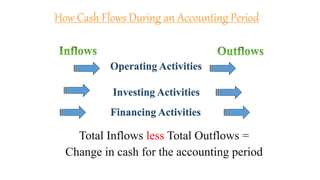

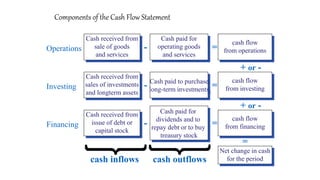

1) A cash flow statement analyzes the inflow and outflow of cash within a business over a period of time and is divided into operating, investing, and financing activities.

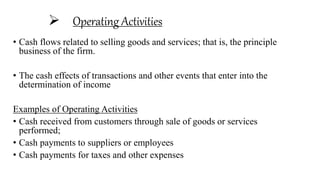

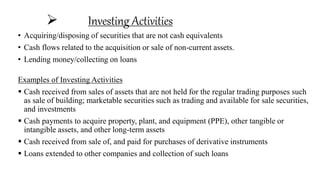

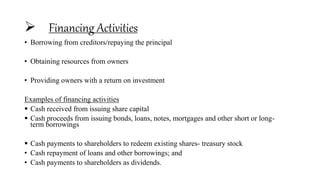

2) Operating activities relate to core business operations like production and sales. Investing activities involve the purchase and sale of long-term assets. Financing activities include activities related to debt and equity.

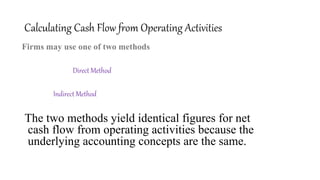

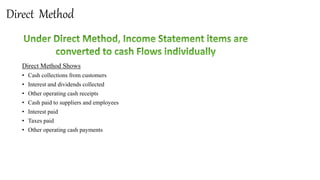

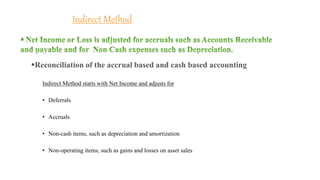

3) There are two methods for calculating cash flow from operations - the direct method lists actual cash flows, while the indirect method reconciles net income to cash flows by adjusting for accruals and non-cash items.