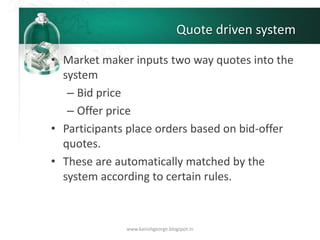

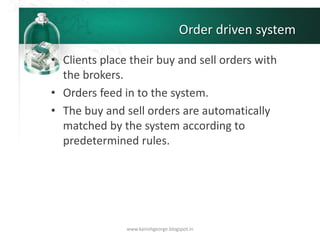

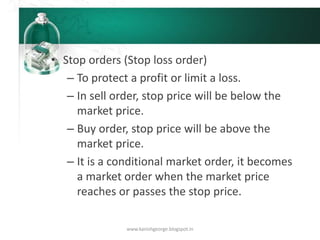

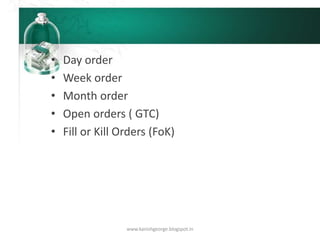

The document provides an overview of the secondary market, detailing its function as a platform for trading previously issued securities and its role in creating liquidity. It discusses regulatory aspects, the role of stock exchanges, the listing process, advantages and disadvantages of listing, and trading systems. Additionally, it covers the types of orders used in trading and the processes involved in settlement.