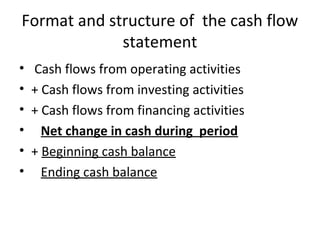

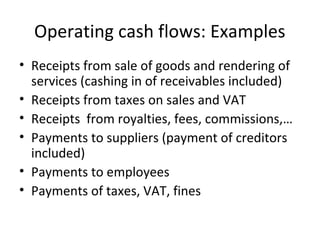

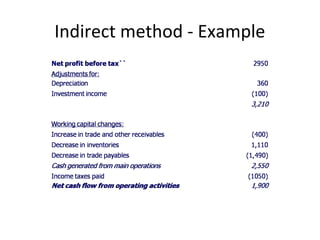

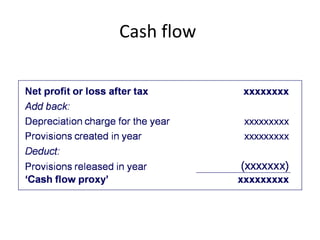

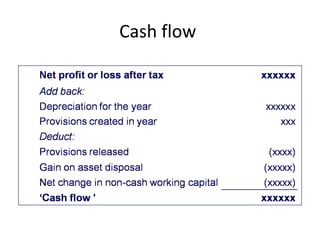

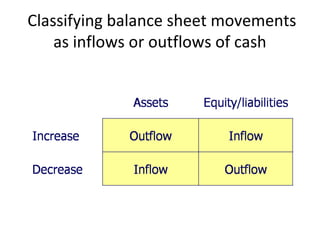

A cash flow statement presents information about the inflows and outflows of cash from a company's operating, investing, and financing activities over a period of time. It shows cash generated and used by the main business operations, investments in long-term assets or financial securities, and cash received or paid related to financing activities like issuing stock or taking loans. The statement is structured to first show cash flows from operating activities, then investing activities, and finally financing activities, with net changes in cash over the period.