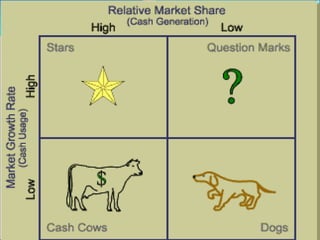

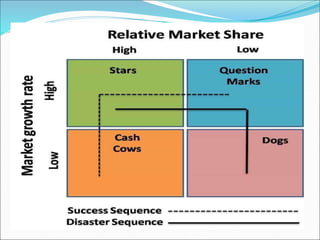

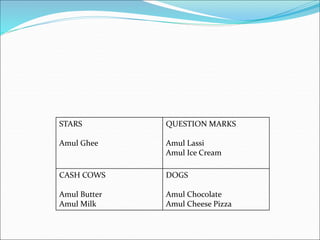

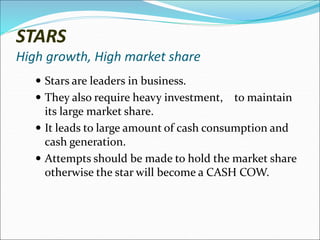

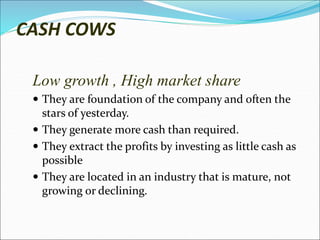

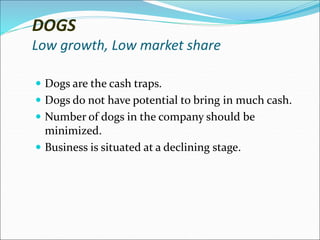

This document provides an overview of the Boston Consulting Group (BCG) Matrix, which classifies businesses into four categories based on their relative market share and market growth rate. The four categories are stars (high share, high growth), cash cows (high share, low growth), question marks (low share, high growth), and dogs (low share, low growth). The BCG Matrix is used to assess a company's portfolio, allocate resources, and make divestment decisions. It provides a simple framework but has limitations in only considering two factors and difficulties obtaining accurate data. Major companies still find it a useful portfolio planning tool.