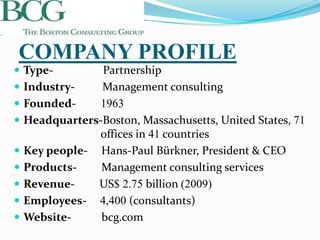

This document provides information about the BCG matrix, a portfolio management tool created by The Boston Consulting Group in the 1970s. It summarizes the BCG matrix as follows:

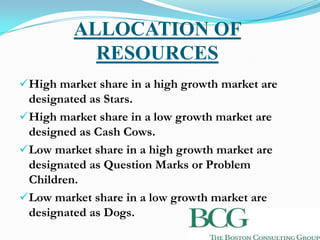

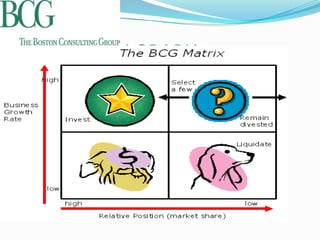

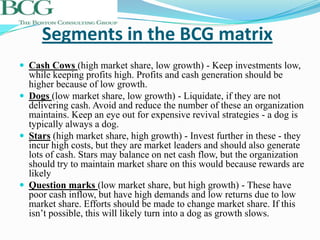

1) The BCG matrix classifies business units based on their relative market share and growth rate, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

2) Stars have high market share and growth, Cash Cows have high share but low growth, Question Marks have low share but high growth, and Dogs have low share and growth.

3) The matrix is used to evaluate a company's portfolio and determine where to allocate resources for maximum returns. It is a simple and easy to understand tool for