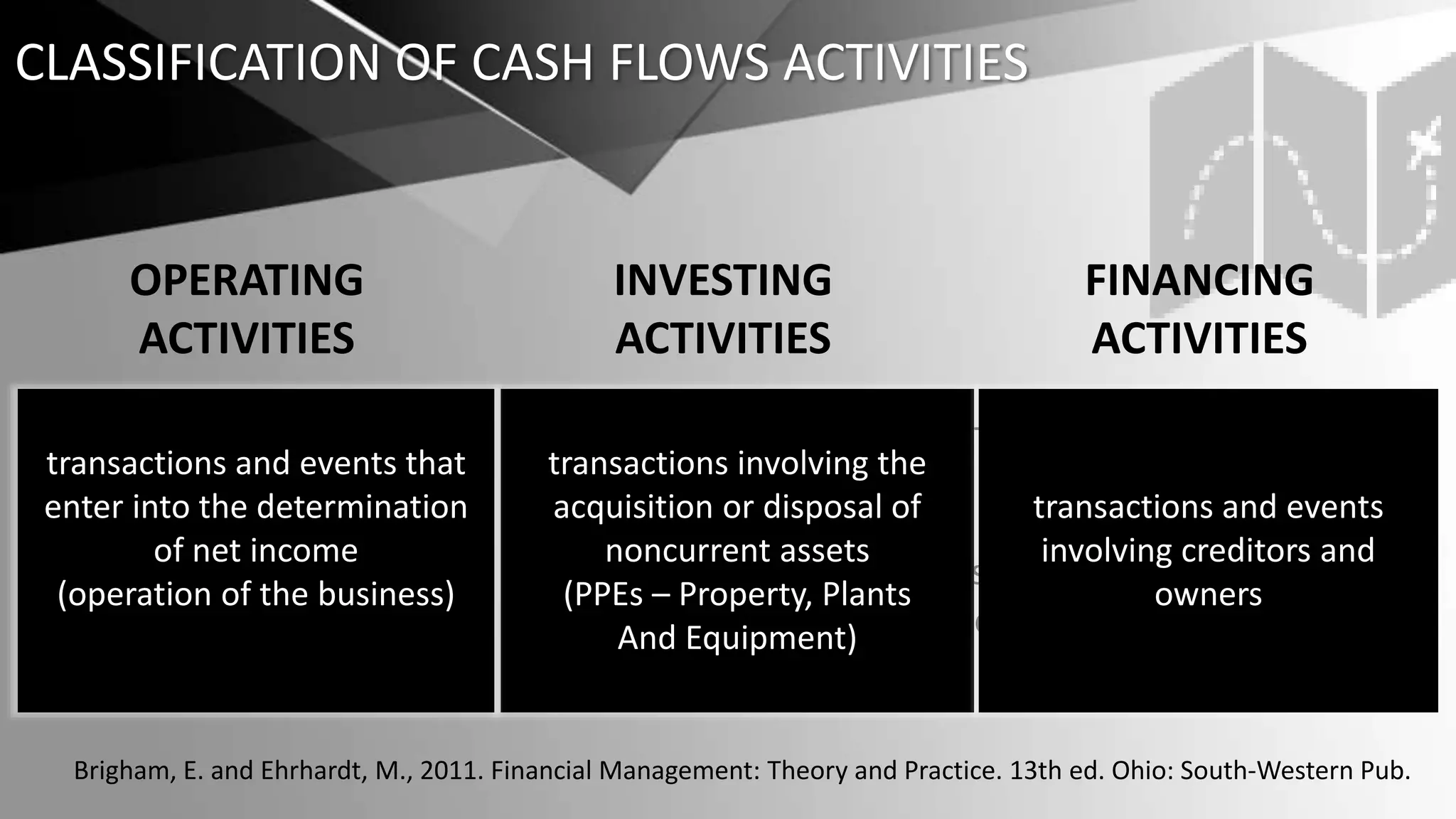

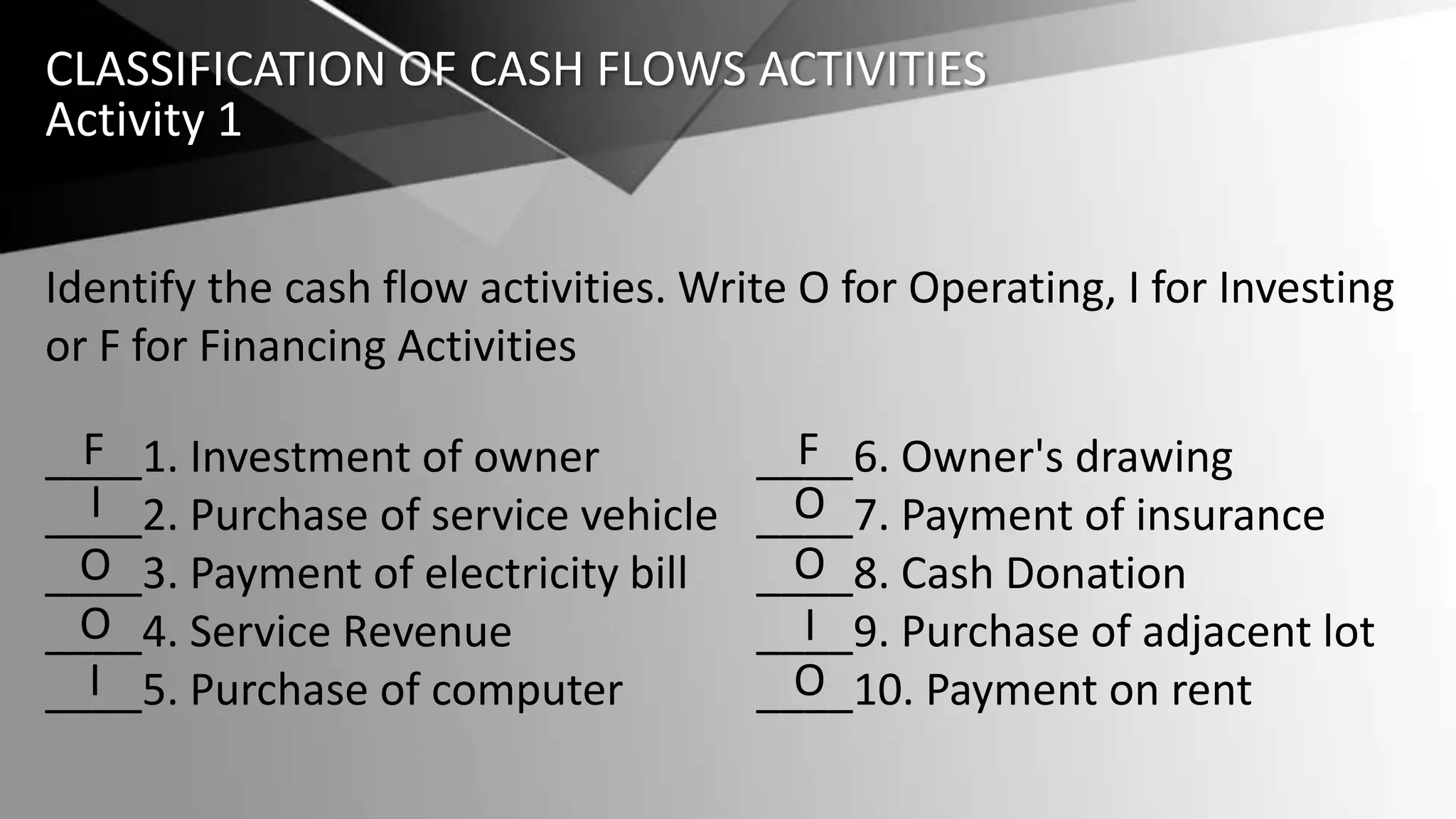

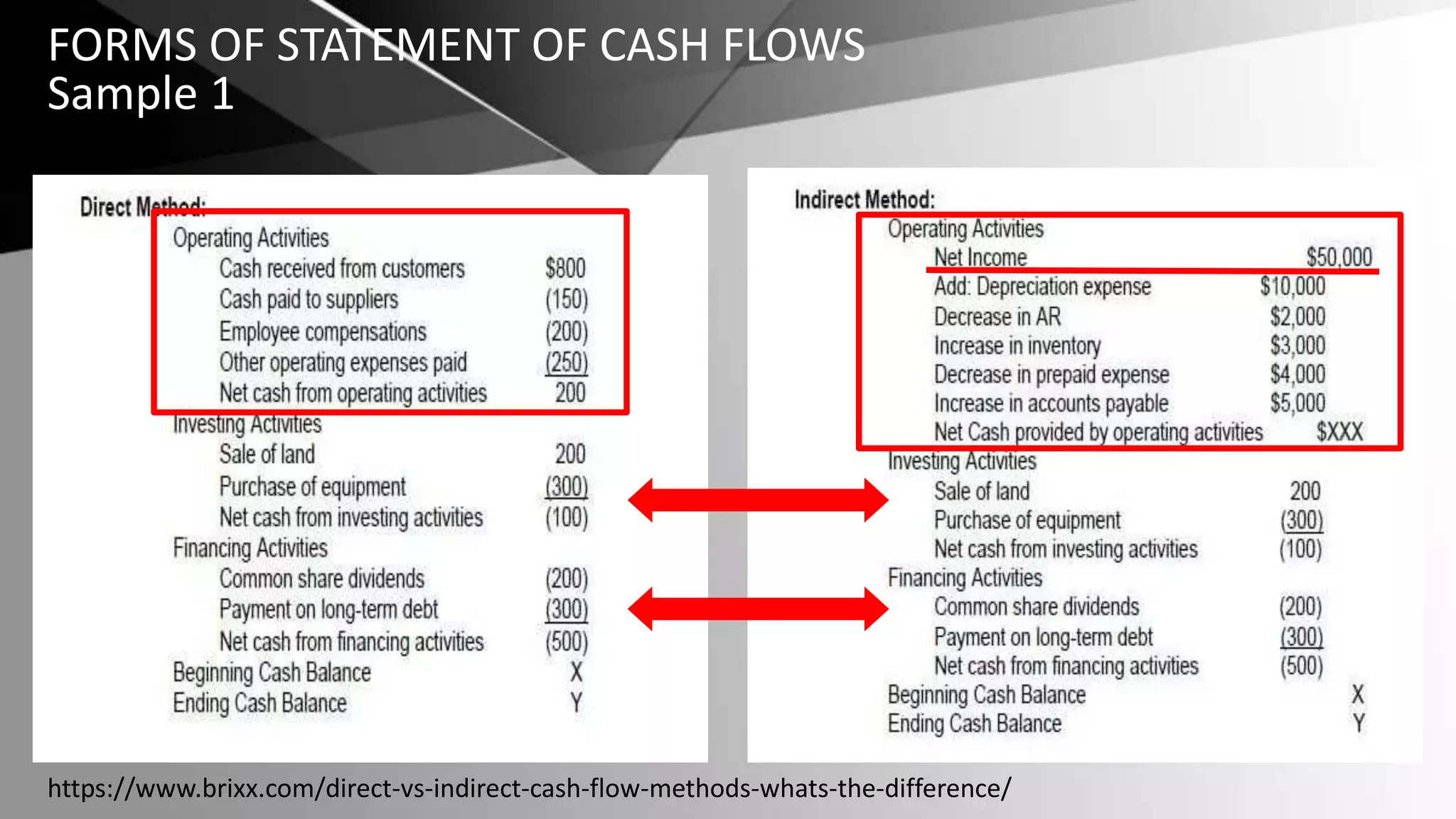

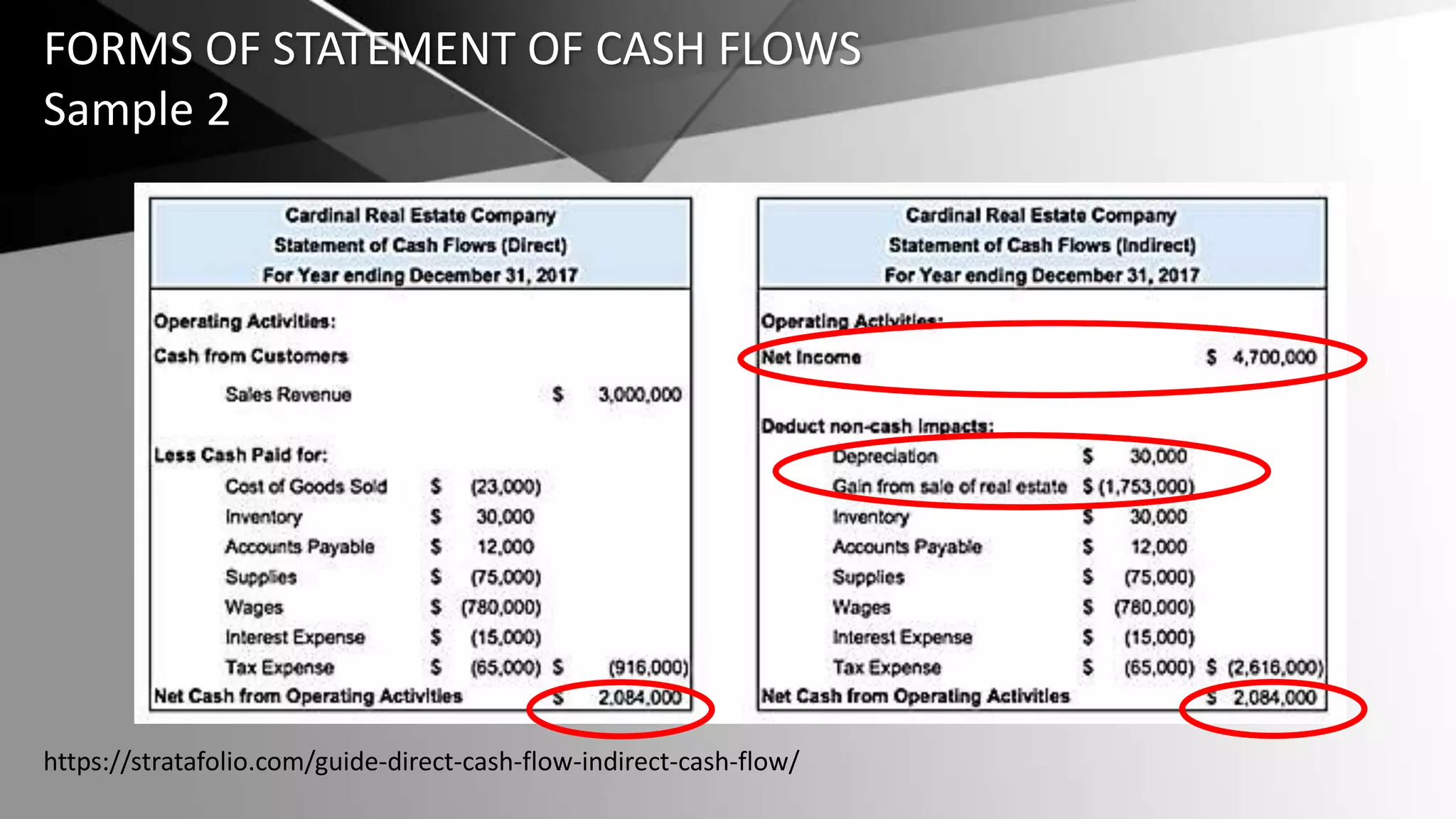

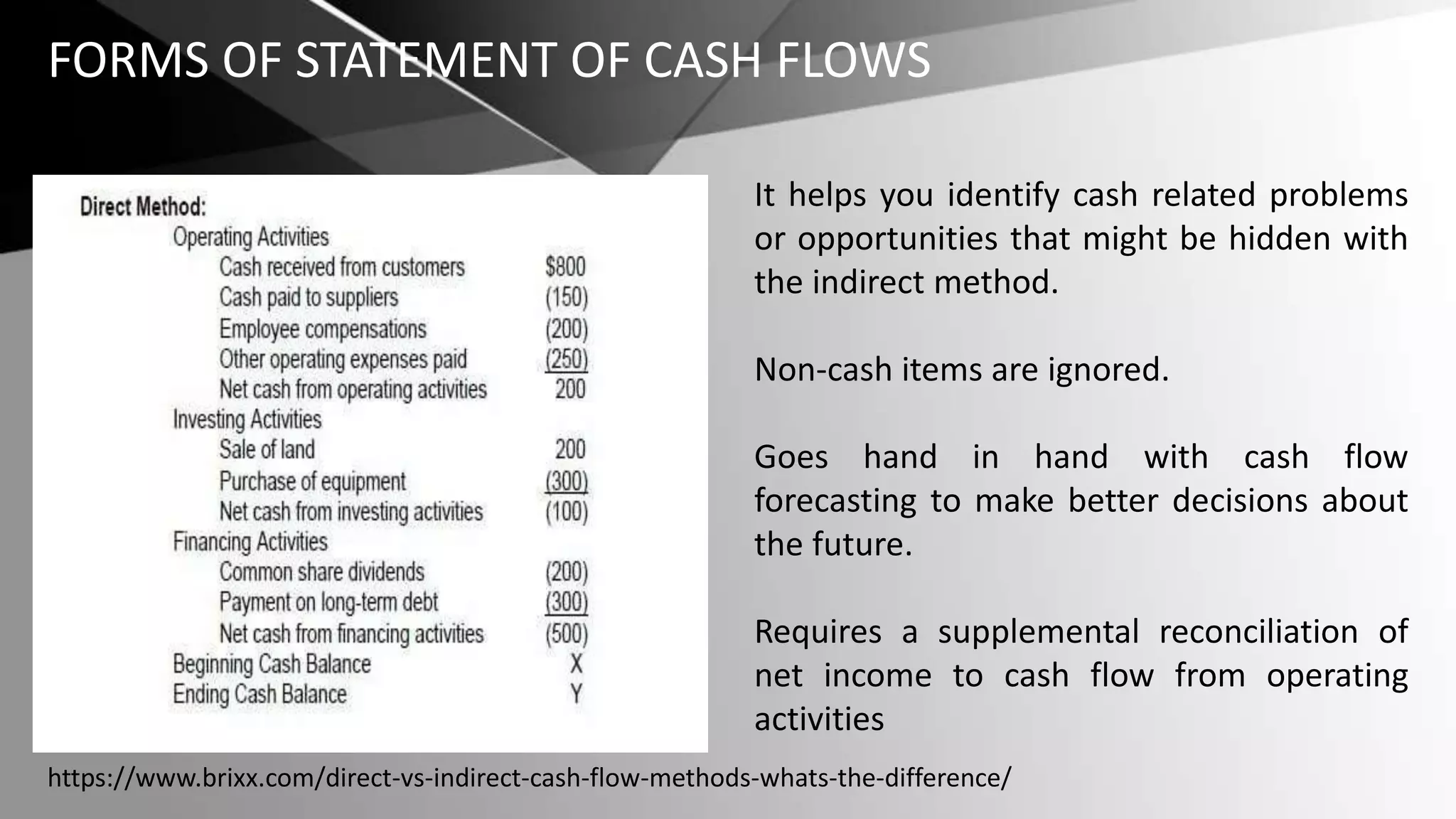

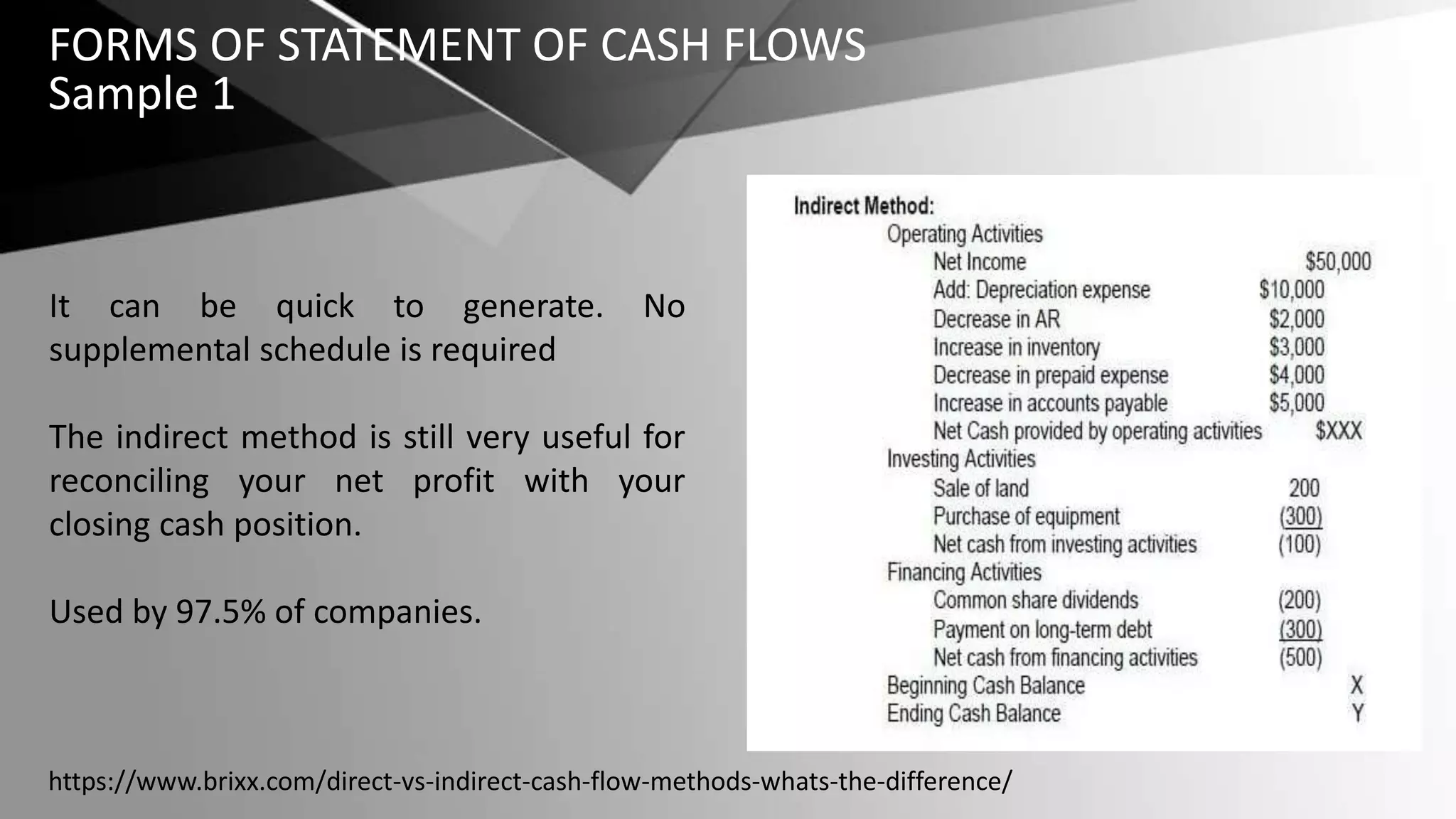

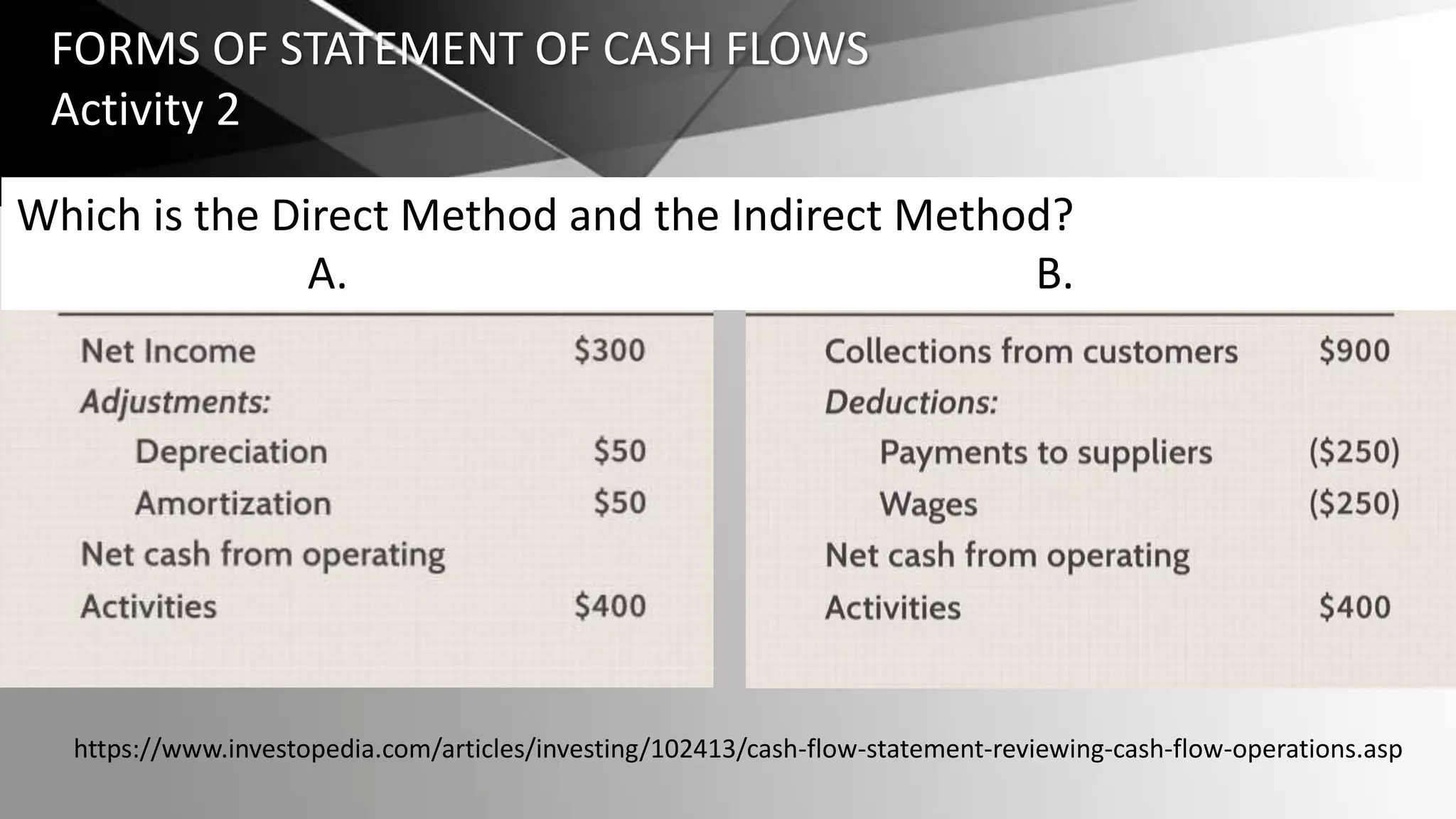

The document discusses cash flow analysis and the statement of cash flows. It describes the statement of cash flows as a financial report that records a company's cash inflows and outflows. It explains that the statement of cash flows has three sections - operating, investing, and financing activities - which classify transactions and events. The direct and indirect methods for preparing the statement of cash flows are also outlined.