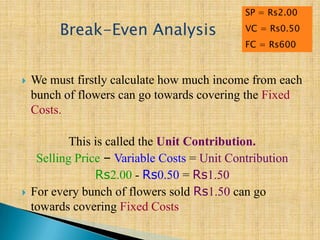

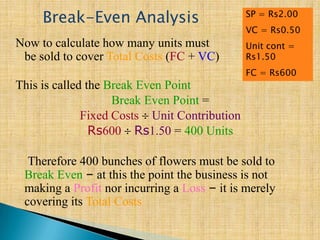

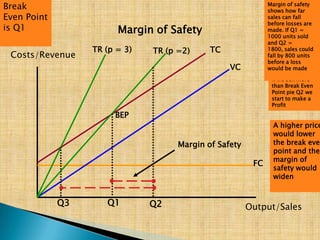

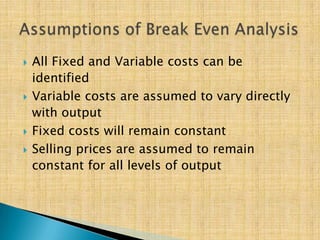

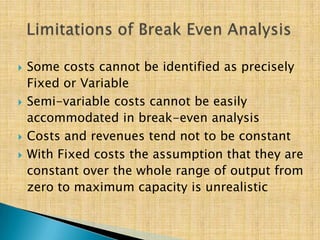

This document discusses break-even analysis, which examines the relationship between changes in volume, sales revenue, expenses, and net profit. It defines variable costs, fixed costs, total costs, contribution margin, break-even point, and margin of safety. An example is provided to illustrate how to calculate break-even point and margin of safety using fixed costs of Rs. 600, variable cost of Rs. 0.50 per unit, and selling price of Rs. 2 per unit. Limitations of break-even analysis are also outlined.