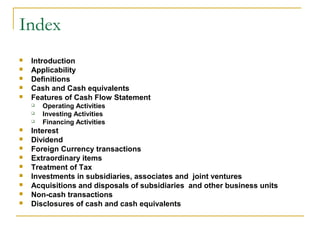

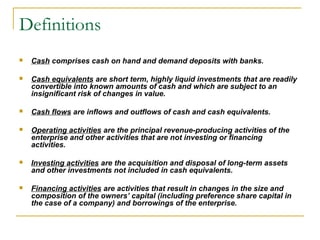

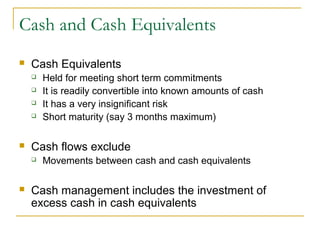

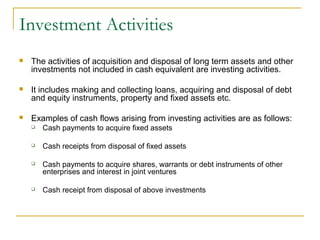

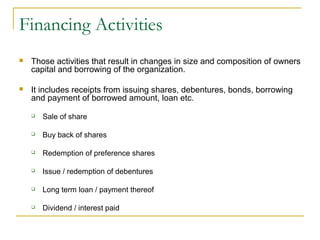

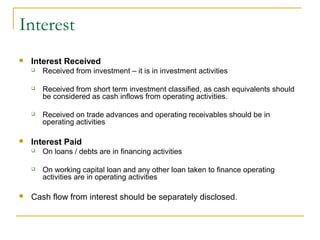

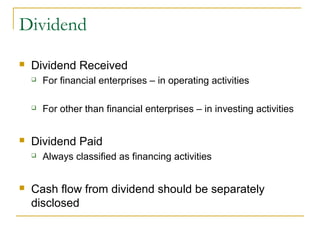

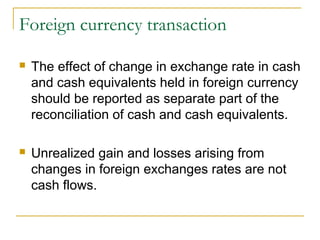

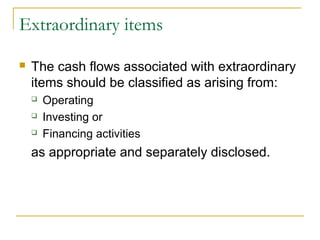

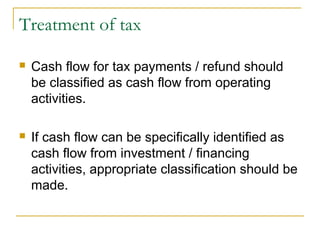

This document outlines Accounting Standard 3 regarding cash flow statements in India. It defines key terms like cash, cash equivalents, and cash flows. It specifies that cash flow statements should classify cash flows as operating, investing or financing activities. It provides guidance on treatment of items like interest, dividends, taxes, acquisitions and more. The standard is applicable to companies with over 50 crore turnover or listed companies in India.