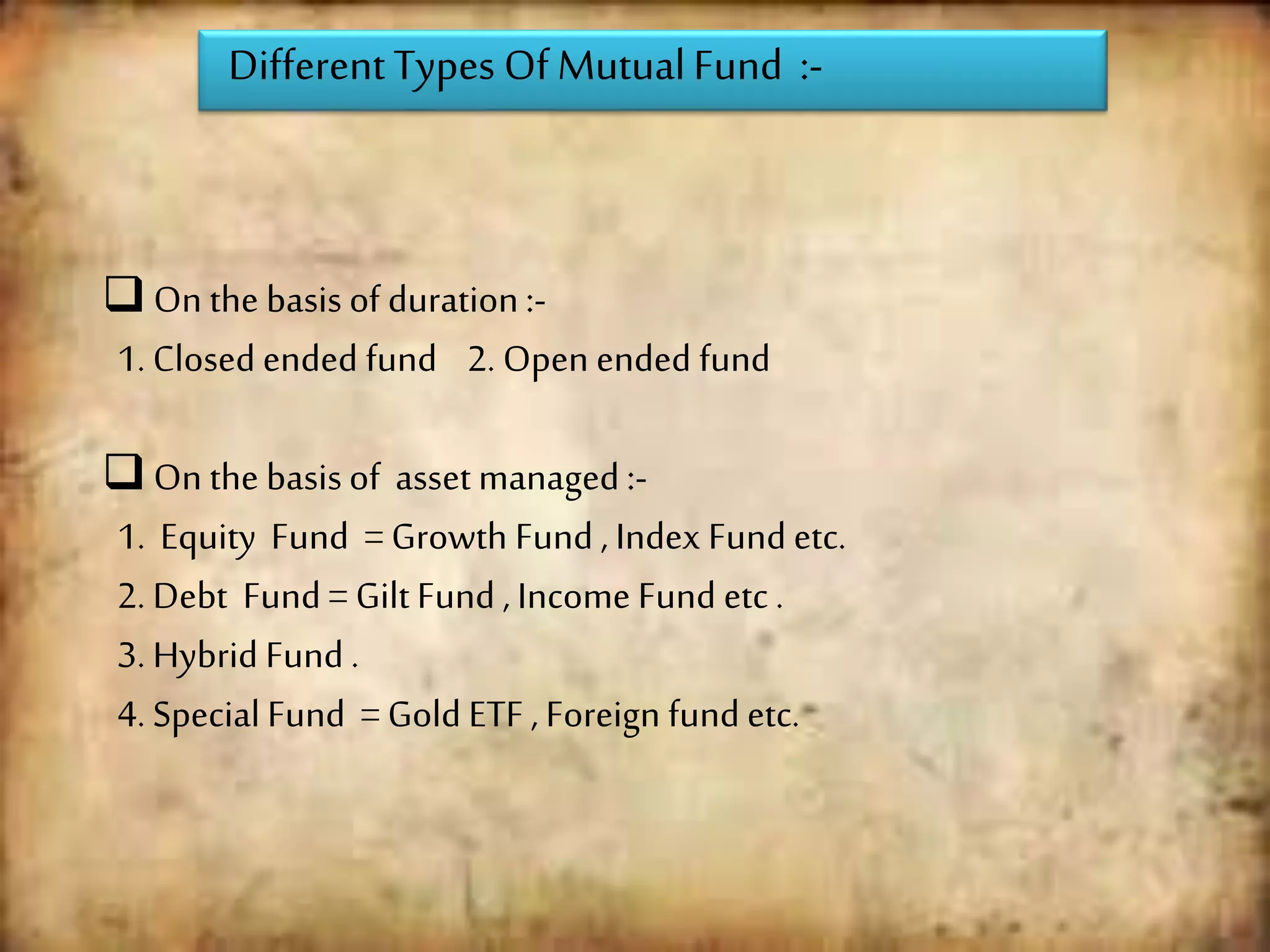

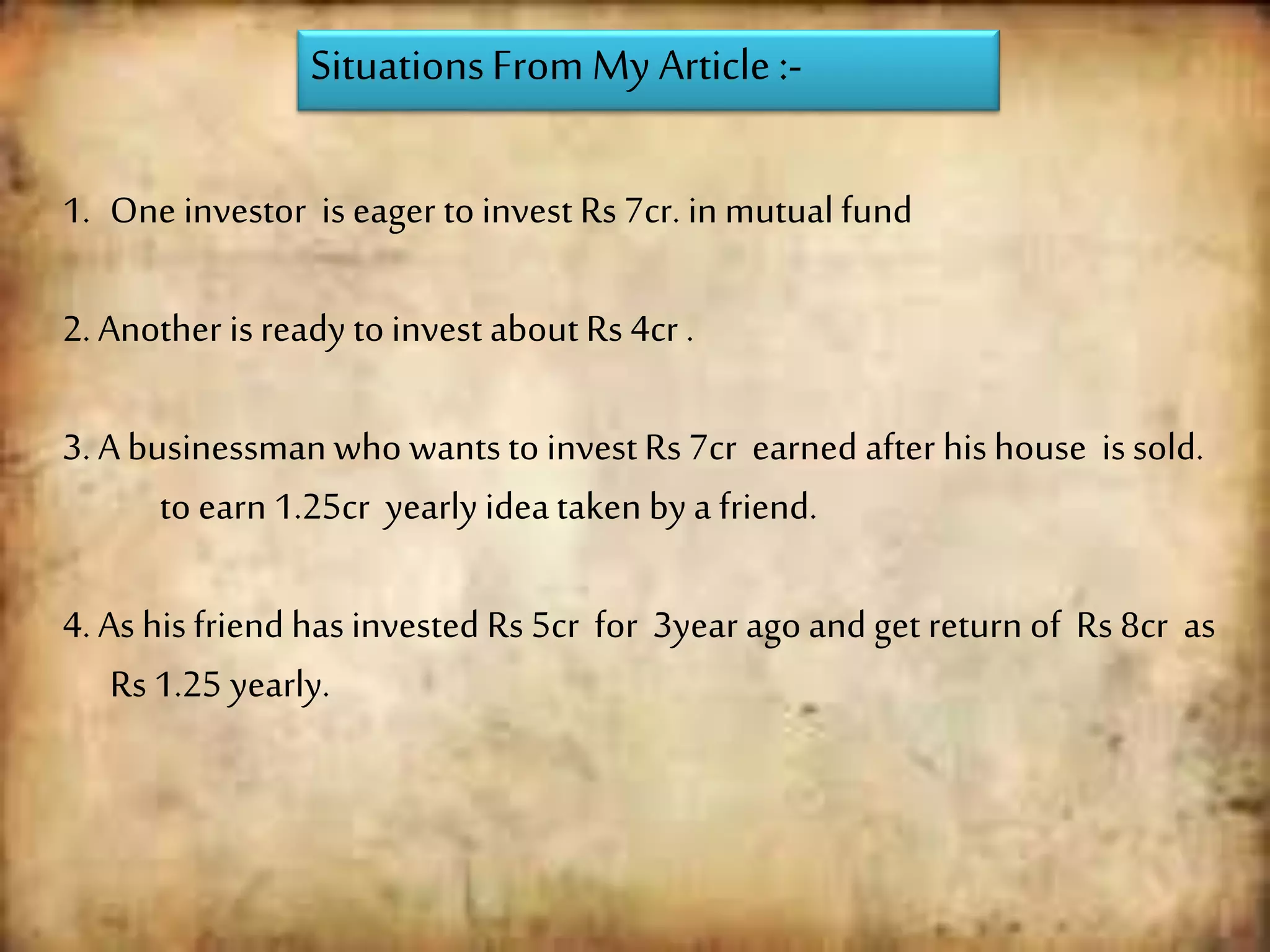

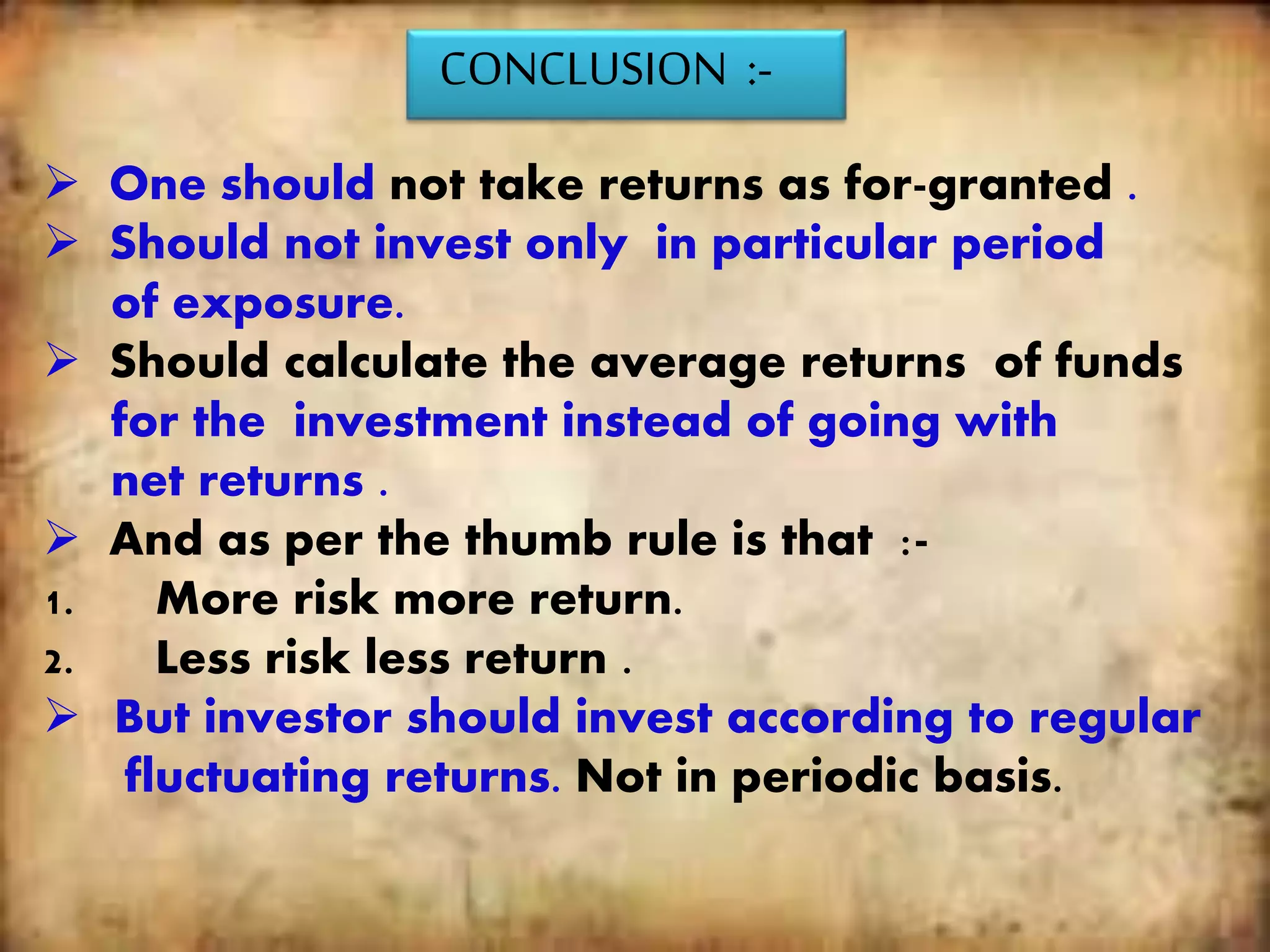

The document discusses the essentials of financial investment planning, including definitions, purposes, types of mutual funds, and their advantages. It emphasizes the importance of not solely relying on historical performance for investment decisions, as mutual funds are subject to market risks and their returns can fluctuate significantly. The author suggests a calculated approach to investing that accounts for average returns and risks, rather than unrealistic expectations based on past performance.