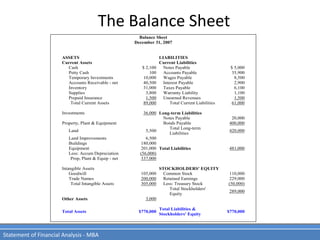

The document discusses key financial statements including the balance sheet, income statement, statement of cash flows, and statement of shareholders' equity. It provides examples of each statement and explains what each measures and why they are important. For example, it states the balance sheet provides a snapshot of a company's health on a given date, showing if it has more assets than liabilities, while the income statement measures performance over a period by showing revenues, expenses, and profits.