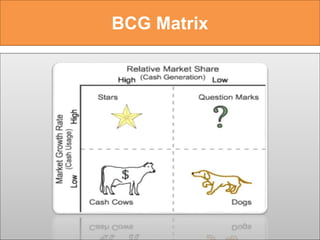

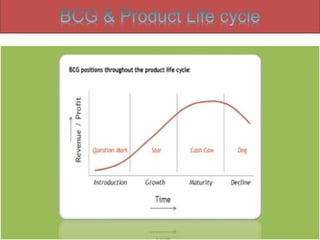

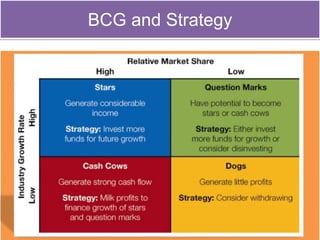

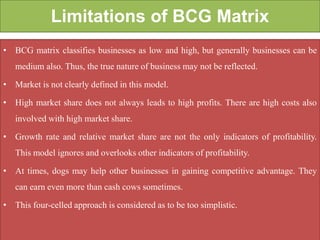

The document summarizes the BCG matrix, a tool developed by Boston Consulting Group in the early 1970s. The BCG matrix analyzes a company's business portfolio based on market share and market growth rate. It divides businesses into four categories: stars, cash cows, question marks, and dogs. Stars have high market share and growth. Cash cows have high share but low growth. Question marks have low share but high growth. Dogs have low share and growth. The matrix is used to determine where to allocate resources and adopt different strategies for each category of business. However, it also has limitations as it oversimplifies businesses and ignores other factors like costs and profitability.