Embed presentation

Downloaded 30 times

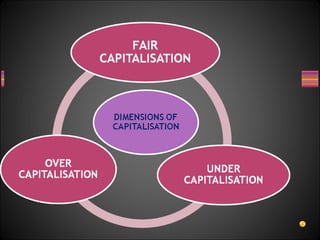

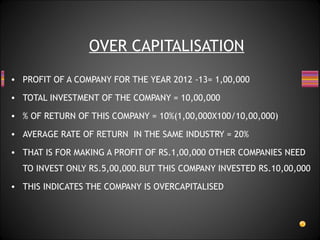

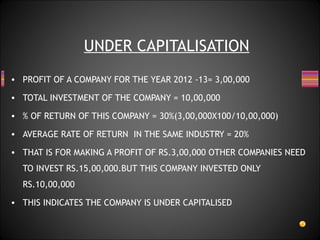

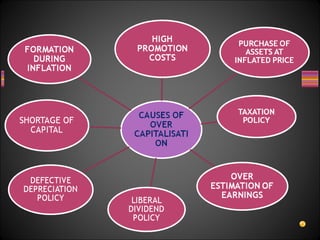

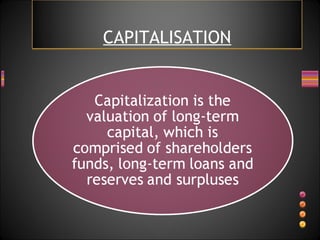

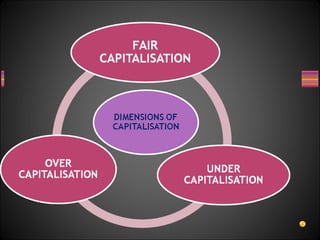

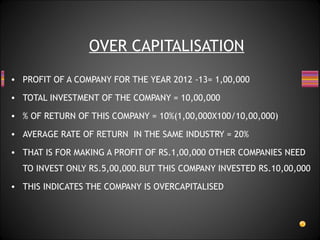

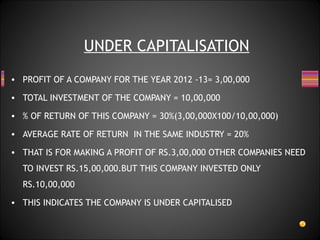

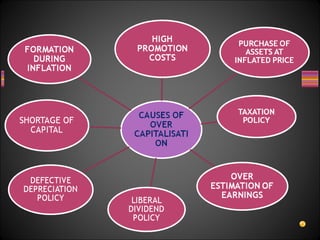

The document discusses capitalization levels in companies. It provides examples of a company being overcapitalized, with a 10% return on investment when the industry average is 20%, and undercapitalized, with a 30% return on an investment of Rs. 10 lakh when other companies need Rs. 15 lakh for a 20% return. Overcapitalization occurs when a company invests more funds than needed to generate its profits, while undercapitalization means not enough funds are invested given the level of profits.