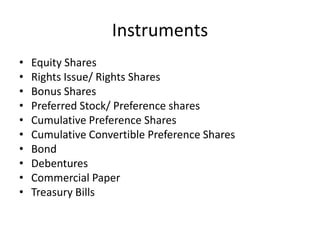

The document discusses capital markets, which consist of primary and secondary markets. The primary market involves the initial sale of securities directly from companies to investors in order to raise capital. The secondary market allows existing securities to be traded between investors on stock exchanges, promoting liquidity. Various types of financial instruments like stocks, bonds, and government securities are discussed. Regulations governing capital markets aim to facilitate capital formation while ensuring fair and transparent trading.