1. Capitalization refers to the total amount of long-term funds available to a company including share capital, reserves, debentures, and long-term loans.

2. There are two main theories of capitalization - the cost theory which is based on the cost of assets, and the earnings theory which is based on expected earnings and rate of return.

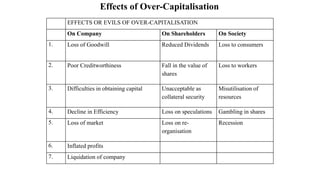

3. Overcapitalization occurs when a company's capital exceeds what is needed based on its earning capacity, resulting in a lower return on capital. Undercapitalization is the opposite, where the capital is too low relative to earning capacity. Maintaining fair capitalization is ideal for a company.