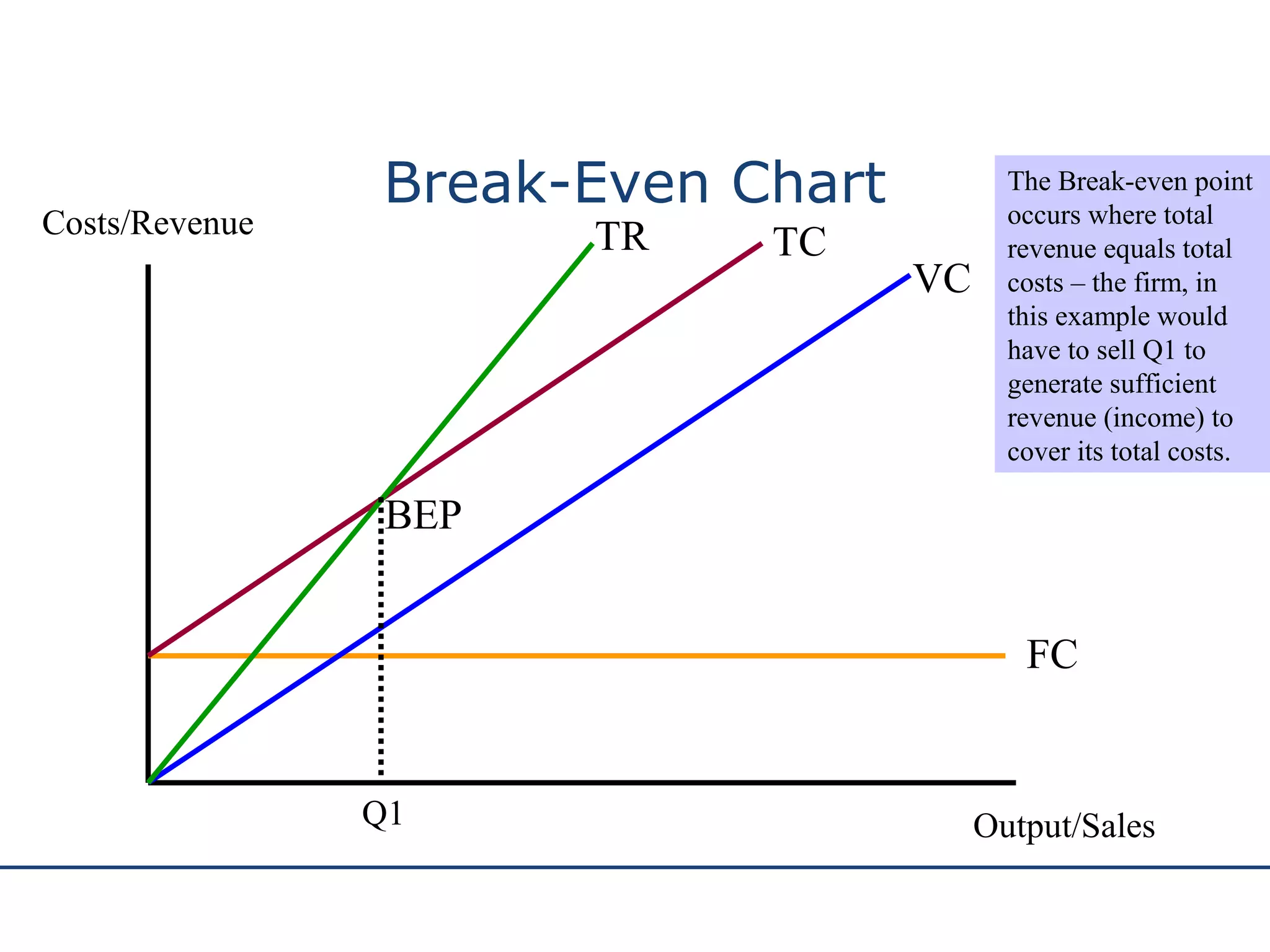

Break-even analysis is used to predict profits and losses and determine the break-even point. It involves calculating total costs, which include fixed and variable costs. The break-even point is where total revenue from sales equals total costs, meaning no profit or loss. It can be found by taking fixed costs and dividing by the unit contribution, which is selling price minus variable cost per unit. Break-even analysis provides a simple way to estimate profitability but has limitations as some assumptions may not hold in reality.