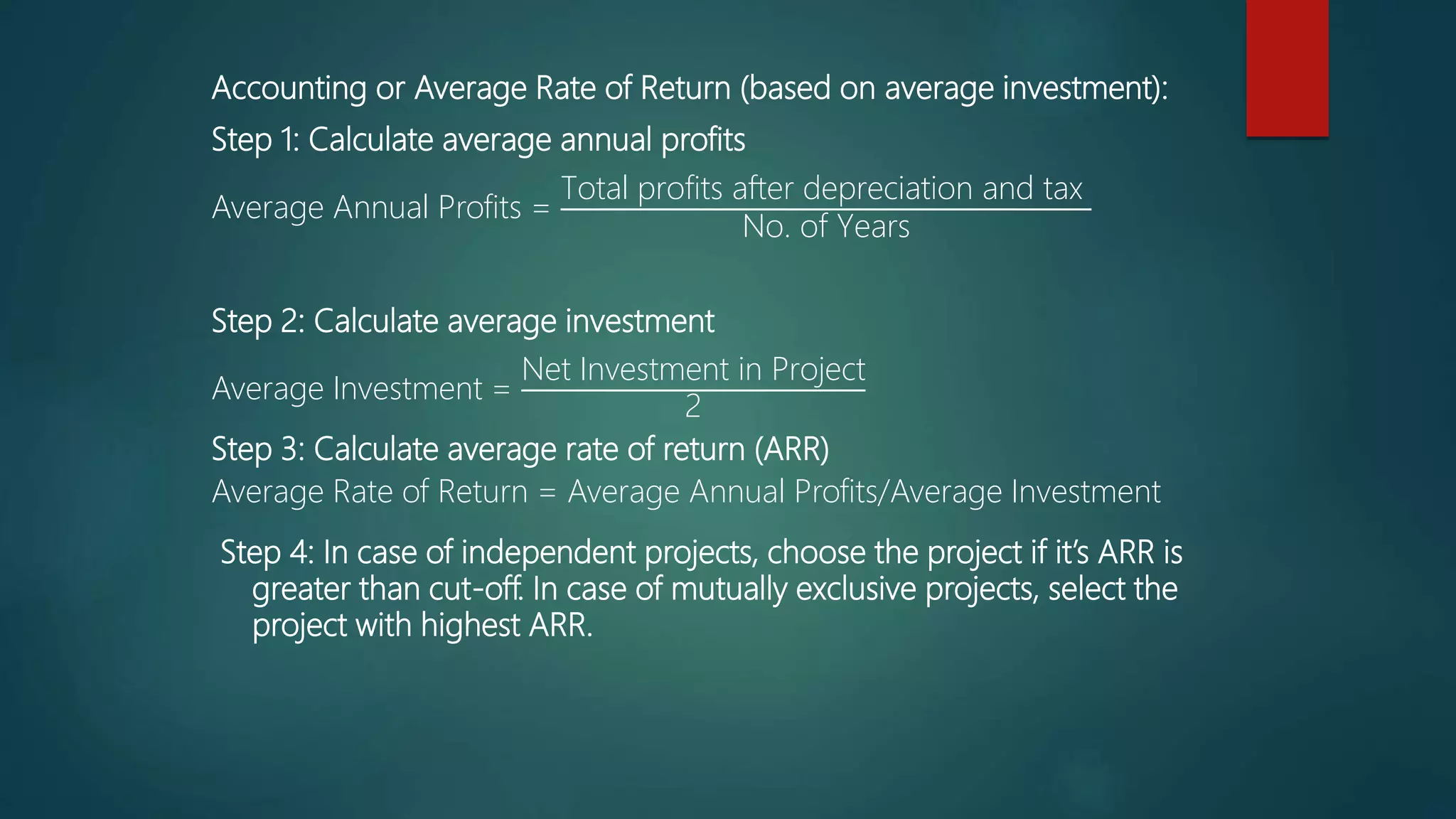

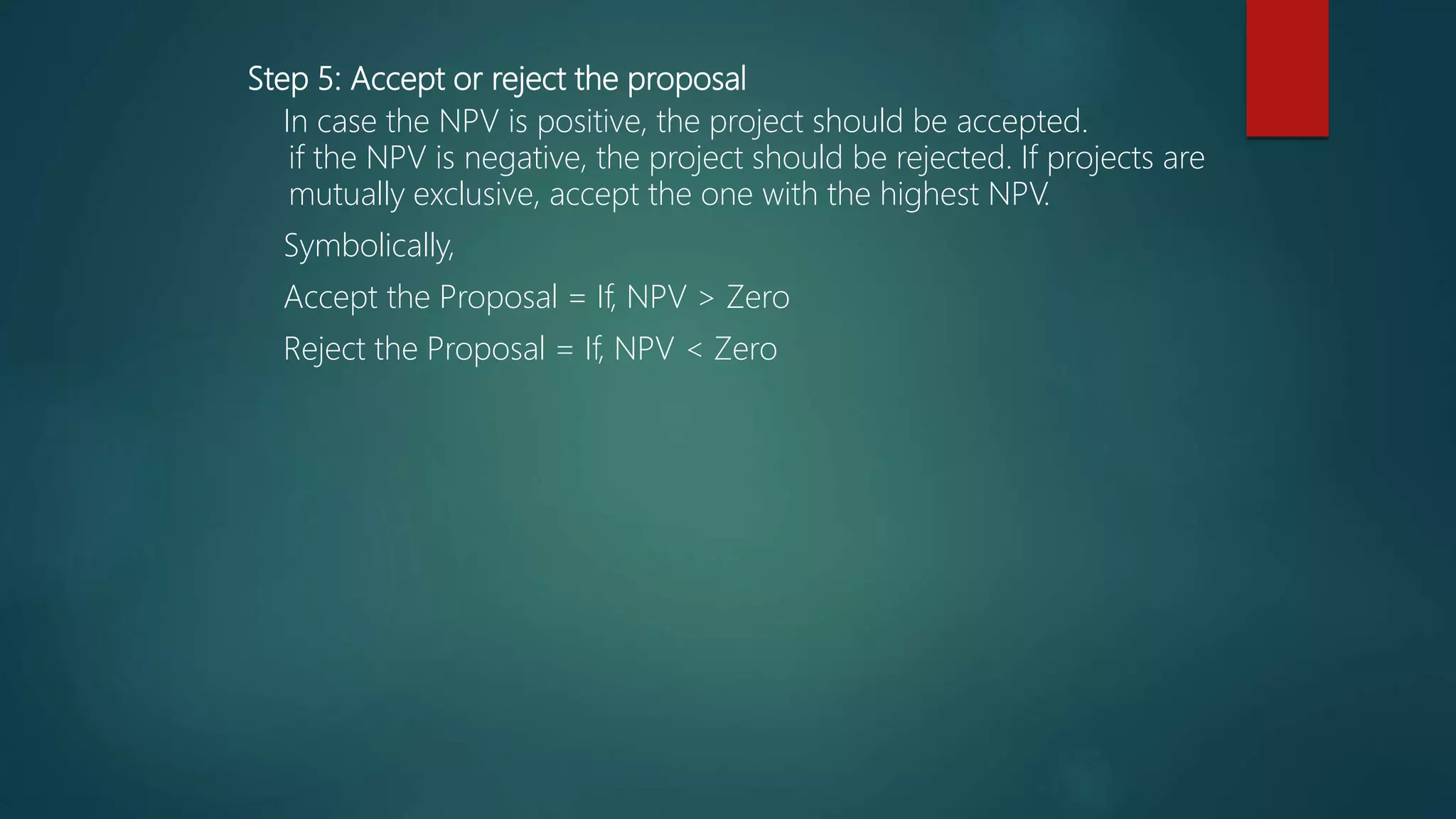

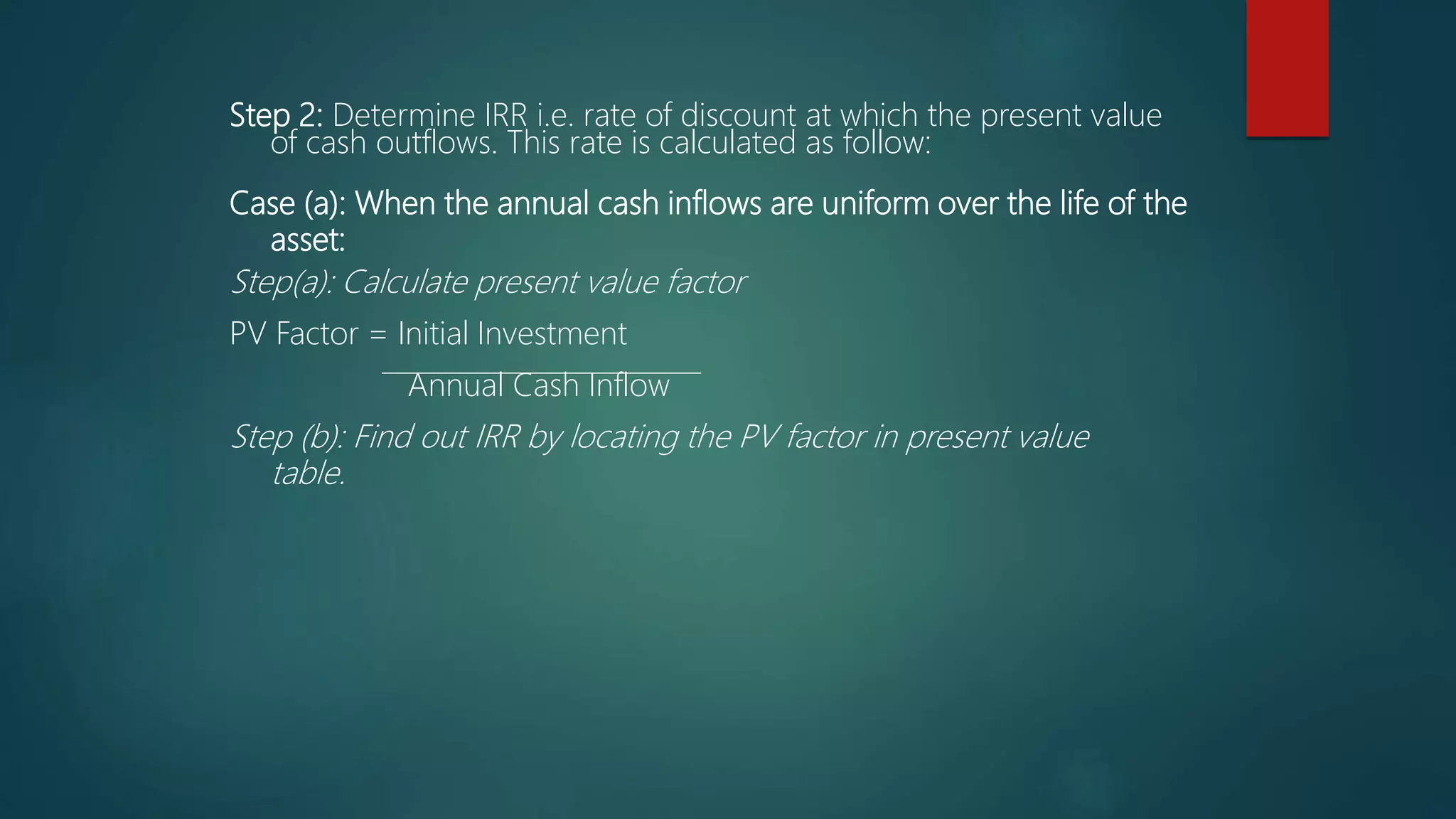

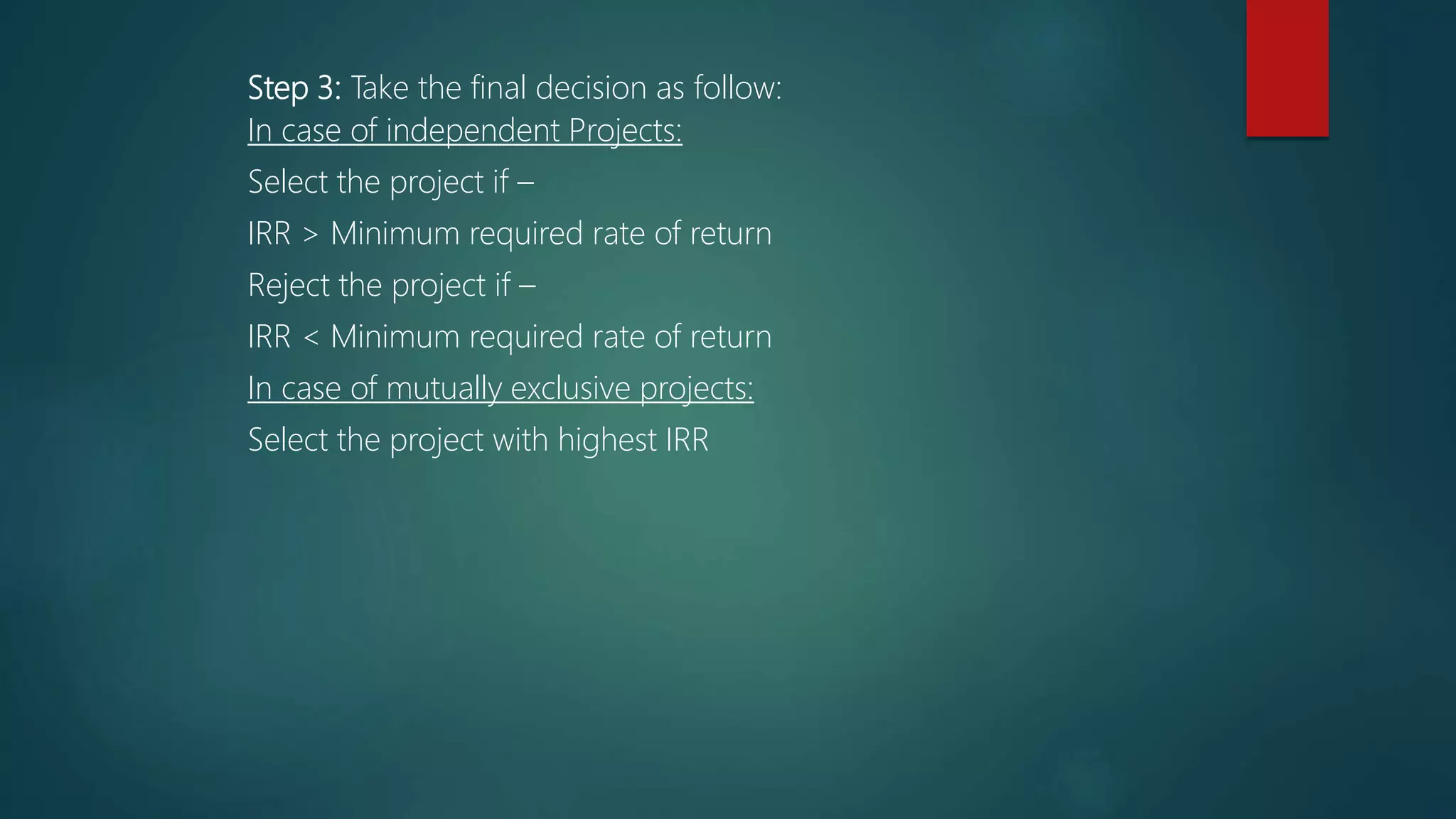

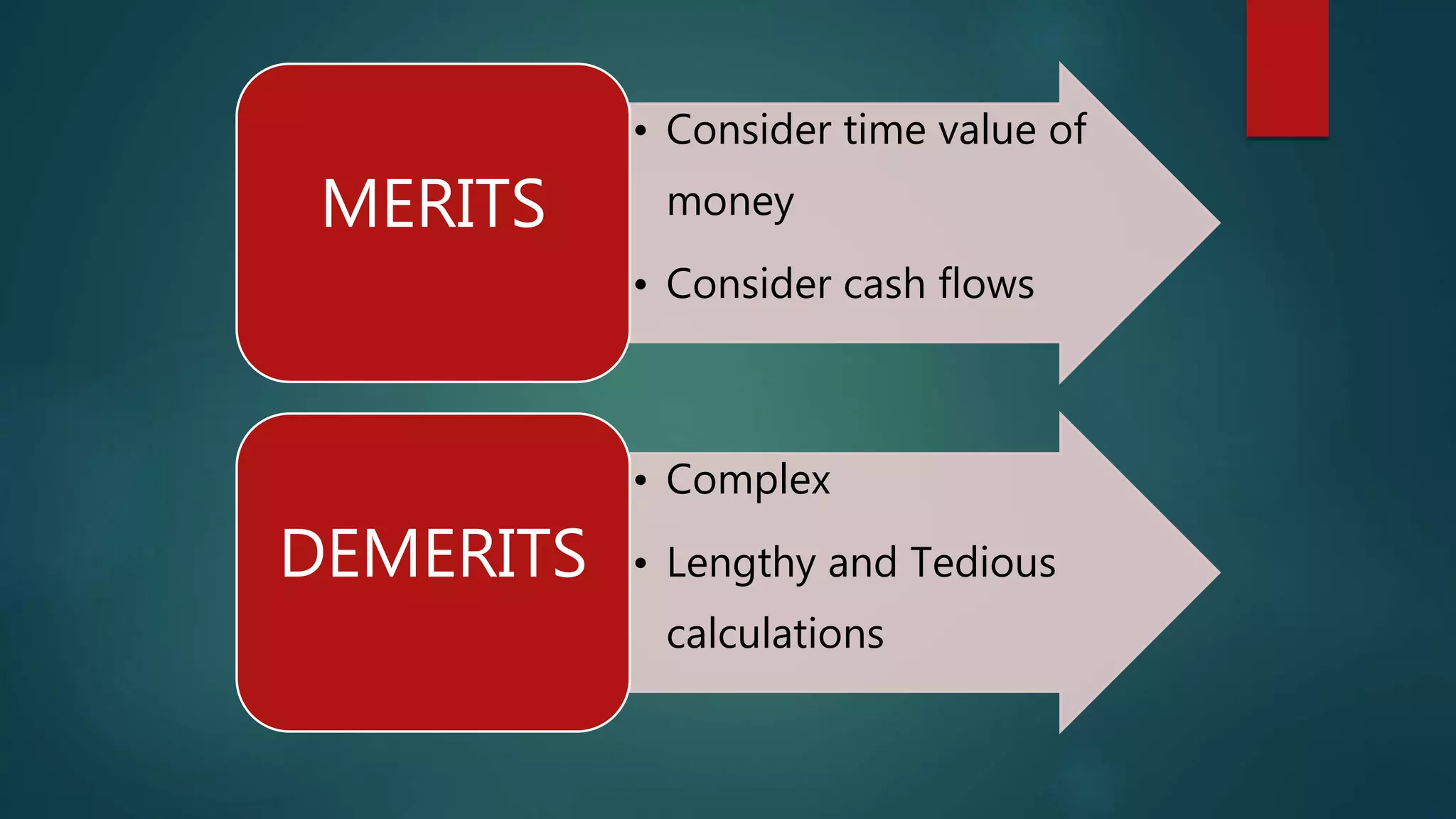

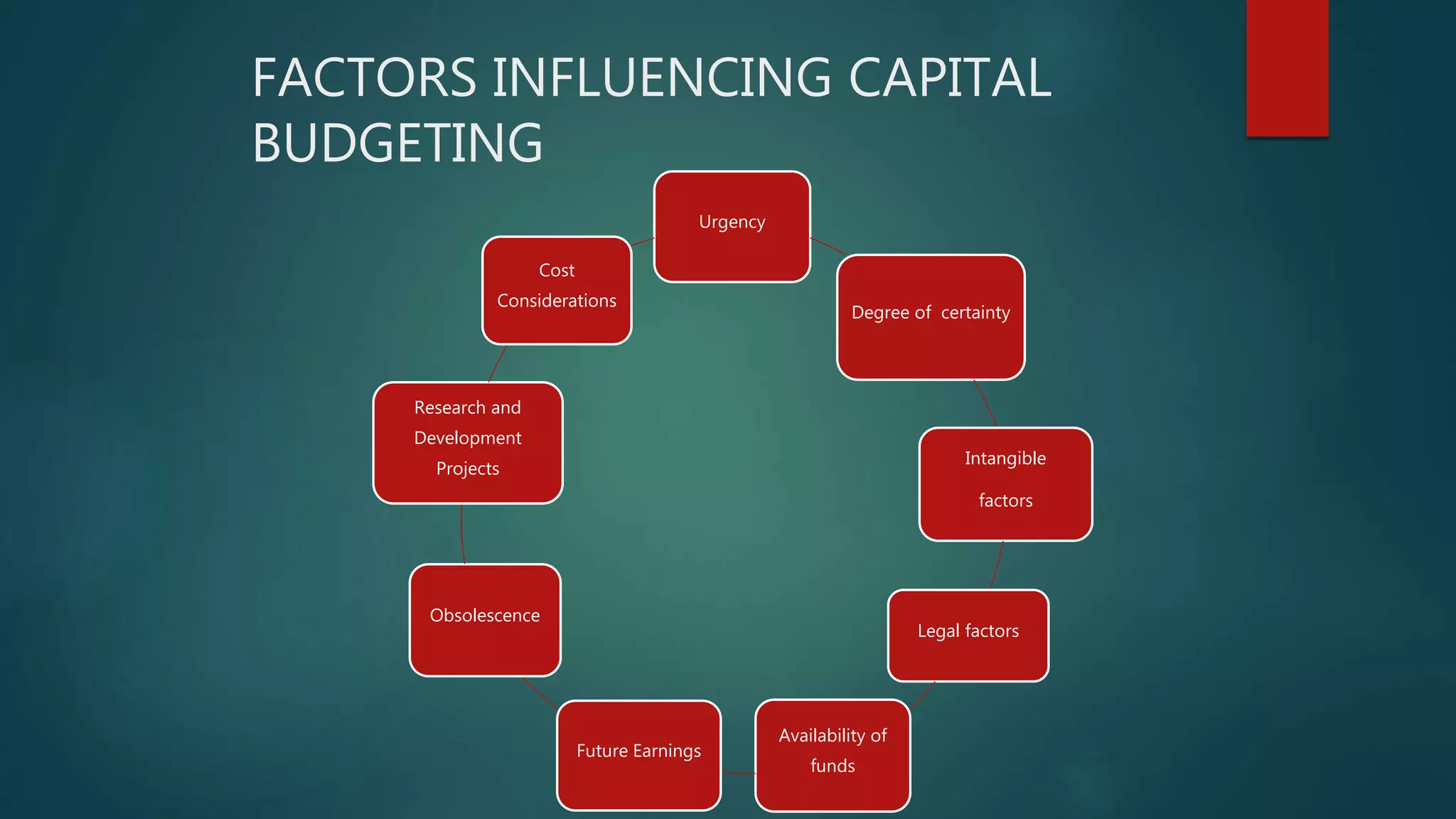

Capital budgeting is the process of evaluating investments and major capital expenses. It is important for maximizing shareholder wealth and making long-term, irreversible decisions. The key methods are payback period, accounting rate of return, net present value, and internal rate of return. NPV and IRR consider the time value of money by discounting future cash flows. They can provide different results for mutually exclusive projects. Factors like uncertainty, risk, and availability of funds also influence capital budgeting decisions.