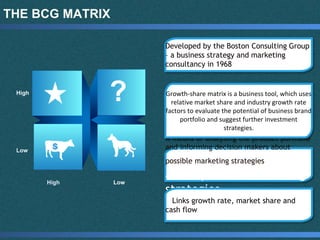

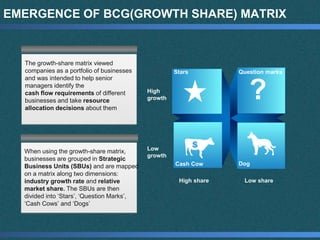

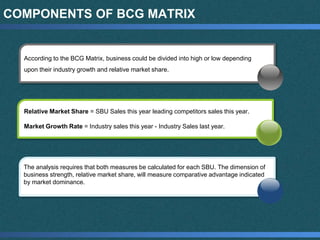

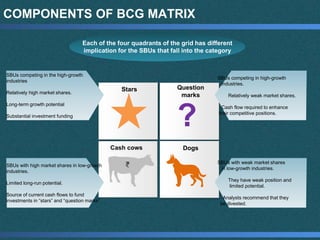

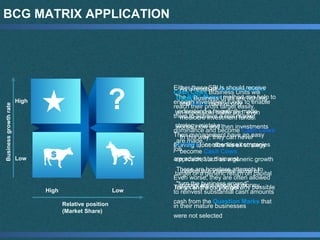

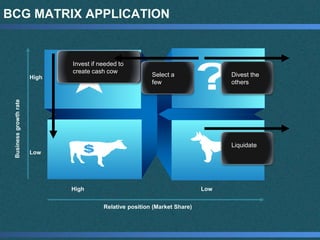

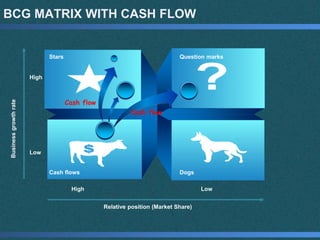

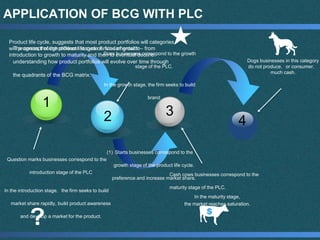

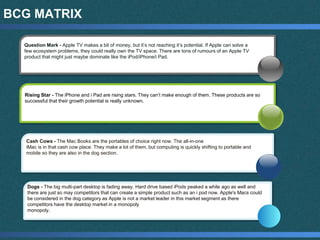

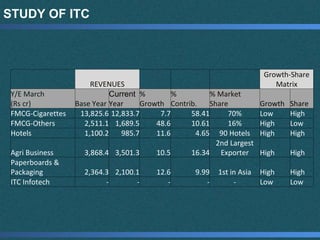

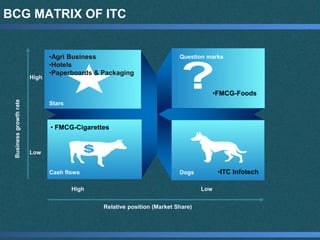

The document discusses the BCG matrix, a tool used to evaluate a company's portfolio of business units. It describes the emergence of portfolio matrices in the 1970s and the key components of the BCG matrix: market growth rate and relative market share. Business units are classified into four categories - Stars, Cash Cows, Question Marks, and Dogs - based on their placement in the matrix. The summary applies the BCG matrix to analyze ITC's revenues across different business segments.