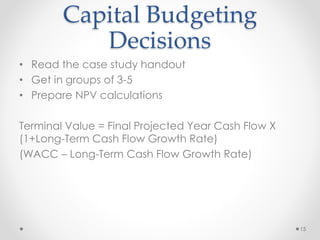

This document outlines an agenda for a workshop on multinational capital budgeting. The workshop will cover basics of capital budgeting, issues in foreign investment analysis, evaluating growth options and projects, and a case study. Participants will work in groups to calculate net present values for a case study and present their analyses. Key concepts that will be discussed include cash flows, net present value, internal rate of return, discount rates, and adjusting analyses for increased risk when evaluating foreign investments.