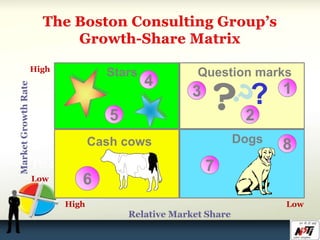

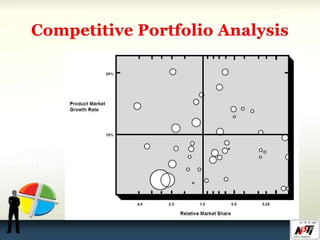

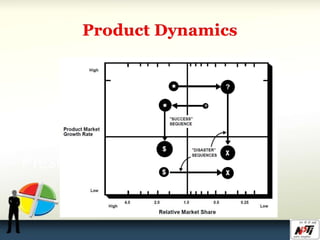

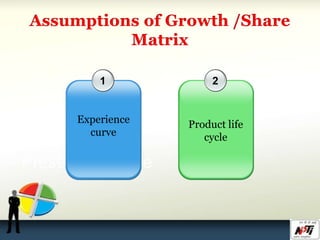

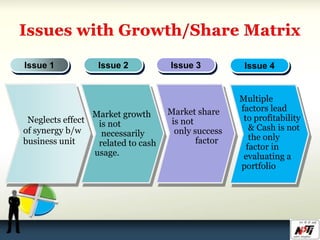

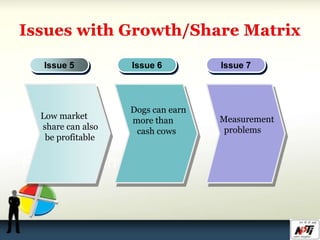

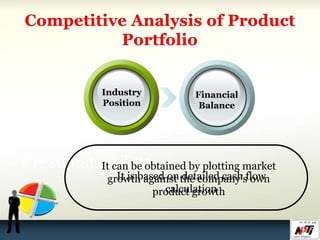

This document presents the Boston Consulting Group (BCG) matrix for analyzing a company's product portfolio. The matrix categorizes products as Stars, Cash Cows, Question Marks, or Dogs based on their relative market share and market growth. It then provides recommendations for each category: Stars should focus on increasing market share; Cash Cows should maximize cash flow; Question Marks require assessing growth potential and investing or withdrawing; Dogs should be divested or concentrated on profitable niches. Several issues with only using the BCG matrix are also noted, such as other factors influencing profitability beyond just market share and cash flow.