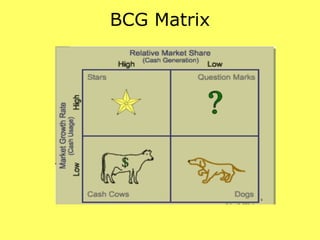

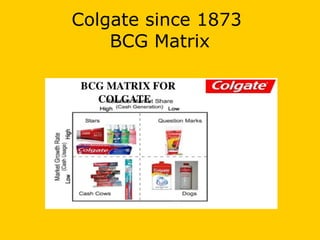

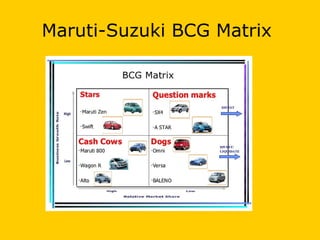

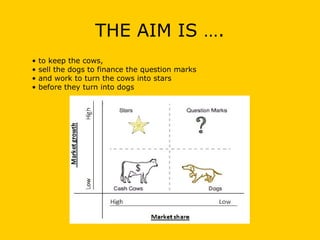

The document summarizes the BCG growth-share matrix, a portfolio analysis tool developed by the Boston Consulting Group in the 1970s. The matrix plots a company's business units based on their relative market share and market growth rate to classify them into four categories: stars, cash cows, question marks, and dogs. Cash cows are stable business units with high market share but low growth. Stars require heavy investment to maintain high share in high-growth markets. Question marks have potential but need funding to grow their low share of high-growth markets. Dogs have low and declining market share and should be considered for divestment. The goal of the analysis is to use cash from cows to fund question marks to become stars or cash cows