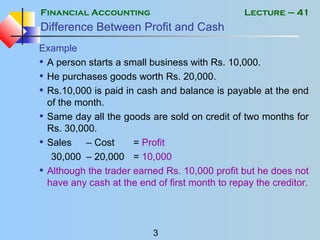

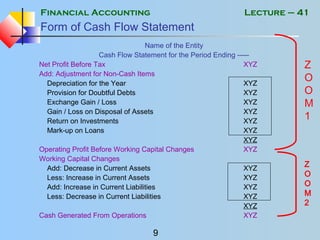

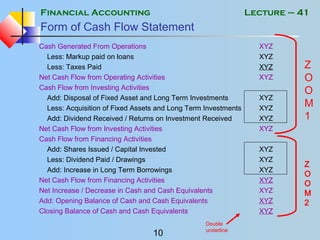

The document outlines key financial accounting concepts including the profit and loss account, balance sheet, and cash flow statement, highlighting their roles in assessing a business's performance and financial position. It details the components of the cash flow statement: operating, investing, and financing activities. The content also explains the difference between profit and cash, emphasizing the importance of liquidity and managing cash flows.