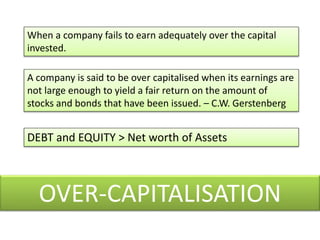

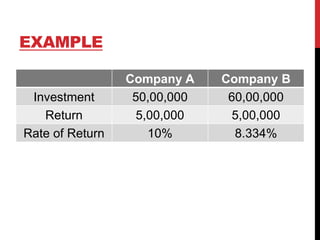

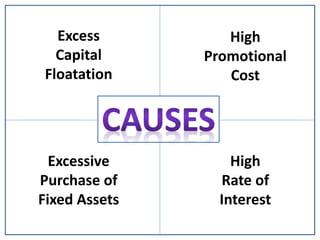

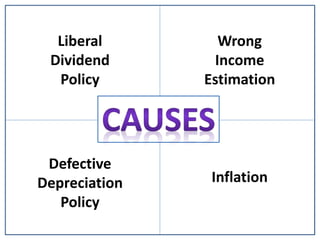

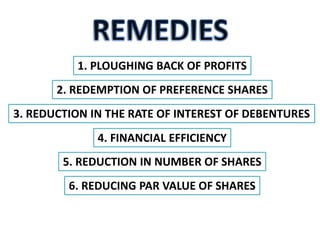

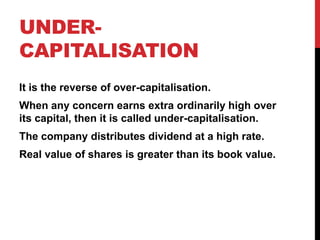

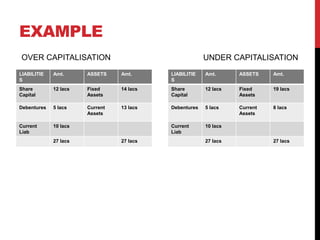

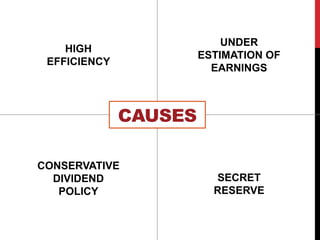

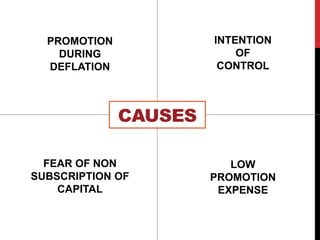

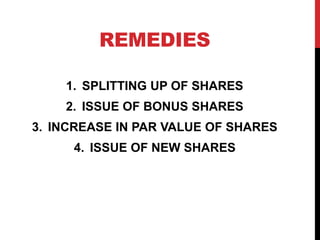

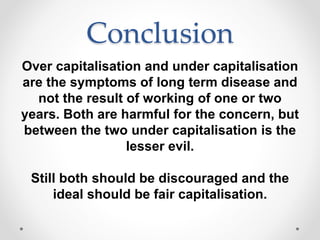

This document discusses over-capitalization and under-capitalization. Over-capitalization occurs when a company's earnings are not large enough to provide a fair return on the capital invested. Under-capitalization is the reverse, where a company earns extraordinarily high returns over its capital. Causes of over-capitalization include excessive purchase of fixed assets and liberal dividend policies. Causes of under-capitalization include high efficiency and conservative dividend policies. Both situations can impact companies, stockholders, society, and workers negatively. Remedies for over-capitalization include reducing shares or interest rates, while remedies for under-capitalization include splitting shares or issuing new shares. Overall, fair capitalization is ideal.