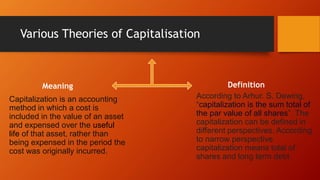

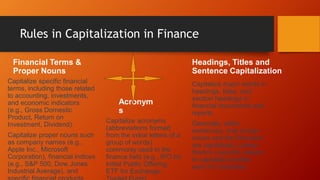

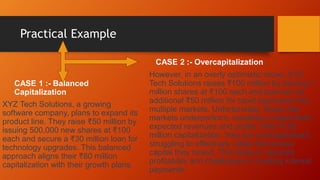

This document discusses various theories and types of capitalization. It defines capitalization as accounting for a cost as an asset that is expensed over the asset's useful life rather than in the period incurred. Types of capitalization include market capitalization, which is the total value of a company's shares, and enterprise value, which includes debt and cash holdings. The document also discusses rules for capitalizing terms in finance writing and provides examples of overcapitalization and undercapitalization in companies. It concludes with formulas for calculating various capitalization metrics and an example of balanced versus over capitalization.