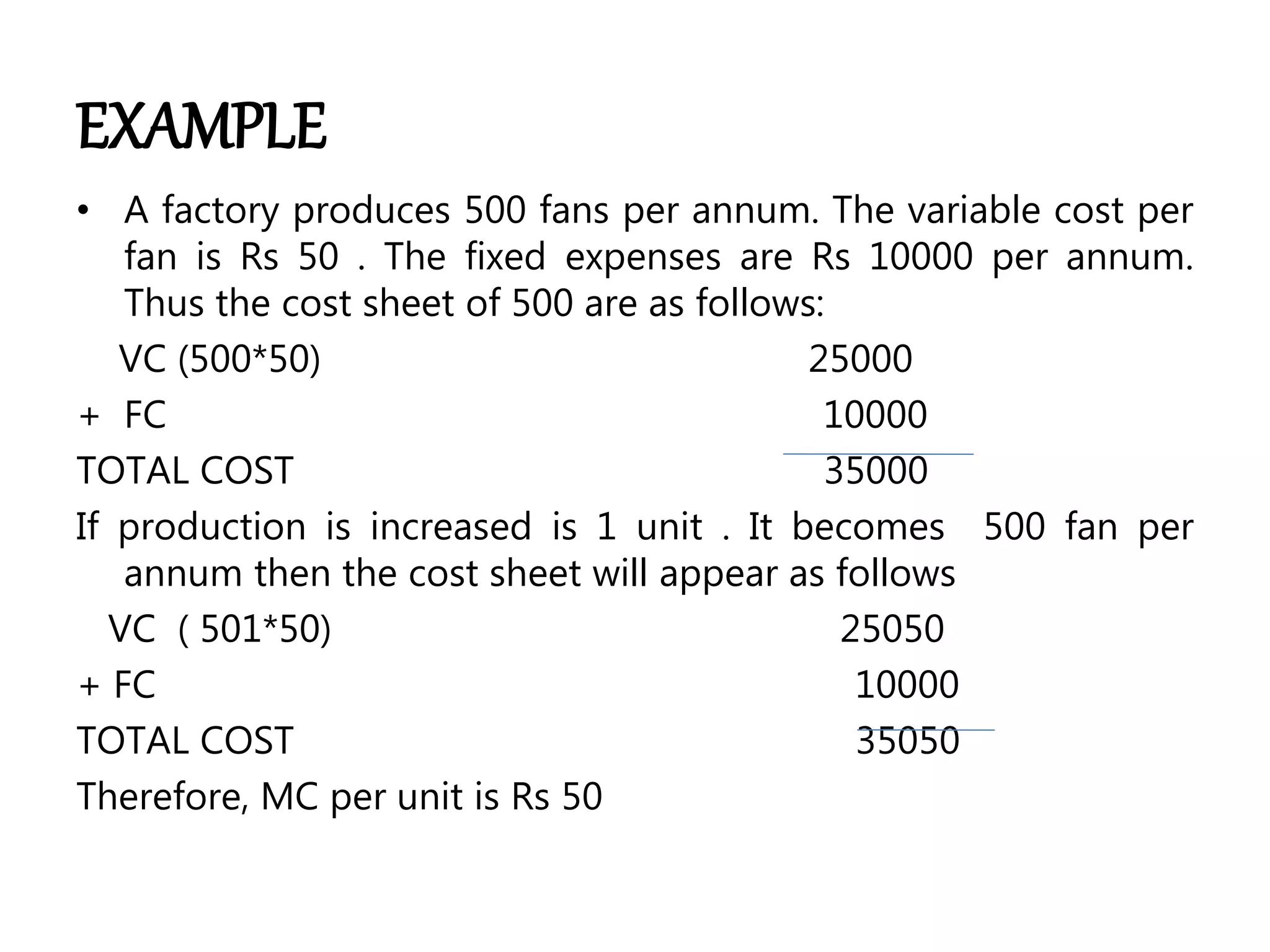

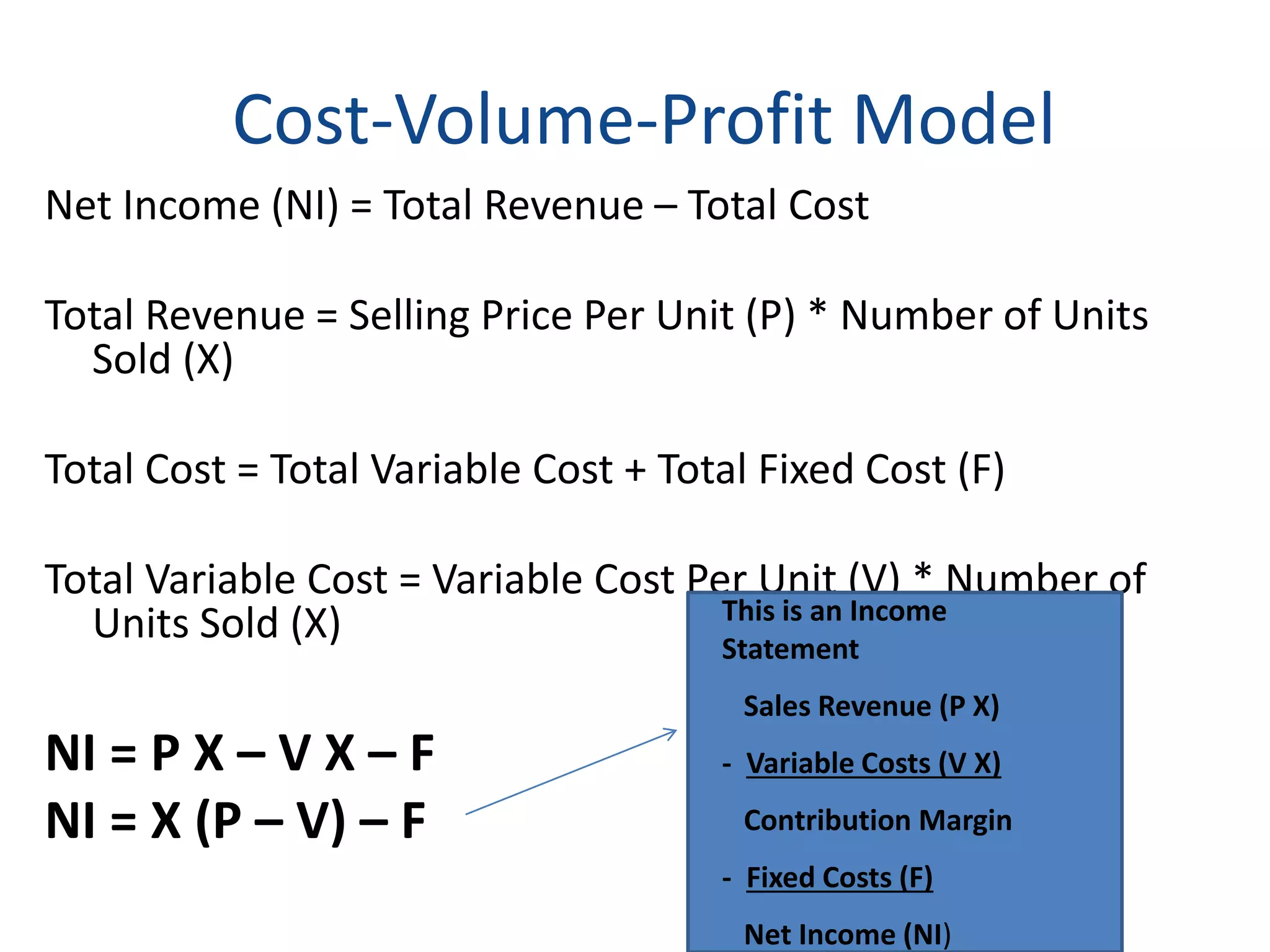

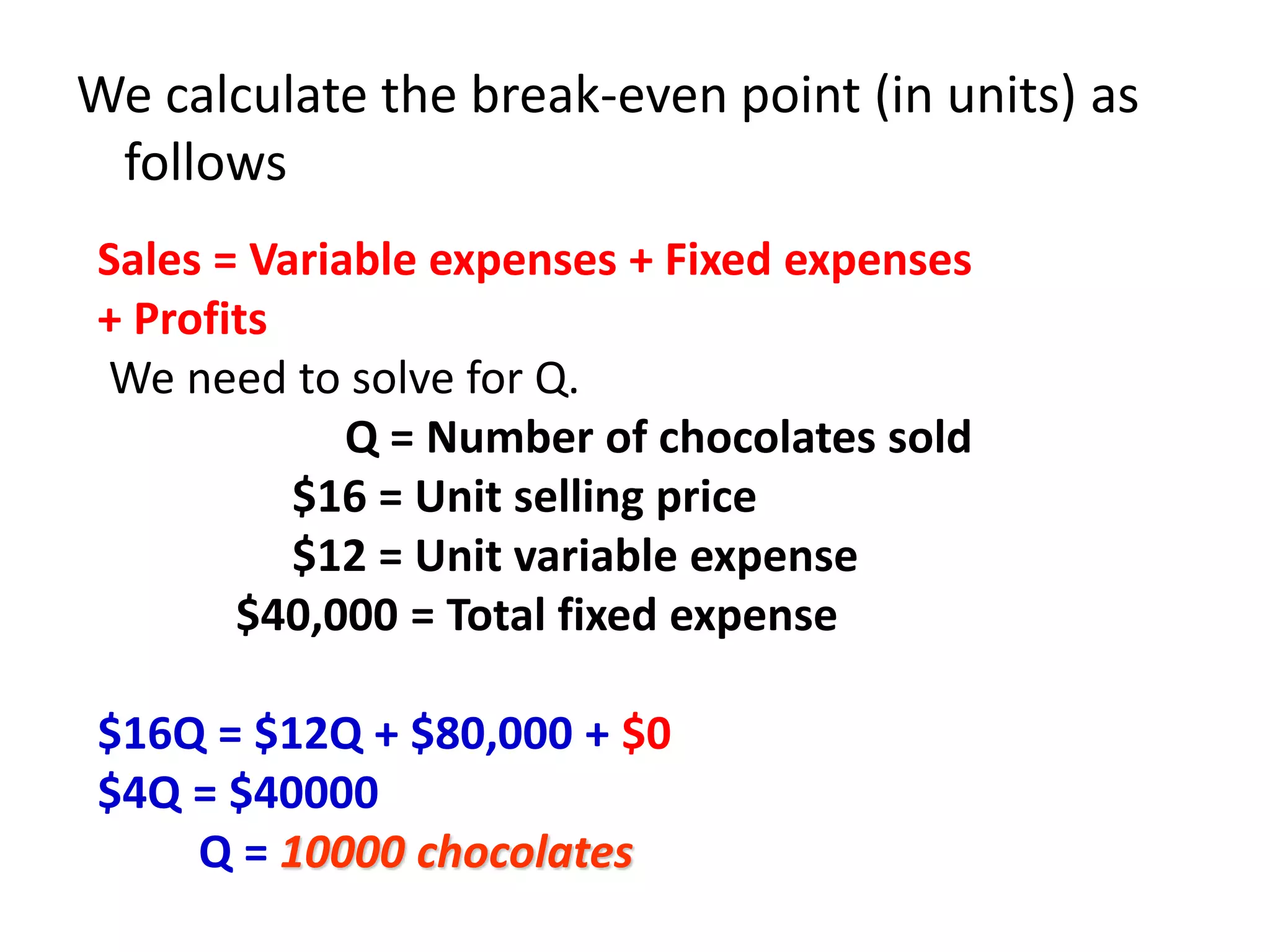

This document provides an overview of cost-volume-profit (CVP) analysis. It defines key CVP terms like marginal cost, contribution margin, break-even point, and margin of safety. An example is provided to illustrate how to calculate break-even point using both the equation method and contribution margin method. The objectives, assumptions and limitations of CVP analysis are also discussed. CVP analysis determines how costs and sales volume affect profitability and is useful for decision making.