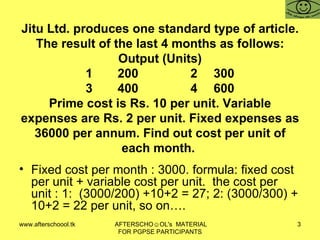

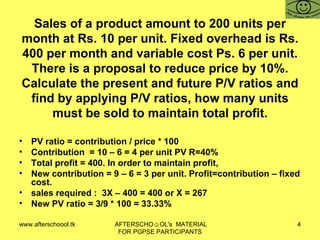

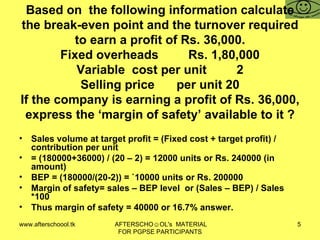

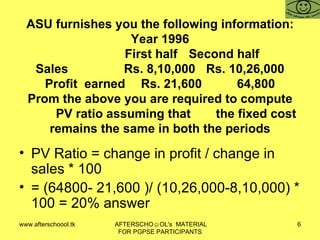

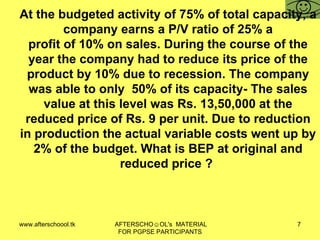

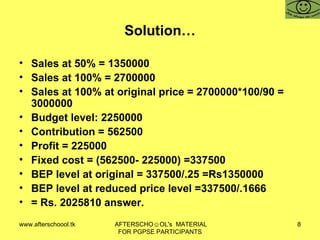

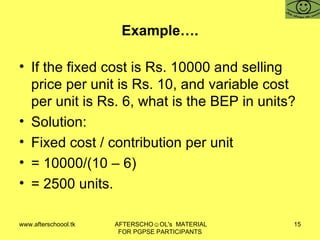

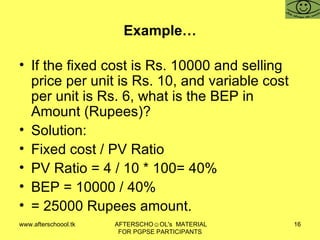

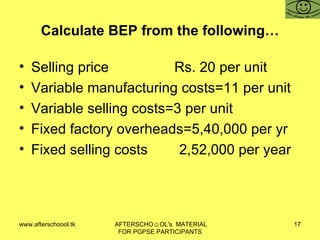

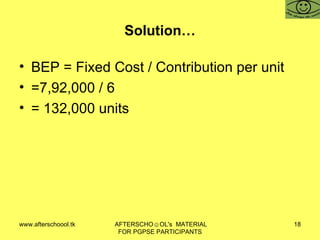

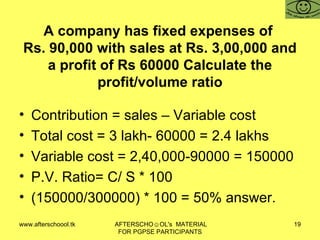

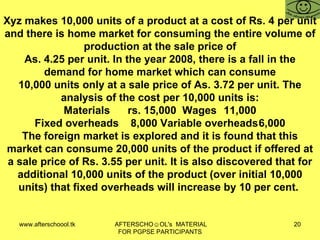

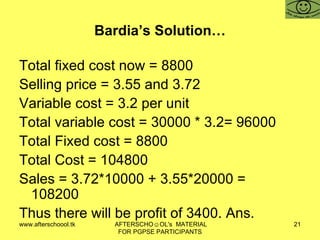

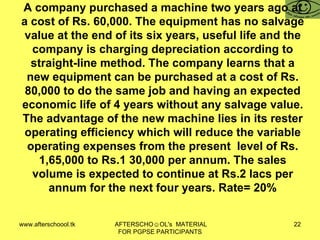

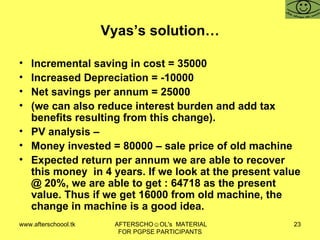

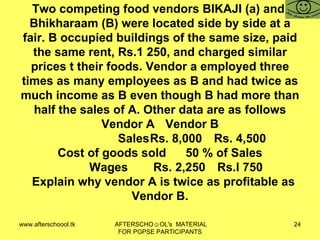

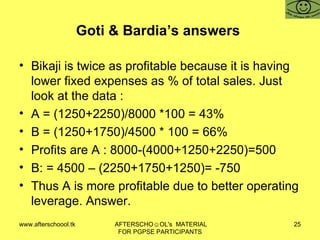

The document outlines the Marginal Costing and Profit Planning materials from the Afterschool program focused on social entrepreneurship. It includes various financial calculations and examples related to cost management, break-even points, profit-volume ratios, and fixed vs variable costs. Additionally, it promotes the Afterschool program, emphasizing its features, the availability of free online resources, and support for aspiring social entrepreneurs.

![MARGINAL COSTING & PROFIT PLANNING Dr. T.K. Jain. AFTERSCHO ☺ OL Centre for social entrepreneurship Bikaner M: 9414430763 [email_address] www.afterschool.tk , www.afterschoool.tk www.afterschoool.tk AFTERSCHO☺OL's MATERIAL FOR PGPSE PARTICIPANTS](https://image.slidesharecdn.com/marginal-costing-profit-planning-1233308629669693-3/85/Marginal-Costing-Profit-Planning-2-320.jpg)