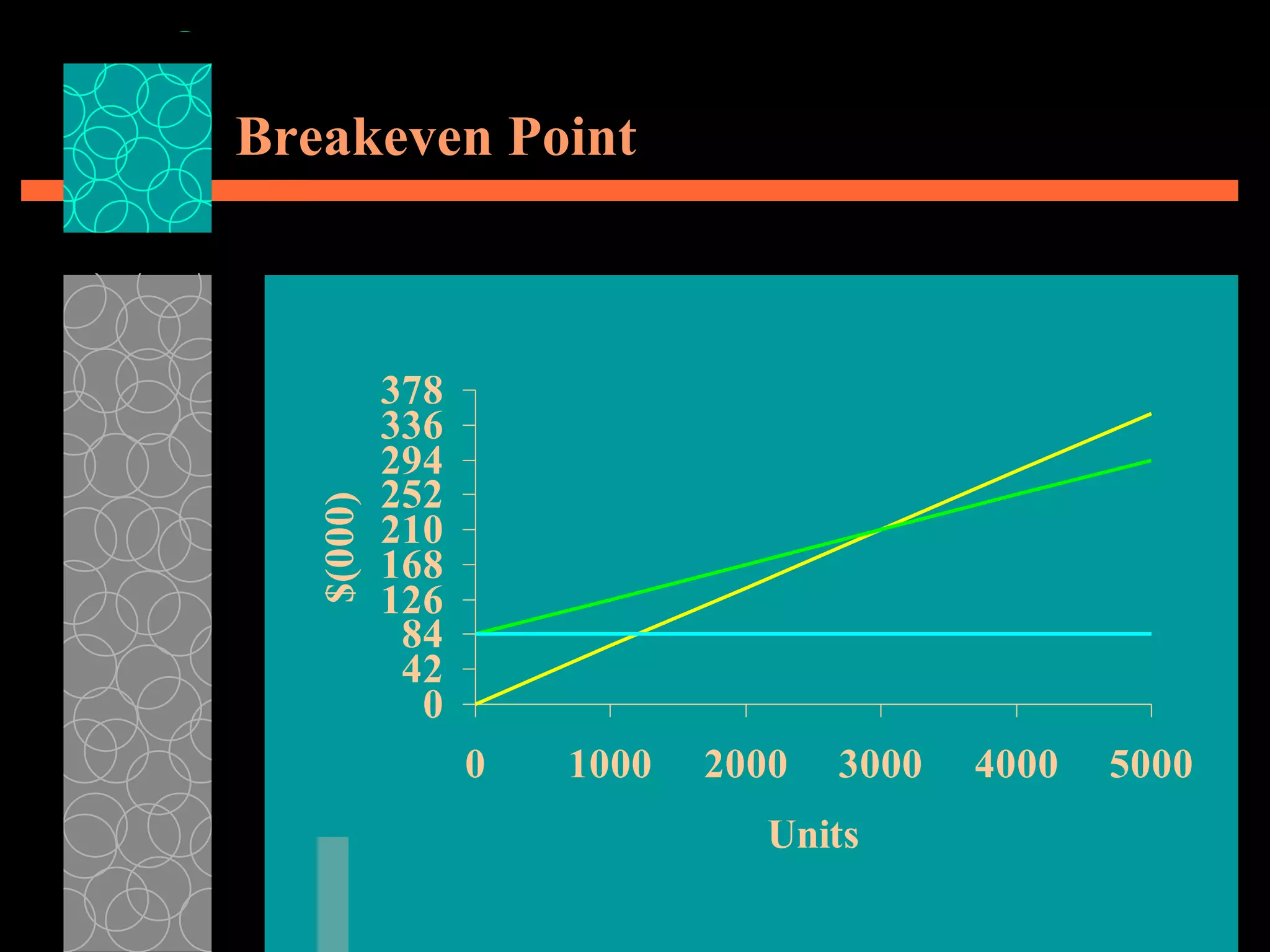

Cost-volume-profit analysis makes assumptions that total costs can be divided into fixed and variable components, and that revenues and costs change linearly with output units. It also assumes selling prices, variable costs, and fixed costs remain constant. The analysis can cover a single product or assume a constant sales mix if multiple products are involved, and it does not consider the time value of money. The breakeven point is where total revenues equal total costs, and is calculated by setting variable expenses plus fixed expenses equal to total revenues.