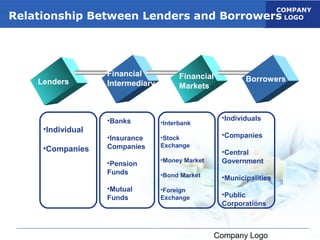

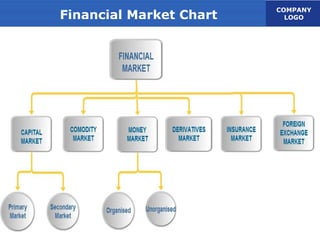

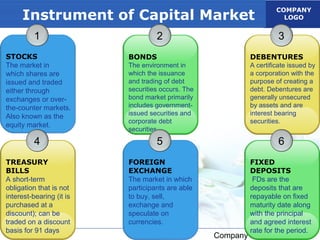

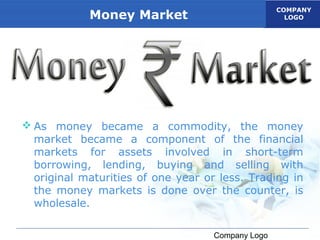

The document discusses financial markets and provides details about capital markets and money markets. It defines a financial market as any marketplace where buyers and sellers trade financial securities and commodities. Capital markets deal with longer term financial instruments like stocks and bonds, while money markets facilitate short term borrowing and lending with maturities of one year or less, including treasury bills, certificates of deposit, and commercial paper. Both markets play important roles in raising capital and facilitating transactions.