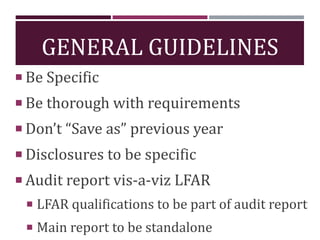

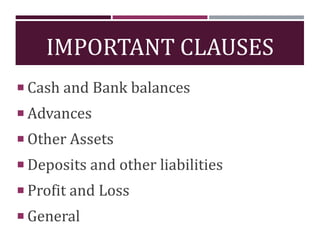

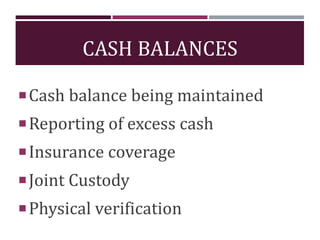

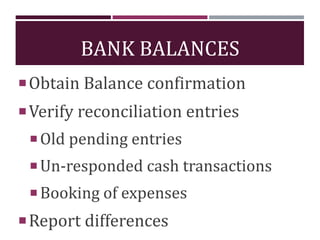

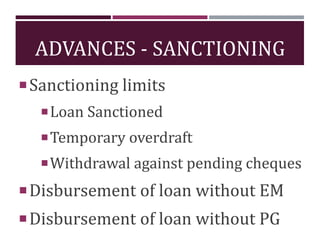

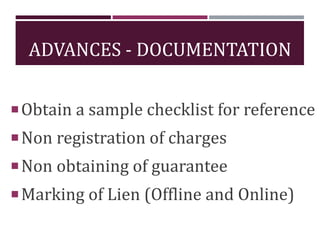

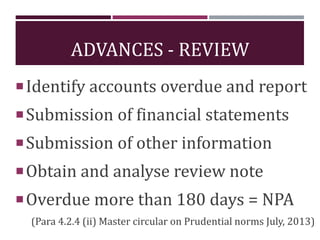

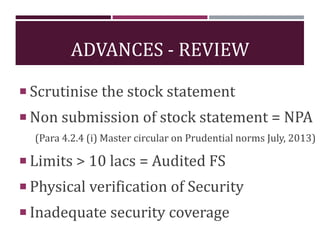

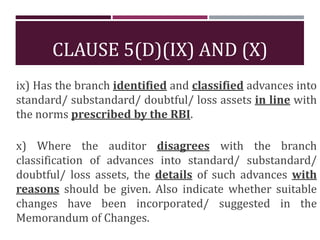

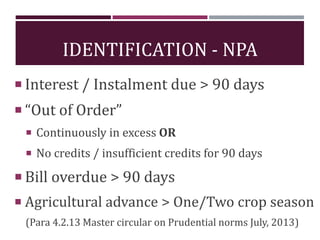

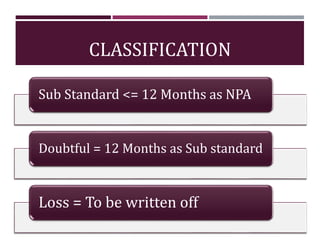

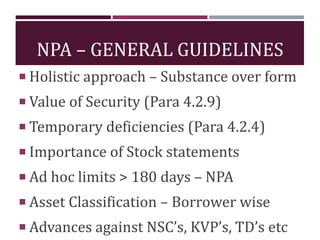

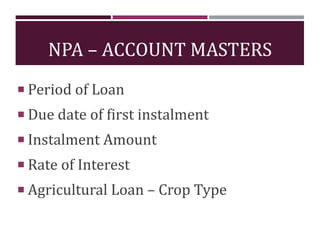

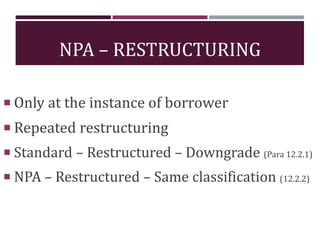

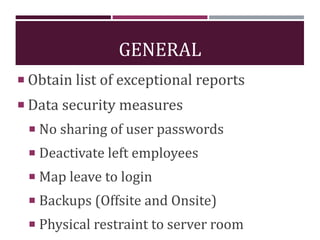

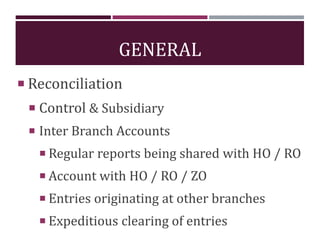

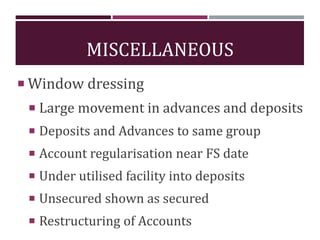

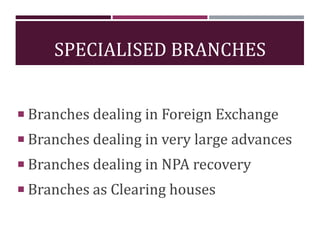

This document outlines guidelines for conducting long-form audit reports (LFARs) for bank branches, including the structure and important clauses to cover for assets, liabilities, income, expenses, and general matters. It discusses guidelines for auditing cash balances, advances, NPAs, deposits, profits and losses, and other assets and liabilities. The document provides details on classifying and identifying NPAs according to RBI guidelines. It emphasizes being thorough, specific, and addressing any qualifications in the LFAR and audit report.