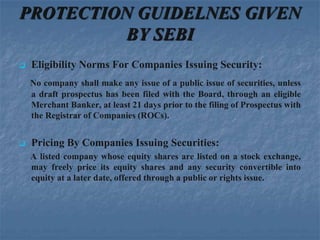

(1) The Securities and Exchange Board of India (SEBI) was established in 1992 to protect investors' interests and regulate the securities market.

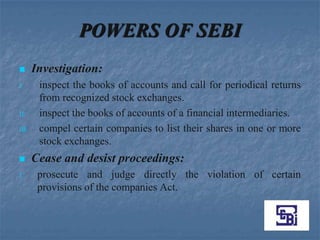

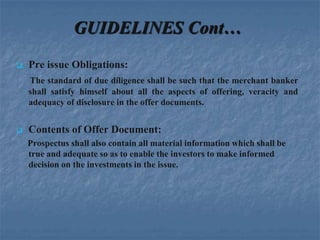

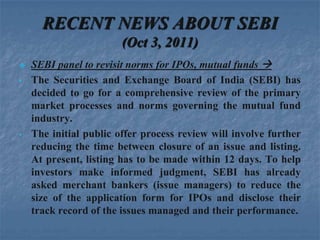

(2) SEBI regulates stock exchanges, brokers, mutual funds and enforces regulations related to public issues, investments, and fraud prevention.

(3) It aims to make the process of public offers easier for retail investors by reducing timelines and disclosure requirements. SEBI periodically reviews regulations and seeks public feedback.