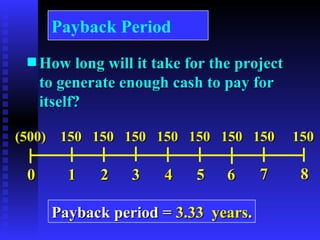

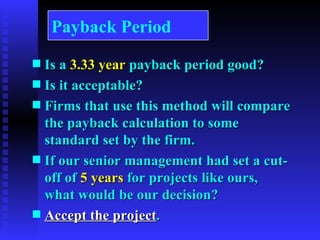

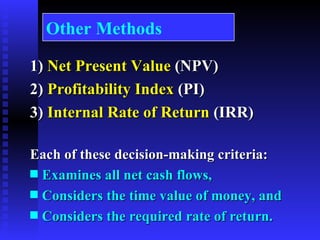

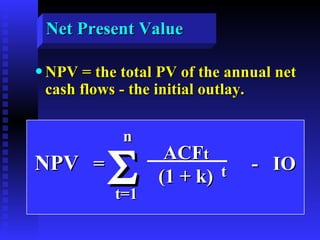

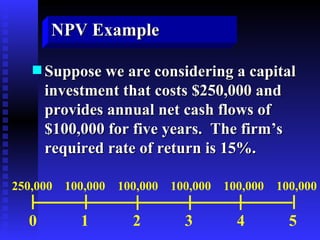

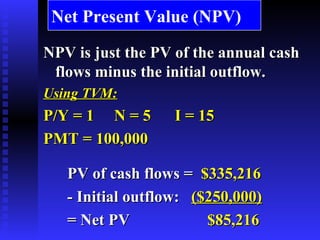

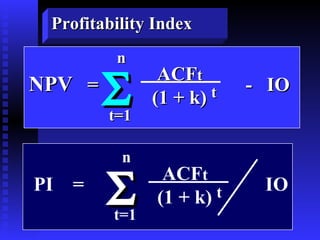

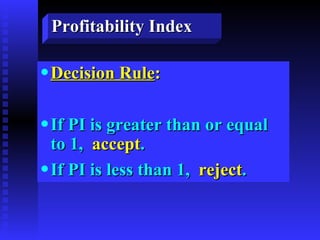

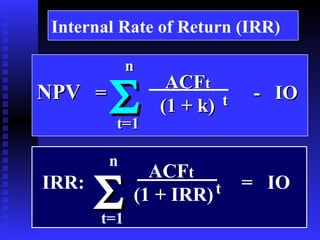

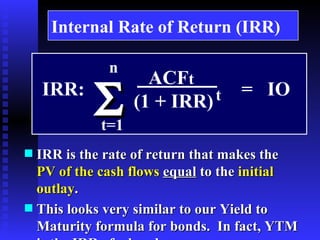

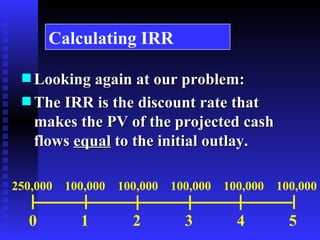

Capital budgeting techniques are used to evaluate long-term investment projects. The ideal evaluation method considers all cash flows over the life of the project, the time value of money, and the required rate of return. Common techniques include payback period, net present value (NPV), profitability index (PI), and internal rate of return (IRR). NPV calculates the present value of all cash flows less the initial investment, and a project is accepted if NPV is positive. IRR is the discount rate that makes the net present value equal to zero.