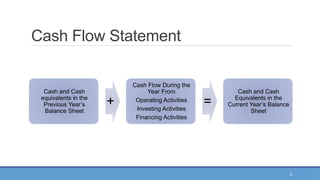

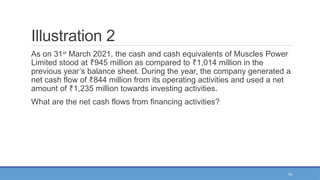

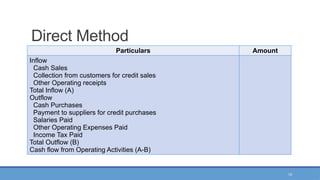

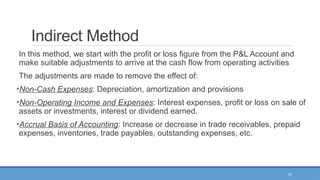

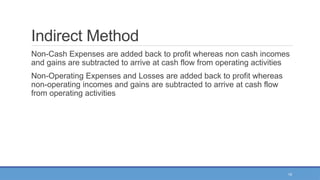

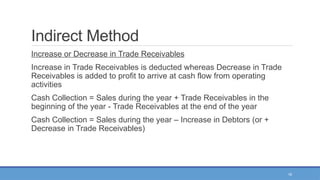

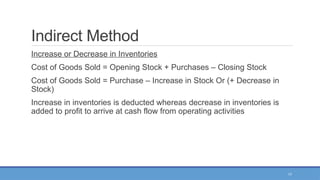

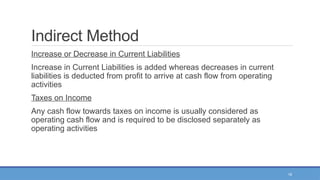

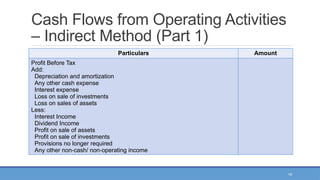

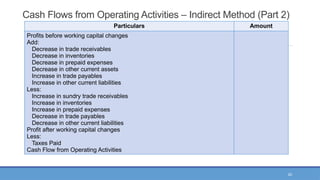

This document provides an overview of cash flow statements, highlighting their purpose, components, and preparation methods. It explains the significance of cash flows for assessing an enterprise's ability to generate cash and outlines operational, investing, and financing activities. Additionally, it covers both direct and indirect methods for calculating cash flows from operating activities, along with the treatment of extraordinary items and foreign currency transactions.